Please use a PC Browser to access Register-Tadawul

Should Liberty Mutual's Shift of Safeco Policies to Mercury General (MCY) Prompt Investor Attention?

Mercury General Corporation MCY | 93.15 | -0.38% |

- Liberty Mutual announced in early August 2025 that it will recommend its independent agents transition thousands of impacted Safeco renters, condo, and select auto policyholders in California to Mercury Insurance, as part of a shift in their personal lines product strategy.

- This move highlights Mercury General's willingness to expand coverage in regions where many other insurers have reduced their presence, underscoring its role as an alternative provider for California consumers facing limited options.

- We'll explore how Mercury General's partnership with Liberty Mutual to serve displaced Safeco customers could reshape its investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Mercury General Investment Narrative Recap

To be a shareholder in Mercury General, you need to believe the company's focus on California personal lines, bolstered by Liberty Mutual’s agent referrals, will generate new business despite the region’s insurance challenges. The Liberty partnership could support Mercury's premium growth in the near term, but persistent wildfire risk and reinsurance costs remain critical uncertainties. At present, the impact of the partnership appears positive for generating new policies, though insurable risk concentration is a key short-term concern.

Of the recent company announcements, the partnership with Liberty Mutual stands out as particularly relevant. With major insurers backing away from California’s personal lines market, Mercury’s willingness to write new policies underscores both a growth catalyst and a potential risk multiplier, since exposure to climate-driven catastrophe losses could increase, testing the company’s ability to maintain stable margins and protect capital.

Yet, for investors, it's crucial to weigh this bold approach against the very real risk of concentrated wildfire losses potentially straining reserves and cash flow...

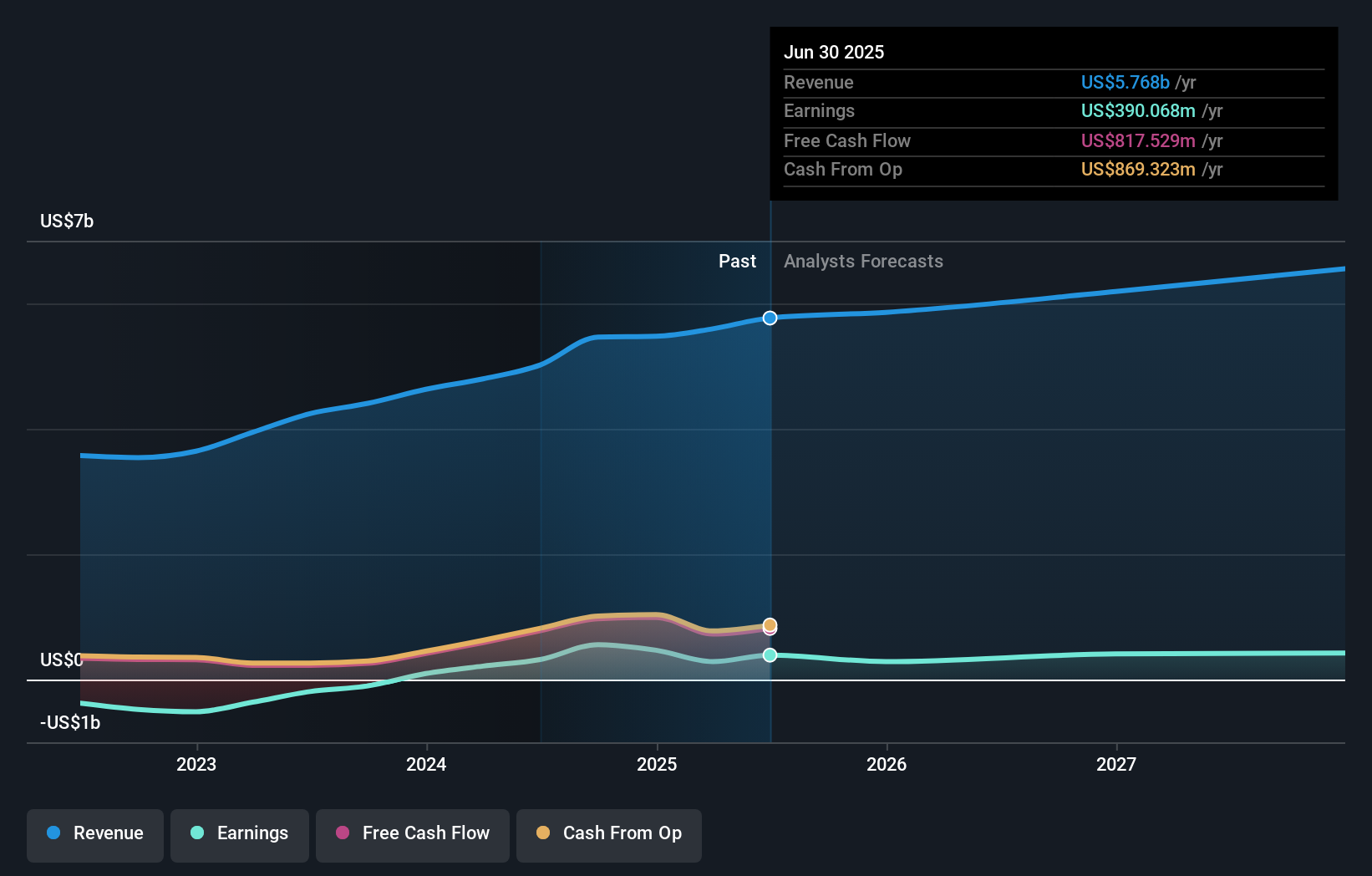

Mercury General's narrative projects $6.7 billion revenue and $452.5 million earnings by 2028. This requires 5.1% yearly revenue growth and a $62.4 million earnings increase from $390.1 million today.

Uncover how Mercury General's forecasts yield a $90.00 fair value, a 27% upside to its current price.

Exploring Other Perspectives

All community fair value estimates collected from Simply Wall St members sit at US$90, based on just one analysis. While this consensus shows strong belief in a single number, increased exposure to California’s high-risk market could challenge long-term earnings momentum. You can see other viewpoints and judge the merits for yourself.

Explore another fair value estimate on Mercury General - why the stock might be worth just $90.00!

Build Your Own Mercury General Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mercury General research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mercury General research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mercury General's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.