Please use a PC Browser to access Register-Tadawul

Should Proto Labs’ (PRLB) CNC Machining Upgrades Prompt a Fresh Look at Its Competitive Positioning?

Proto Labs, Inc. PRLB | 52.57 | -1.22% |

- In October 2025, Proto Labs launched advanced features for its automated CNC machining service, offering higher precision, expanded finishes, and rapid, quality-assured parts from its ITAR- and AS9100-certified facility.

- This upgrade is tailored toward high-demand industries like aerospace and defense, emphasizing not just speed and quality but also mass customization with no minimum order, comprehensive documentation, and dedicated service.

- We'll examine how the addition of tighter tolerances and new finishes in CNC machining could reshape Proto Labs' investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Proto Labs Investment Narrative Recap

To be a shareholder in Proto Labs, you have to believe in the company’s ability to capture expanding demand for rapid, high-precision manufacturing from sectors like aerospace and defense, especially as mass customization and speed become industry imperatives. The October 2025 upgrade to Proto Labs’ CNC machining offers tighter tolerances and diverse finishes, but does not appear to directly address the most important short-term risk: revenue dependence on a handful of large aerospace and defense accounts.

Of all recent announcements, the October 2025 product launch stands out for its direct ties to Proto Labs’ core growth catalyst: heightened demand for flexible, low-volume manufacturing from regulated, high-requirement sectors like aerospace. By providing enhanced precision, rapid part delivery, and compliance with stringent industry standards, this move aligns with the needs of customers driving revenue growth, yet also underscores continued exposure to customer concentration.

By contrast, investors should also be aware that any shift in spending by key aerospace clients could quickly change Proto Labs’ outlook…

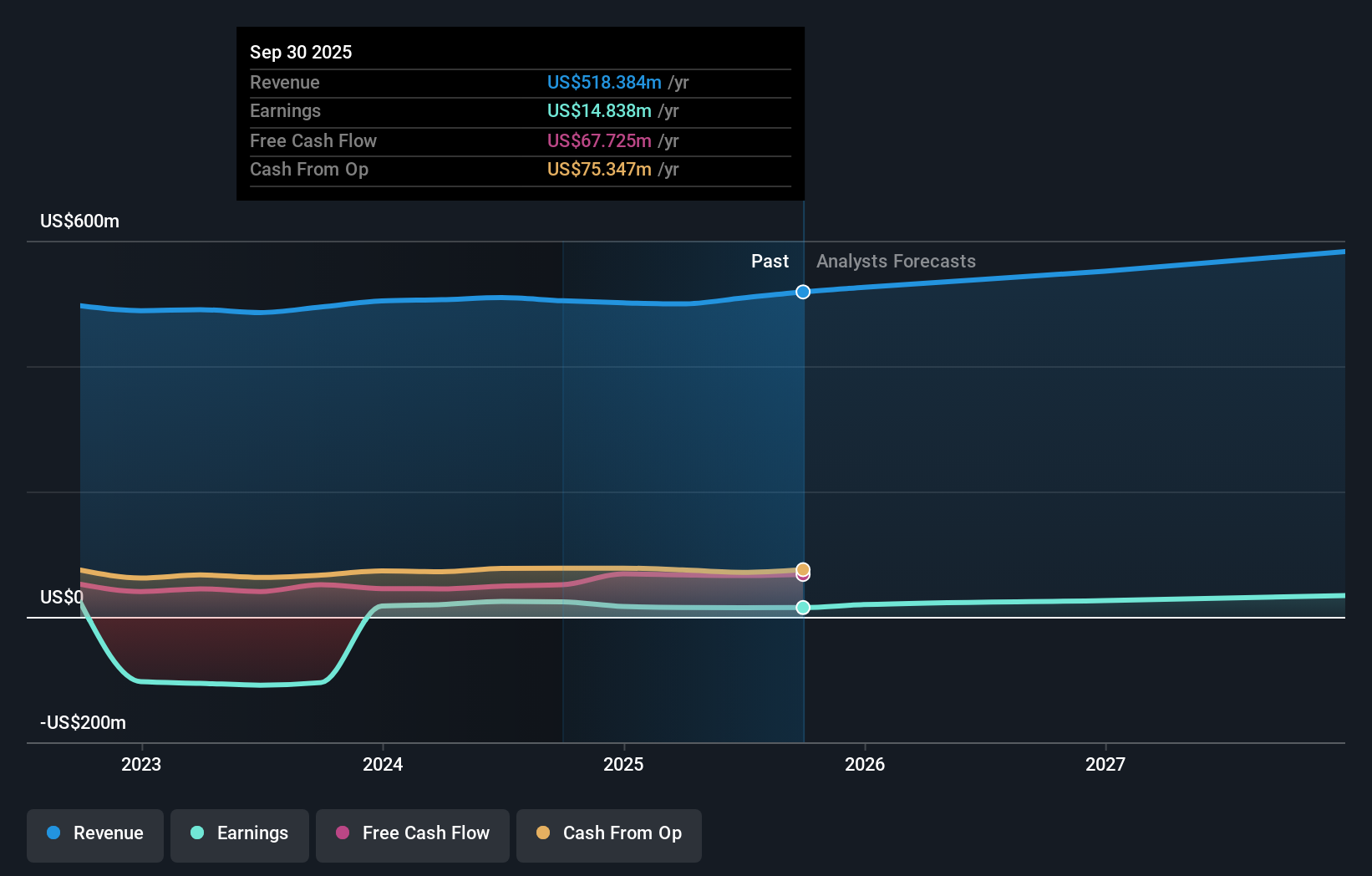

Proto Labs' narrative projects $592.3 million revenue and $33.7 million earnings by 2028. This requires 5.2% yearly revenue growth and an increase of $18.9 million in earnings from $14.8 million today.

Uncover how Proto Labs' forecasts yield a $50.00 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Two estimates from the Simply Wall St Community place Proto Labs' fair value between US$34.63 and US$50. With rising aerospace demand shaping the company's results, comparing these perspectives can reveal how much opinions differ on future performance.

Explore 2 other fair value estimates on Proto Labs - why the stock might be worth 37% less than the current price!

Build Your Own Proto Labs Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Proto Labs research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Proto Labs research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Proto Labs' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.