Please use a PC Browser to access Register-Tadawul

Should Rising Sales and Enhanced Rewards Prompt Action From Costco (COST) Investors?

Costco Wholesale Corporation COST | 884.47 879.02 | 0.00% -0.62% Pre |

- In October 2025, Costco Wholesale Corporation announced an increase in quarterly net sales to US$26.58 billion and declared a quarterly dividend of US$1.30 per share, payable November 14 to shareholders of record as of the end of October.

- Costco also enhanced its Executive membership rewards, aiming to drive membership fee growth and reinforce loyalty among its most profitable customer segment.

- We’ll consider how recent gains in membership fee income and new Executive member incentives may influence Costco’s investment outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Costco Wholesale Investment Narrative Recap

To be a shareholder in Costco Wholesale, you need to believe in the company's proven warehouse club model, strong member base, and ability to drive consistent sales growth through membership retention and expansion. The recent news of rising net sales and higher dividends reflects Costco's ongoing operational strength, but does not materially change the key short-term catalyst: continued growth in membership fee income. The biggest risk remains cost pressures from labor and supply chain challenges, which are not resolved by this quarter's performance.

One recent announcement that ties closely to current catalysts is Costco's introduction of new incentives for Executive members, such as early shopping hours and monthly credits on large grocery orders. These enhancements are designed to drive higher membership retention and upgrade rates, supporting the primary driver of revenue, membership growth, while reinforcing Costco’s unique value proposition in a competitive retail sector.

However, investors should be aware that while revenue gains are clear, the risk of rising labor and inventory costs could impact future margins if...

Costco Wholesale's narrative projects $329.0 billion revenue and $10.4 billion earnings by 2028. This requires 7.0% yearly revenue growth and a $2.6 billion earnings increase from $7.8 billion today.

Uncover how Costco Wholesale's forecasts yield a $1061 fair value, a 13% upside to its current price.

Exploring Other Perspectives

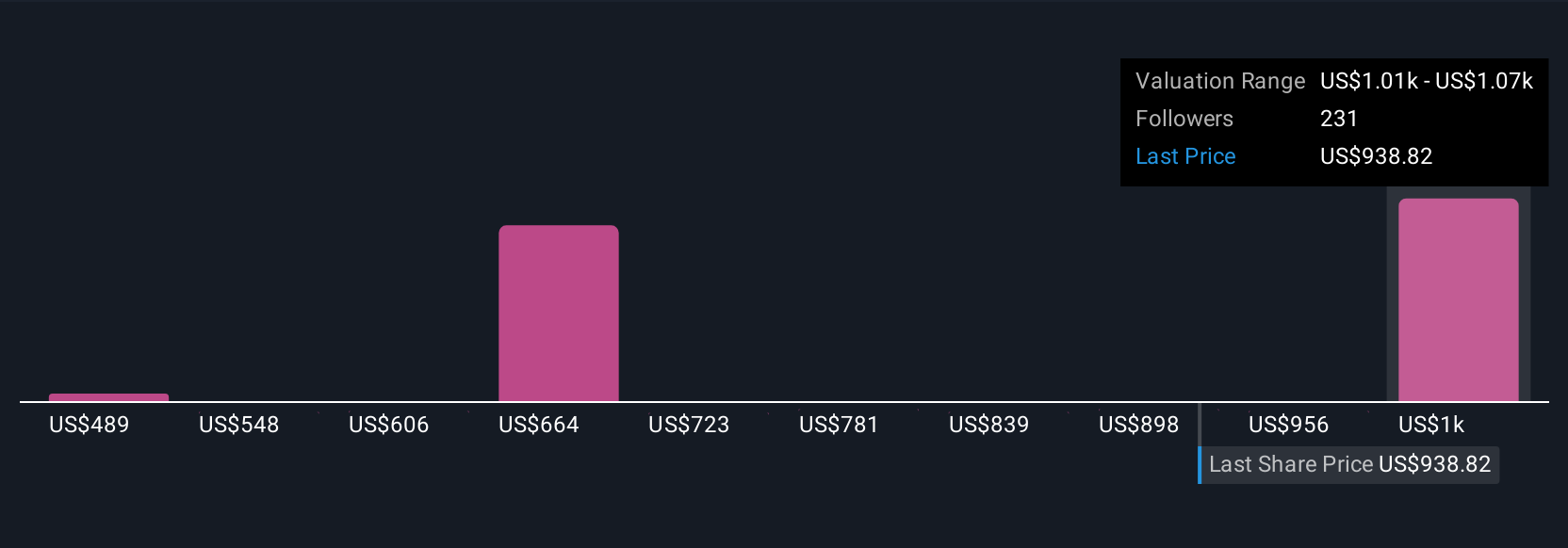

Across 35 fair value estimates from the Simply Wall St Community, Costco's perceived worth ranges from US$489.26 to US$1,061.20 per share. Many participants focus on membership growth as a key driver but also acknowledge that rising labor costs could weigh on profit margins in future periods.

Explore 35 other fair value estimates on Costco Wholesale - why the stock might be worth as much as 13% more than the current price!

Build Your Own Costco Wholesale Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Costco Wholesale research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Costco Wholesale research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Costco Wholesale's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.