Please use a PC Browser to access Register-Tadawul

Should Rockpoint IPO and Insider Buying Prompt a Rethink of Brookfield Infrastructure's (BIP) Asset Rotation Strategy?

Brookfield Infrastructure Partners L.P. BIP | 38.42 | +1.00% |

- In the past week, Rockpoint Gas Storage Inc., an operator of natural gas storage facilities backed by Brookfield Infrastructure, announced plans for an initial public offering on the Toronto Stock Exchange, with Brookfield affiliates as selling shareholders and proceeds supporting further acquisitions in the North American storage sector.

- Several analysts cited Brookfield Infrastructure’s capital recycling approach, recent acquisitions, and ongoing insider buying activity as reasons for renewed positive sentiment toward the company’s outlook.

- Next, we'll consider how heightened analyst confidence, driven by recent acquisitions and asset rotation, supports Brookfield Infrastructure’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Brookfield Infrastructure Partners Investment Narrative Recap

To be a shareholder in Brookfield Infrastructure Partners, investors must have conviction in the long-term value of essential infrastructure and the company’s ability to self-fund growth through disciplined capital recycling. The recent Rockpoint Gas Storage IPO is consistent with this strategy and, while it reinforces Brookfield’s access to capital and liquidity, it does not materially alter the primary short-term catalyst: redeployment of sale proceeds into higher-return assets. The most important risk remains elevated acquisition and refinancing activity during a period of heightened competition.

Of the recent announcements, Brookfield Infrastructure’s completion of three marquee acquisitions in the last quarter stands out as most relevant. These deals, alongside ongoing asset sales like Rockpoint, underline the company’s commitment to recycling capital into growth areas and supporting distributable earnings expansion. This cycle remains key to driving renewed analyst optimism and future returns, but with increased deal activity comes additional risk if acquisition discipline is compromised.

However, investors should be aware that, in contrast, the expanding deal flow also introduces greater exposure to...

Brookfield Infrastructure Partners is forecast to generate $14.5 billion in revenue and $1.1 billion in earnings by 2028. This outlook relies on a 12.3% annual decline in revenue, but a sharp earnings increase of $1.06 billion from the current $38.0 million.

Uncover how Brookfield Infrastructure Partners' forecasts yield a $39.91 fair value, a 29% upside to its current price.

Exploring Other Perspectives

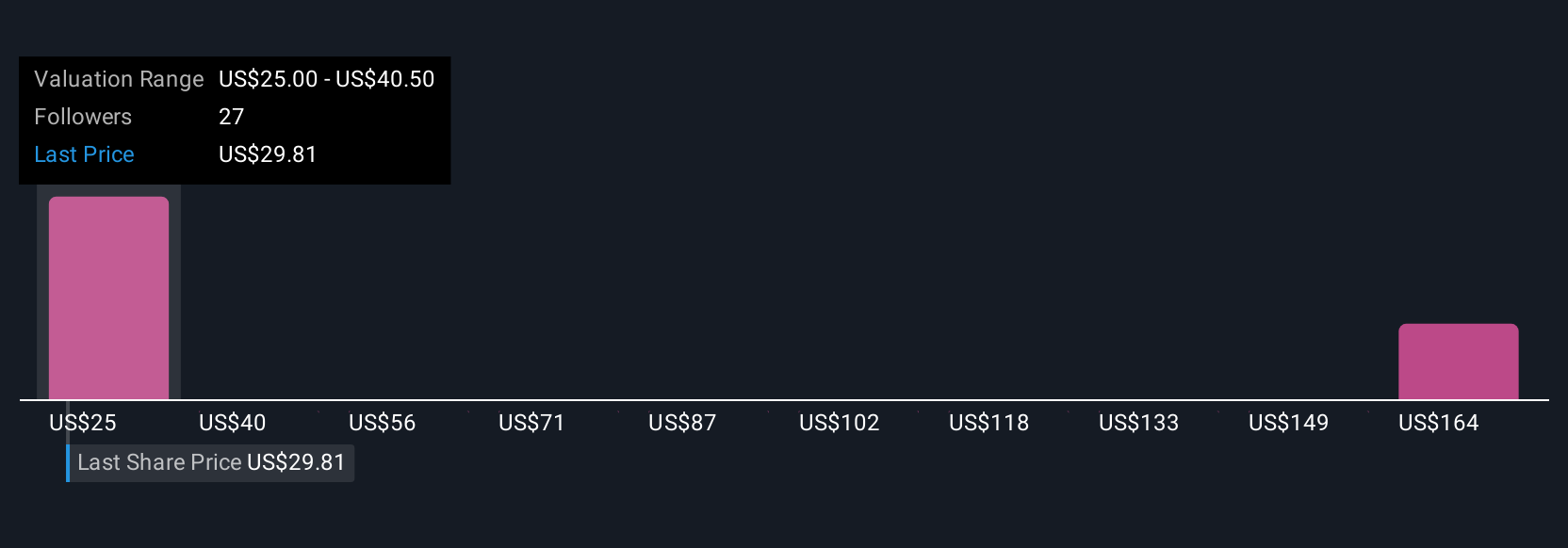

Five private members of the Simply Wall St Community estimate Brookfield Infrastructure's fair value anywhere from US$25.03 to US$178.13 per share. While many see upside linked to high-profile asset rotations and ongoing acquisitions, some highlight the risk of overpaying for assets amid stiff competition, which could weigh on returns and long-term growth. Explore several alternative viewpoints to broaden your perspective.

Explore 5 other fair value estimates on Brookfield Infrastructure Partners - why the stock might be worth over 5x more than the current price!

Build Your Own Brookfield Infrastructure Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield Infrastructure Partners research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Brookfield Infrastructure Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield Infrastructure Partners' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 31 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.