Please use a PC Browser to access Register-Tadawul

Should Seagate’s (STX) 30TB HAMR Drive Launch Prompt Investor Action?

Seagate Technology PLC STX | 286.82 | -0.28% |

- Earlier this month, Seagate Technology Holdings announced the global channel availability of its Exos M and IronWolf Pro hard drives, which offer industry-leading capacities of up to 30TB and leverage advanced HAMR technology on the Mozaic 3+ platform.

- This launch signals Seagate's ability to address rapidly growing enterprise storage needs as AI-driven data center and NAS demands continue to mount worldwide.

- We'll examine how the release of Seagate's 30TB drives using HAMR technology strengthens its investment narrative in mass capacity storage.

Seagate Technology Holdings Investment Narrative Recap

To be a shareholder of Seagate Technology Holdings, you need to believe that mass capacity storage will remain essential as digital transformation and AI-driven infrastructure demands rise. The launch of Seagate’s 30TB HAMR-based drives directly supports this narrative, reinforcing the key near-term catalyst of transitioning to higher-capacity, advanced storage technologies. However, this announcement does not materially reduce the company’s biggest risk: rising competition from SSDs and alternative storage technologies.

Of Seagate’s recent updates, the expansion of its share buyback program to US$12.3 billion stands out, showing continued management confidence in capital returns. This action ties into the company’s investment story, as returning capital to shareholders often signals management’s view that the company can generate strong future cash flows and manage near-term pressures even as new technologies, such as HAMR, are being scaled.

Yet, despite breakthrough technology, investors should be aware that increased competitive pressure from SSD adoption could reshape Seagate's outlook...

Seagate Technology Holdings is forecast to reach $12.1 billion in revenue and $2.4 billion in earnings by 2028. This outlook relies on a projected annual revenue growth rate of 12.2% and an increase in earnings of $0.9 billion from the current $1.5 billion.

Exploring Other Perspectives

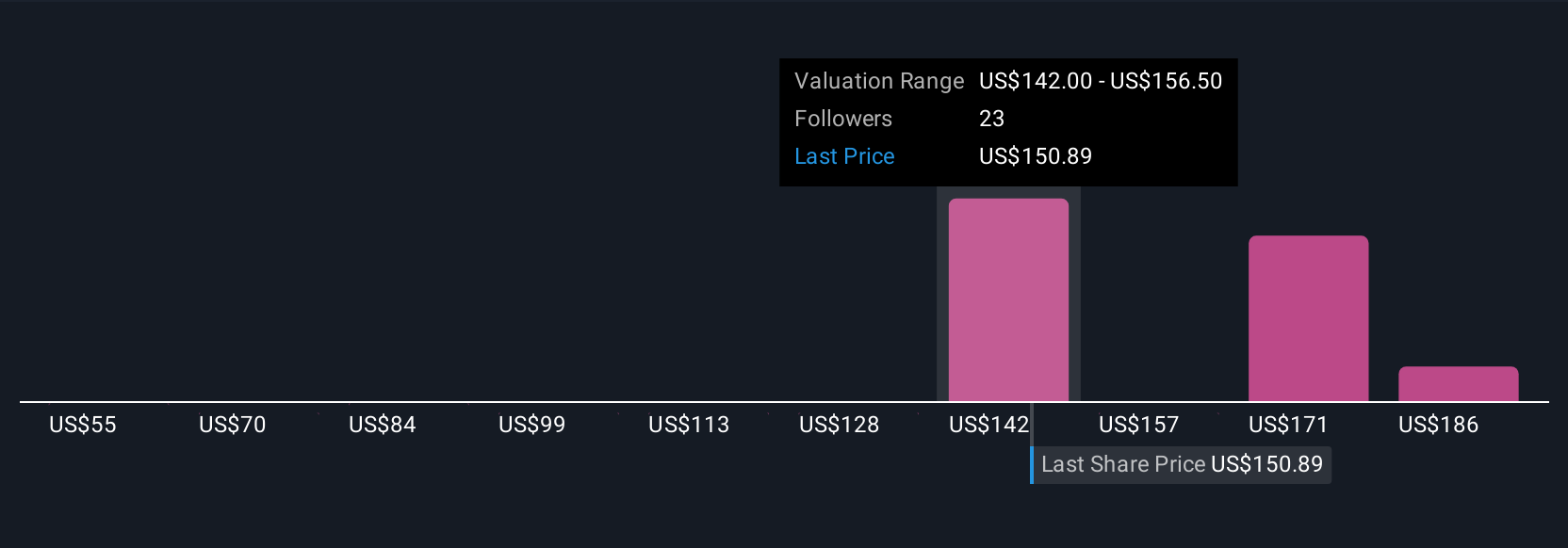

Community fair value estimates for Seagate range from US$55 to US$200 based on five unique views from the Simply Wall St Community. Many see growth potential tied to the rollout of advanced Mozaic HAMR drives, but opinions around future competitive threats remain sharply divided.

Build Your Own Seagate Technology Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Seagate Technology Holdings research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Seagate Technology Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Seagate Technology Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.