Please use a PC Browser to access Register-Tadawul

Should SQM's Latest Financials and Analyst Sentiment Shift Require Action From Sociedad Química y Minera (SQM) Investors?

Sociedad Quimica y Minera de Chile S.A. Sponsored ADR Pfd Series B SQM | 71.15 71.15 | -0.46% 0.00% Post |

- Sociedad Química y Minera de Chile S.A. recently published its consolidated interim financial statements for the period ending June 30, 2025, offering updated transparency into its financial standing and operations.

- The disclosure underscores SQM's continued emphasis on lithium and iodine production within the broader chemical industry landscape.

- We'll explore how these latest financial results and the accompanying shift in analyst sentiment could influence SQM's investment outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Sociedad Química y Minera de Chile Investment Narrative Recap

To be a shareholder in Sociedad Química y Minera de Chile, you need to believe in sustained demand and pricing for lithium and iodine, as well as the company's global cost-advantage in these critical resources. The recent interim financials and analyst downgrade highlight liquidity and margin pressures, but do not materially alter the importance of lithium price volatility as the main short term catalyst or the risk of regulatory headwinds from negotiations over Chilean lithium assets.

Among recent developments, the reaffirmation of earnings guidance for 2025 stands out, with management expecting sales to be on par with 2024 despite global pricing swings. This outlook remains closely tied to lithium market dynamics, which continue to drive both opportunity and near-term uncertainty for the business.

Yet, against expectations for growth, investors should be aware of the potential for regulatory setbacks from complex state negotiations that...

Sociedad Química y Minera de Chile's outlook anticipates $6.5 billion in revenue and $1.9 billion in earnings by 2028. This scenario is based on an expected annual revenue growth rate of 15.4% and an earnings increase of $1.4 billion from the current earnings of $477.5 million.

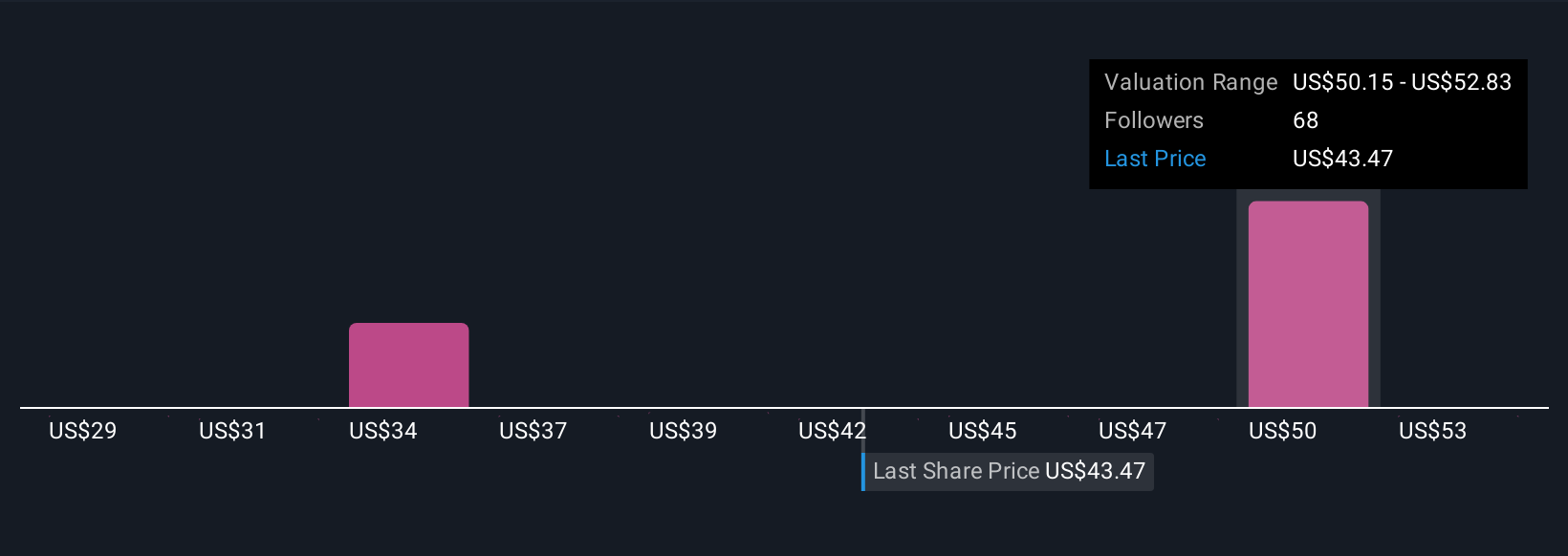

Uncover how Sociedad Química y Minera de Chile's forecasts yield a $50.99 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Nine Simply Wall St Community members estimate SQM’s fair value in a US$28.73 to US$55.51 range. Such wide variation reflects how regulatory uncertainty could meaningfully shift views on growth and future profitability.

Explore 9 other fair value estimates on Sociedad Química y Minera de Chile - why the stock might be worth 36% less than the current price!

Build Your Own Sociedad Química y Minera de Chile Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sociedad Química y Minera de Chile research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sociedad Química y Minera de Chile research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sociedad Química y Minera de Chile's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.