Please use a PC Browser to access Register-Tadawul

Should Upcoming ATTRibute-CM Acoramidis Data at ESC 2025 Prompt Action From BridgeBio Pharma (BBIO) Investors?

BridgeBio Pharma BBIO | 70.00 | +2.87% |

- BridgeBio Pharma recently announced it will present additional open-label extension data and ePosters from the ATTRibute-CM study of Acoramidis at the European Society of Cardiology Congress 2025 in Madrid, with presentations scheduled from August 29 to September 1, 2025.

- This upcoming release of long-term efficacy and biomarker data for Acoramidis could influence clinicians' perspectives on treatment options for patients with ATTR-CM and spark fresh interest in BridgeBio’s clinical program.

- We'll explore how these anticipated ATTRibute-CM data presentations could impact BridgeBio's pipeline differentiation and future market perception.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

BridgeBio Pharma Investment Narrative Recap

Owning BridgeBio Pharma means believing in the potential of Acoramidis and its ATTRibute-CM program to transform treatment for ATTR-CM, with clinical and regulatory momentum critical for market adoption. The upcoming ESC Congress presentations with new long-term Acoramidis data may reinforce the company’s leading position, a significant short-term catalyst, yet the concentration risk tied to a single pipeline product remains the company’s biggest vulnerability, with financial durability still in question amid growing operating losses.

Of the recent announcements, the ESC Congress presentations revealing Acoramidis’s cardiovascular mortality reduction and biomarker improvements at Month 42 are most influential. These results are poised to strengthen BridgeBio’s pipeline differentiation, possibly swaying competitive dynamics and clinical adoption, which directly impacts near-term revenue and longer-term growth prospects.

However, despite positive momentum, investors should beware that a heavy reliance on one therapy increases exposure to competitive threats and regulatory uncertainties...

BridgeBio Pharma's outlook projects $1.7 billion in revenue and $289.1 million in earnings by 2028. This requires 92.2% annual revenue growth and a $1.07 billion increase in earnings from the current level of -$776.4 million.

Uncover how BridgeBio Pharma's forecasts yield a $62.43 fair value, a 28% upside to its current price.

Exploring Other Perspectives

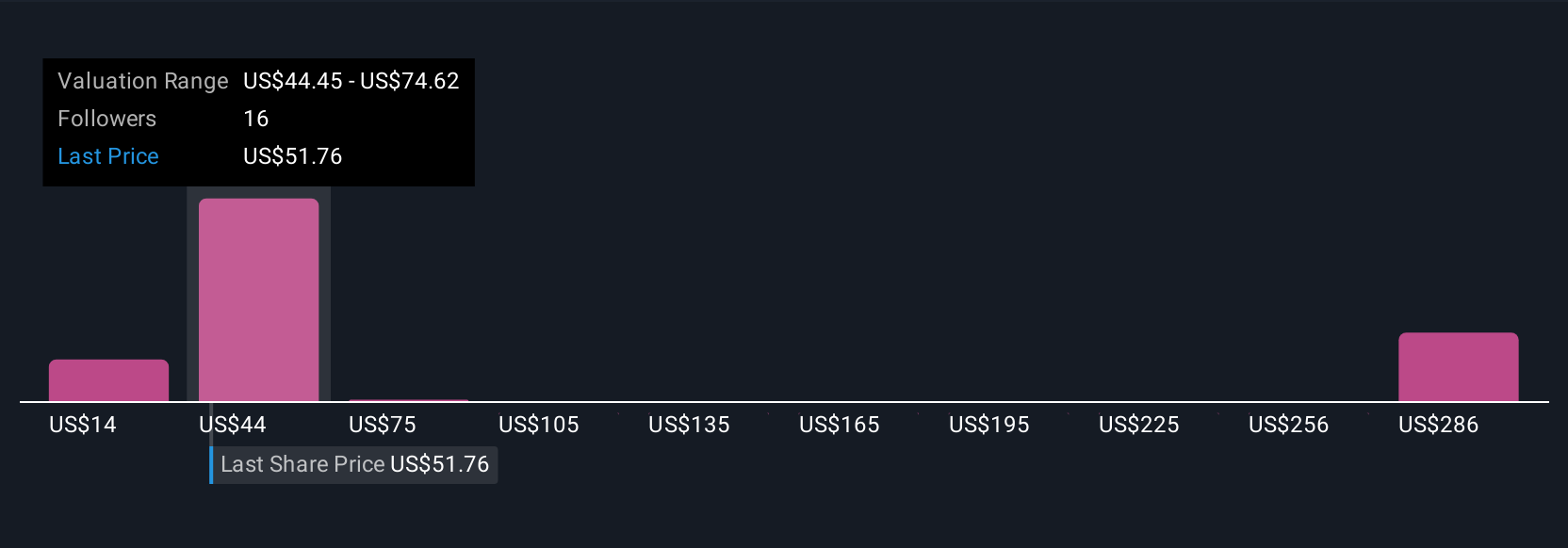

Seven recent fair value estimates from the Simply Wall St Community span from US$14.28 to US$312.36 per share, showing a broad spectrum of opinions. With so much riding on the ATTRibute-CM program's success, you will find widely contrasting viewpoints that could reshape your expectations.

Explore 7 other fair value estimates on BridgeBio Pharma - why the stock might be worth less than half the current price!

Build Your Own BridgeBio Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BridgeBio Pharma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free BridgeBio Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BridgeBio Pharma's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.