Please use a PC Browser to access Register-Tadawul

Should Upward Earnings Revisions and Market Leadership in Multifamily Deals Require Action From CBRE Group (CBRE) Investors?

CBRE Group Inc Class A CBRE | 161.54 | +1.68% |

- In recent news, analysts revised their earnings estimates upwards for CBRE Group, citing expectations of strong earnings growth for fiscal 2025 and highlighting robust deal activity in its Boston multifamily capital markets group, which closed US$1.63 billion in 2024 deals and is leading the market in 2025. The company's involvement in arranging major financing and securing high-profile property management contracts further reflects deepening client relationships and expansion into emerging real estate sectors.

- CBRE's expanding leadership in multifamily capital markets underpins its strengthened business outlook, amplified by the company's role in financing and property management for landmark projects.

- We'll now explore how CBRE's upward earnings revisions and market leadership in multifamily deals influence the company's investment outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

CBRE Group Investment Narrative Recap

To be a shareholder in CBRE Group, you need to believe in the company’s ability to maintain market leadership in commercial real estate services while successfully driving growth in resilient segments like multifamily capital markets. The latest upward revision in earnings estimates supports the main short-term catalyst, continued deal momentum and operational expansion, but does not materially diminish exposure to interest rate volatility, which remains the key risk to near-term earnings consistency.

Of the recent announcements, the closure of $1.63 billion in multifamily deals by CBRE’s Boston team in 2024, and early 2025’s leading performance, provides tangible evidence of the strong pipeline and deep client relationships that underpin the current optimism around earnings. This momentum illustrates how success in a high-demand vertical can reinforce the company’s broader growth outlook, despite economic headwinds and shifting capital markets dynamics.

However, despite these strengths, investors should be aware that interest rate swings could still...

CBRE Group's narrative projects $50.0 billion revenue and $2.3 billion earnings by 2028. This requires 9.5% yearly revenue growth and a $1.2 billion increase in earnings from the current $1.1 billion.

Uncover how CBRE Group's forecasts yield a $169.73 fair value, a 3% upside to its current price.

Exploring Other Perspectives

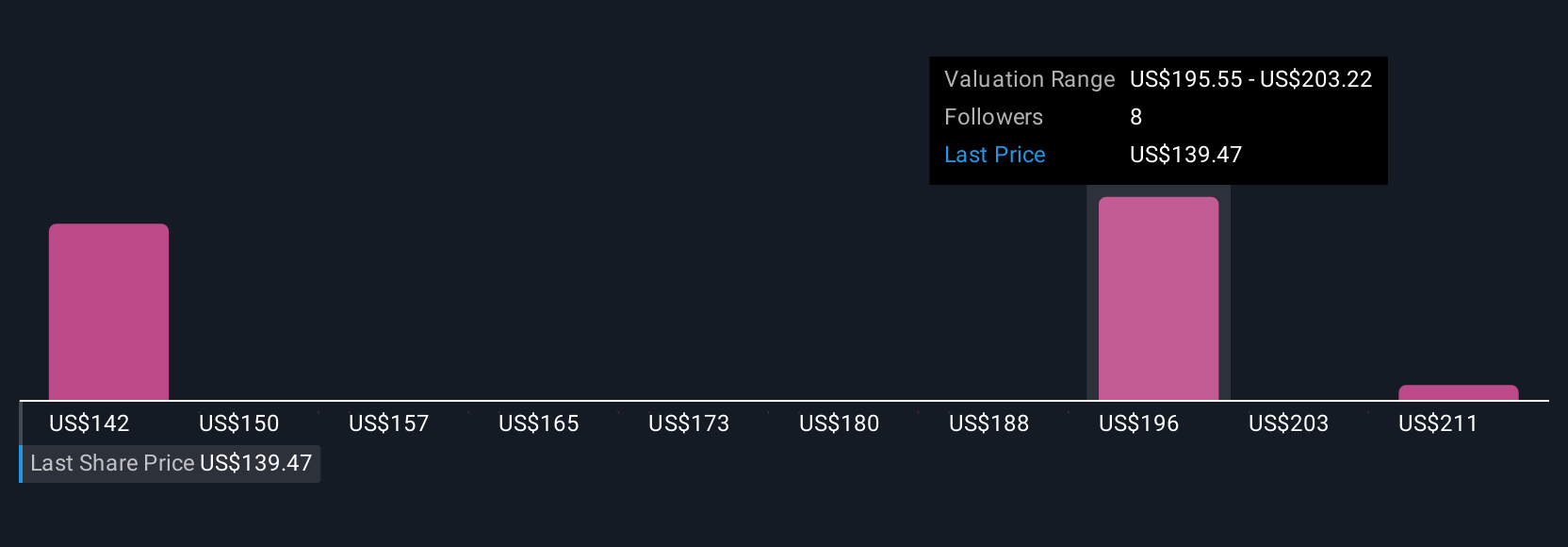

The Simply Wall St Community’s 3 fair value estimates for CBRE Group range widely from US$155.37 to US$218.54 per share. Amid strong earnings momentum, it’s clear that opinions can differ and there is value in exploring multiple viewpoints.

Explore 3 other fair value estimates on CBRE Group - why the stock might be worth as much as 33% more than the current price!

Build Your Own CBRE Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CBRE Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CBRE Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CBRE Group's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 25 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.