Please use a PC Browser to access Register-Tadawul

Should Ussery’s Planned Retirement Prompt a Fresh Look at National HealthCare’s (NHC) Management Strategy?

National HealthCare Corporation NHC | 141.21 | +1.91% |

- National HealthCare Corporation has announced that President and Chief Operating Officer R. Michael Ussery will retire effective December 31, 2025, after a 45-year tenure with the company.

- Ussery’s long-standing leadership and influence has been integral to shaping the company’s focus on high-quality patient care and operational direction.

- We'll explore how this leadership transition and Ussery’s deep impact may influence National HealthCare’s investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is National HealthCare's Investment Narrative?

For those considering National HealthCare as a long-term holding, belief in the company’s stability, operational experience, and commitment to patient care remains central. The newly announced retirement of President and COO R. Michael Ussery after more than four decades doesn’t immediately alter the key short-term catalysts or primary risks, given the lengthy transition period and NHC’s track record of leadership continuity. Core strengths, reliable dividend growth, good value relative to sector peers, and earnings that outpaced the broader healthcare industry last year, remain in place for now. However, Ussery’s departure does create new questions around management succession, especially as it follows other high-profile retirements and a recent auditor change. While current price moves suggest the news hasn’t had a material impact, shifts in leadership always carry the possibility of disrupting momentum or strategic focus in the coming months.

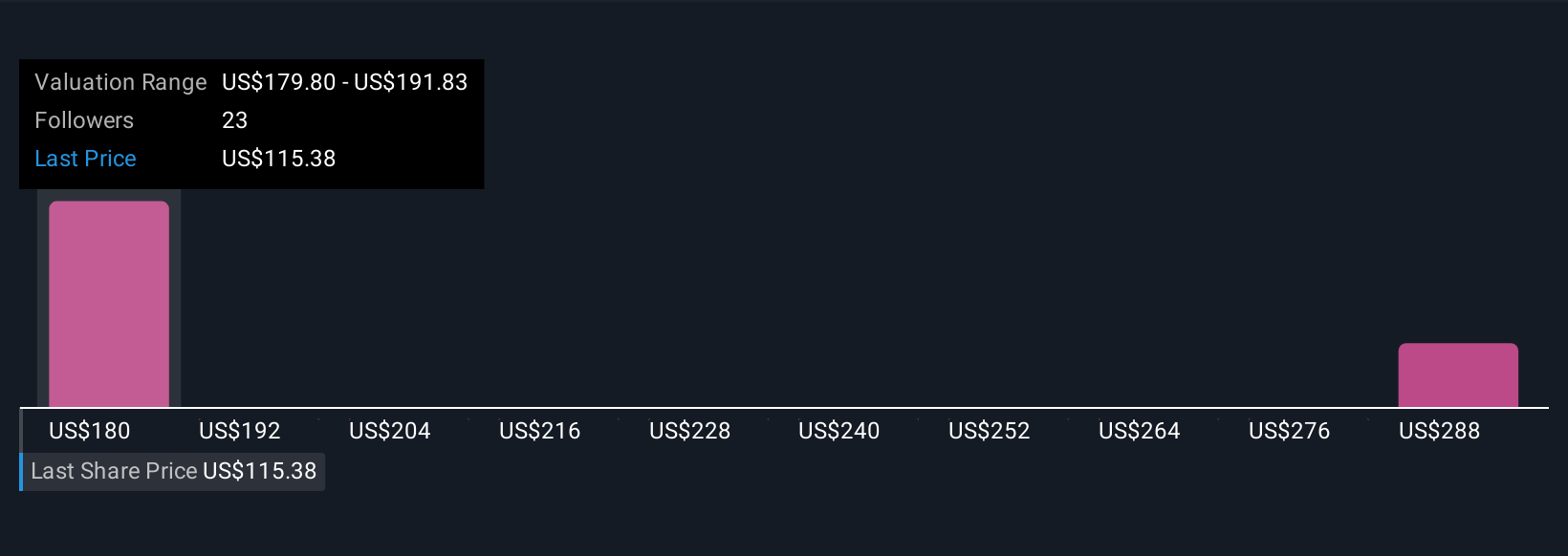

But the risk of management transition disrupting performance is something investors should not overlook. Despite retreating, National HealthCare's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 3 other fair value estimates on National HealthCare - why the stock might be worth just $122.63!

Build Your Own National HealthCare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National HealthCare research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free National HealthCare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National HealthCare's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.