Please use a PC Browser to access Register-Tadawul

Should WisdomTree’s Buyback‑Fueled EPS Surge and 18.9% Revenue Growth Require Action From WT Investors?

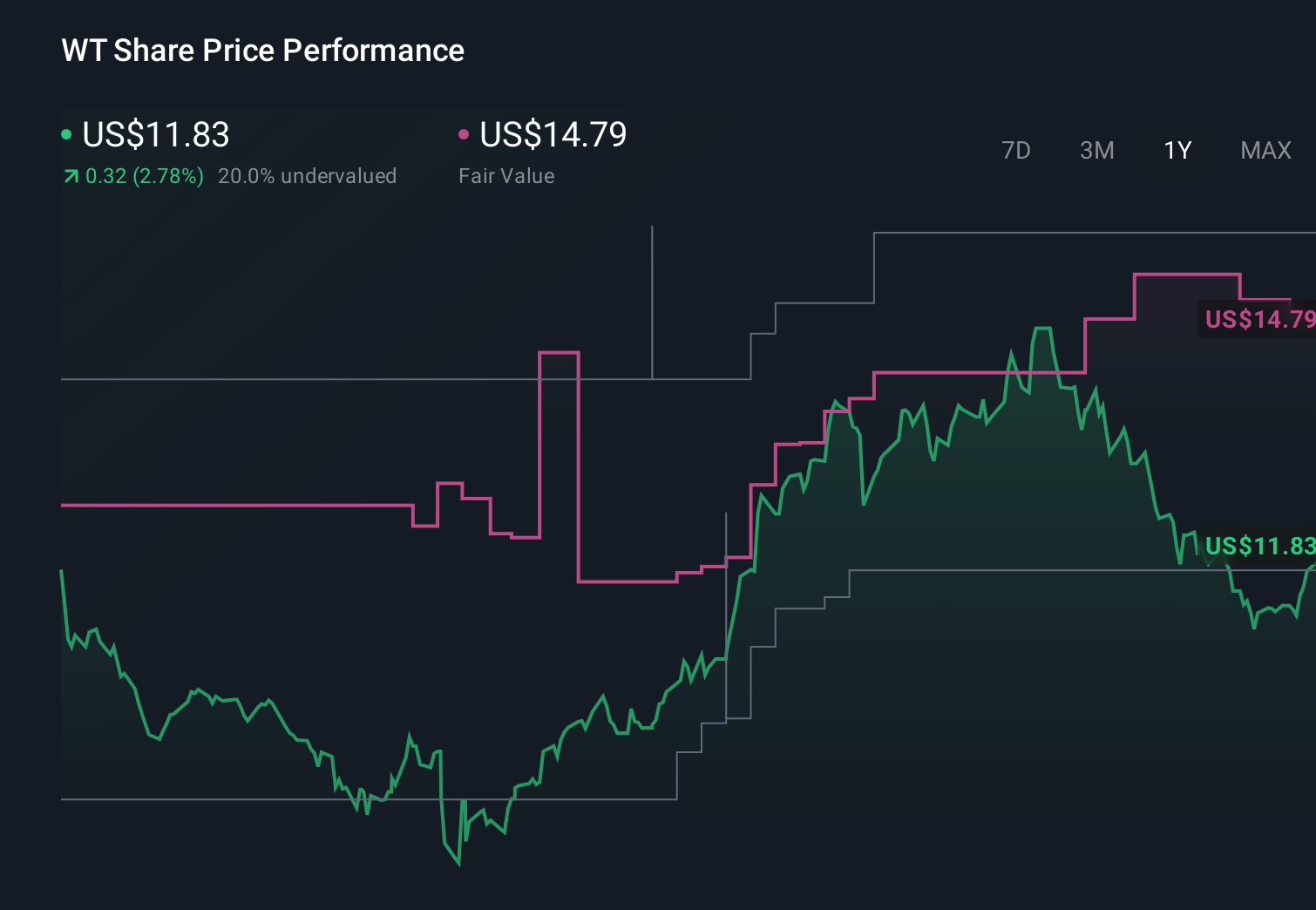

WisdomTree Investments Inc WT | 16.38 | -0.79% |

- In recent periods, WisdomTree has reported approximately 18.9% annual revenue growth over two years, alongside very large annual earnings per share growth of about 52.5% boosted by share buybacks, signaling strong operational progress.

- The combination of rapid earnings per share expansion and active repurchases suggests management is prioritizing capital returns while consolidating market share in its asset management niches.

- Next, we’ll examine how WisdomTree’s sharp earnings per share acceleration, fueled by buybacks, may influence its existing investment narrative and outlook.

We've uncovered the 12 dividend fortresses yielding 5%+ that don't just survive market storms, but thrive in them.

WisdomTree Investment Narrative Recap

To own WisdomTree, you need to believe its ETF and digital asset platforms can keep attracting assets while fee pressure and competition steadily increase. The recent surge in revenue and earnings per share supports the near term catalyst of continued asset growth and buybacks, but it does little to reduce the key risk that fee compression and product commoditization could weigh on margins if growth slows.

The most relevant recent announcement is WisdomTree’s expansion of its tokenized funds to the Solana blockchain, alongside broader access through WisdomTree Connect and WisdomTree Prime. This move ties directly into the digital asset and tokenization catalyst, reinforcing the idea that the company is building out a differentiated, tech enabled product set that could help offset traditional fee pressure if digital adoption holds up.

Yet investors should be aware that growing exposure to digital assets could become a bigger risk if...

WisdomTree's narrative projects $600.8 million revenue and $227.8 million earnings by 2028. This requires 10.6% yearly revenue growth and about a $168.2 million earnings increase from $59.6 million today.

Uncover how WisdomTree's forecasts yield a $14.79 fair value, a 10% downside to its current price.

Exploring Other Perspectives

Some of the lowest analysts were expecting revenue of about US$590,000,000 and earnings near US$210,000,000 by 2028, yet they still see higher competition and digital asset uncertainty as real headwinds, so your own view on this latest growth and buyback fueled EPS jump may lead you to a very different conclusion.

Explore 2 other fair value estimates on WisdomTree - why the stock might be worth less than half the current price!

Build Your Own WisdomTree Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WisdomTree research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free WisdomTree research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WisdomTree's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The future of work is here. Discover the 32 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.