Please use a PC Browser to access Register-Tadawul

Should You Chase Citi Trends After Q3 Earnings?

Citi Trends, Inc. CTRN | 43.44 | +1.24% |

Citi Trends (NASDAQ:CTRN) released its Q3 results today, reporting $197.1 million in total sales, a 38.9% gross margin, and a net loss of $6.9 million. While higher store traffic helped lift sales, and management delivered a generally positive outlook, the key question is: Should you chase the stock after earnings?

To answer that, we examine Citi Trends through the lens of its Adhishthana cycle, which tells a far clearer story than the earnings print alone.

Analysing Citi Trends' Adhishthana Cycle

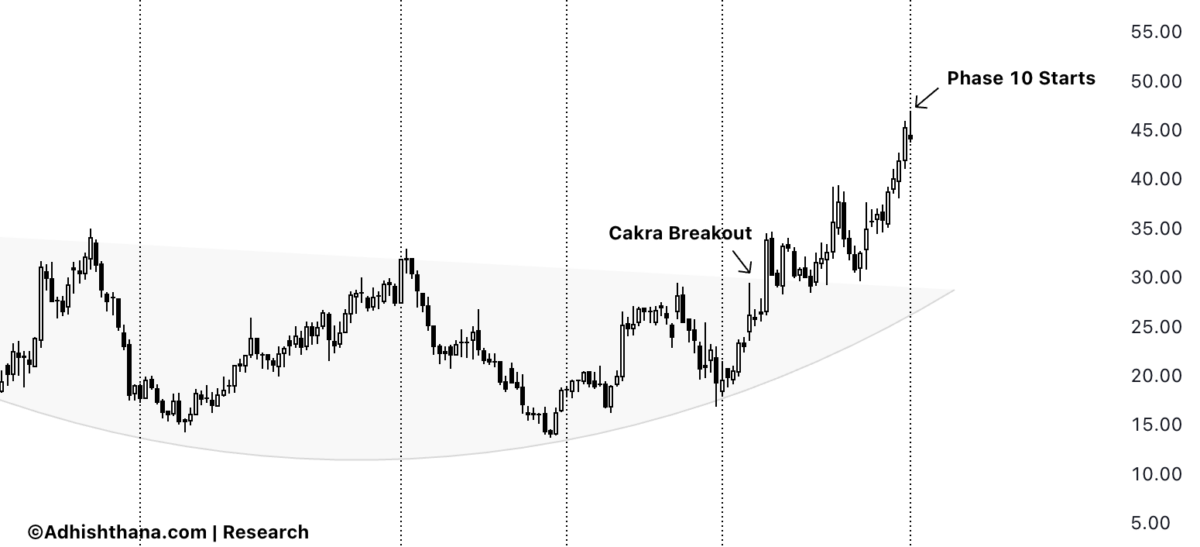

Citi Trends is currently in Phase 10 of its 18-phase Adhishthana cycle, and the stock is progressing through the ascent leg of the Himalayan Formation, the bullish leg that unfolds immediately after a Cakra breakout.

Revisiting the Cakra Structure

Under Adhishthana Principles, stocks typically develop a Cakra formation between Phases 4–8. This structure is a curved channel that prepares the base for a major breakout that happens in Phase 9, which then ignites the Himalayan Formation, a powerful three-stage move. The formation consists of an ascent, peak, and descent.

For Citi Trends:

- The Cakra formed between Jan 2022 and Phase 8, with the stock oscillating within the arc.

- As expected, the stock reversed cleanly from the lower arc boundary and broke out in Phase 9.

- Phase 9 delivered a massive ~174% rally, validating the Cakra breakout and confirming the start of the Himalayan ascent.

Now, the stock has entered Phase 10 on December 1st, a phase known for volatility, rapid swings, and early peak-formation attempts.

Understanding the Phase 10 Window

As noted in my book, Adhishthana: The Principles That Govern Wealth, Time & Tragedy:

"The 18th interval is expected to be the level of peak formation; if not, then the 23rd interval. If this phase concludes without forming the peak, it is anticipated to occur in the following phases."

Translated into the current cycle, Citi Trends' peak-formation window falls roughly between late March and early May 2026.

Until that window arrives, the ascent remains structurally intact, meaning the broader bullish tendency should continue, although not without volatility.

Investor Outlook For Citi Trends’ Stock

Earnings-driven volatility is normal for a stock in Phase 10, which is known for sharp pullbacks that often look like early peaks but are simply part of the ascent structure.

For existing holders:

You should continue to hold, but keep a close watch on the peak-formation window in 2026. That is where risk escalates sharply and profit-taking becomes essential.

For prospective buyers:

The stock should not be viewed as a long-term value pick at this stage, because:

- The peak-formation window is approaching.

- The ascent is already well underway.

- Phase 10 carries heightened volatility and false reversals.

Buying is possible, but only as a short-term tactical trade, taking advantage of volatility rather than chasing strength blindly.

Bottom line:

Citi Trends remains structurally bullish, but the window for a sustainable long-term entry has not yet opened. Short-term traders may find opportunities, but the stronger hand is with those who hold the stock.

Also Read: Can Macy's Sustain Its Breakout As Q3 Earnings Loom?

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.