Please use a PC Browser to access Register-Tadawul

Should You Reconsider Brighthouse Financial After Its Strategic Review and Recent Price Drop?

Brighthouse Financial, Inc. BHF | 65.40 | 0.00% |

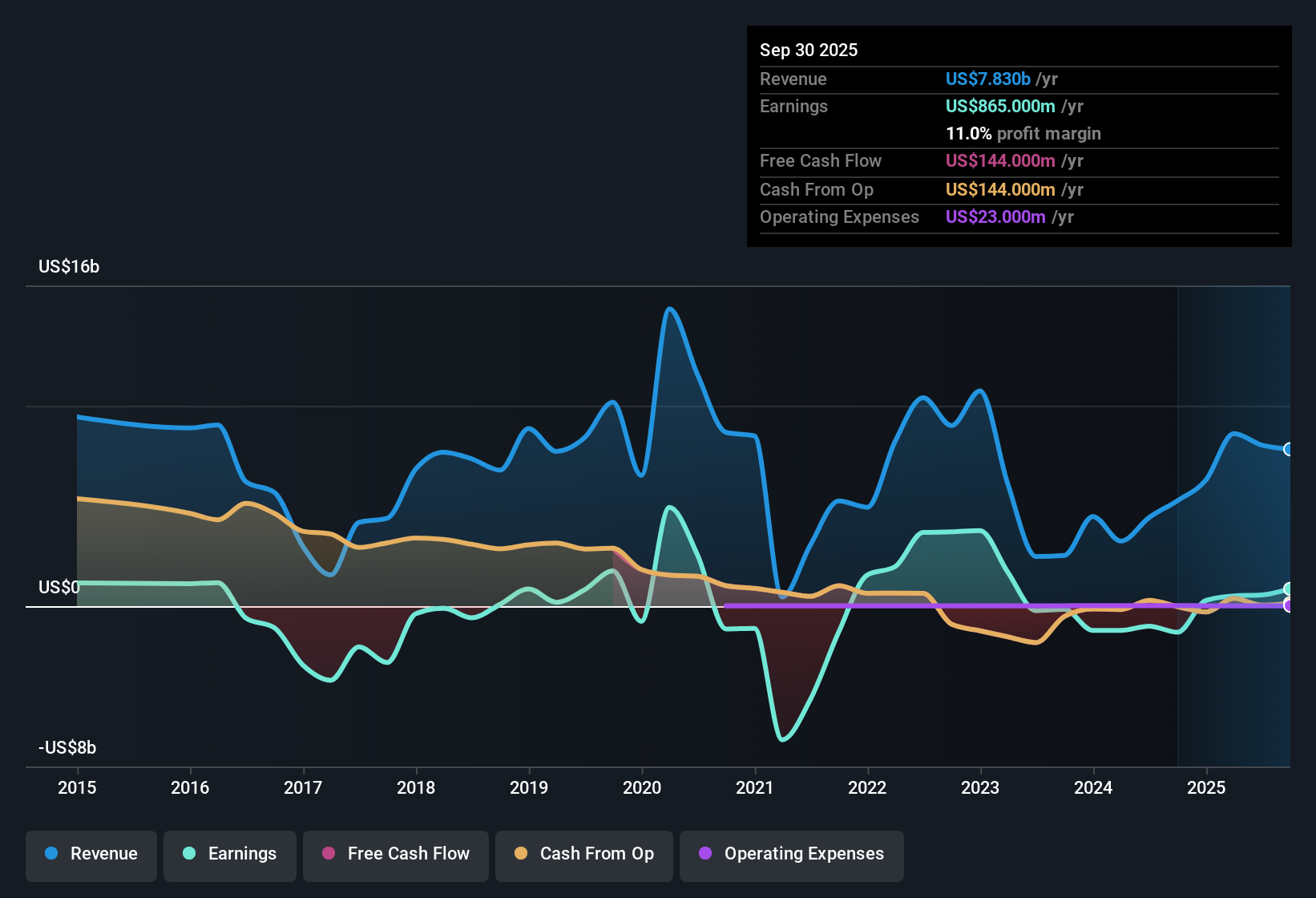

Trying to figure out what to do with Brighthouse Financial’s stock right now? You’re in good company. With prices pulling back by 15.6% over the past month and sliding 3.5% in the last week, many investors are wondering whether the volatility spells opportunity or risk. But before you let the headlines or recent swings worry you, let’s put things in perspective. Last year’s market was tough for insurers, yet Brighthouse Financial actually posted a solid 54.7% gain over the past five years, showing it can recover and deliver for patient holders.

It’s not just the charts catching attention. There’s been renewed interest in Brighthouse Financial after it announced a strategic review of its product mix and reaffirmed its focus on building capital strength. Some analysts see these moves as positioning the company for resilience, even amid sector headwinds. This strategic clarity may not excite momentum traders, but it’s precisely the kind of news that long-term investors appreciate when weighing whether a stock is undervalued or overlooked.

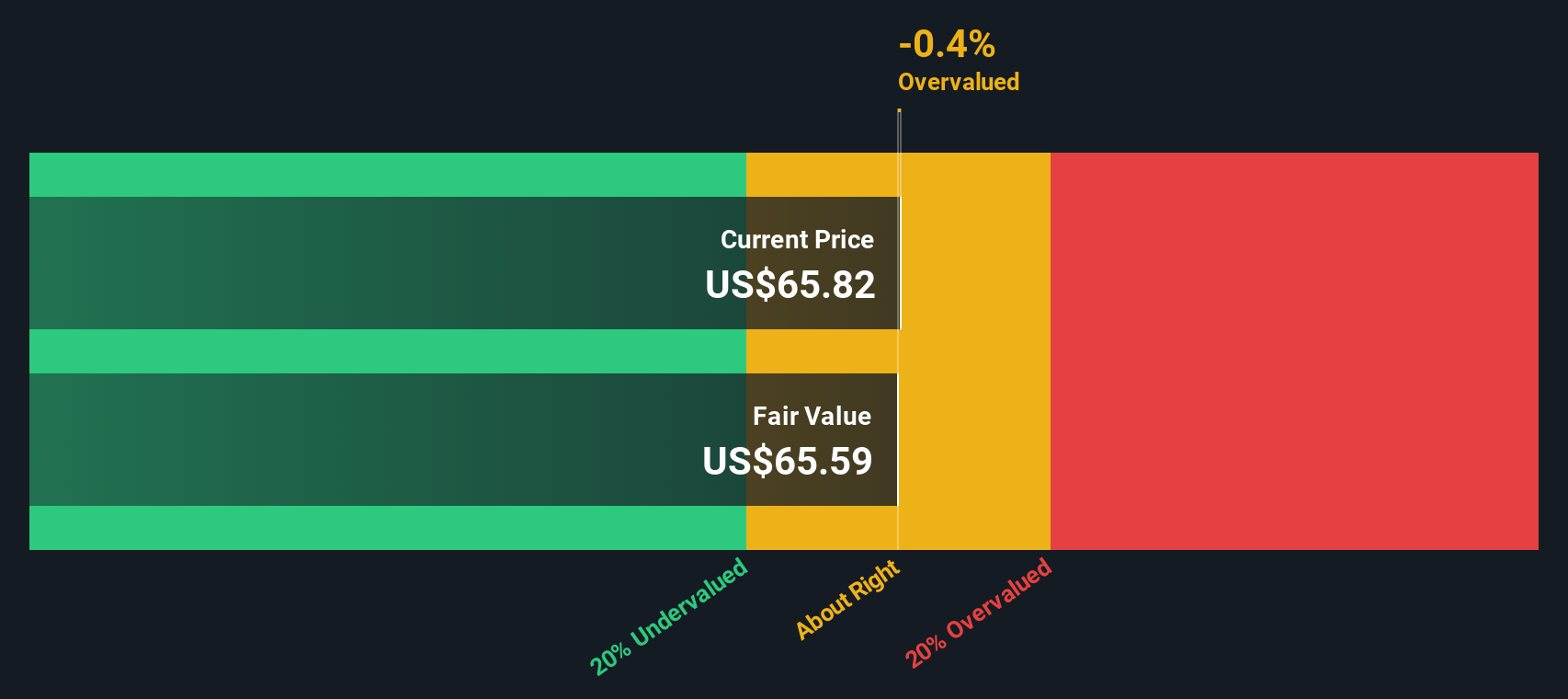

And undervalued is exactly how Brighthouse Financial looks right now, at least by the numbers. A perfect 6 out of 6 valuation score suggests the company checks every box for being priced below its underlying worth. But as any savvy investor knows, not all value signals are created equal. Up next, we’ll break down exactly how Brighthouse earns its rating using several valuation approaches, before shining a light on what might be an even more reliable way to determine whether this company deserves a spot in your portfolio.

Approach 1: Brighthouse Financial Excess Returns Analysis

The Excess Returns model evaluates whether a company is generating returns on its capital above the required cost of equity. This is considered a strong indicator of long-term value creation. For Brighthouse Financial, this approach sheds light on its profitability relative to what shareholders demand for their investment risk.

According to the latest data, Brighthouse Financial reports a book value of $99.31 per share, with stable earnings per share (EPS) of $14.86. These figures are based on a weighted average of future return on equity estimates from six analysts, indicating a consistent ability to generate profits. The cost of equity is $11.26 per share, meaning the company exceeds this hurdle by a comfortable margin. Its excess return, which is the profit above that equity cost, is $3.60 per share, while the average return on equity stands at 14.88 percent. Projections for a stable book value of $99.88 per share support the view that Brighthouse is maintaining strong capital foundations.

This method estimates the intrinsic value at $143.82 per share. With the stock currently priced at a steep 67.6 percent discount to this valuation, Brighthouse Financial appears considerably undervalued according to this framework.

Result: UNDERVALUED

Our Excess Returns analysis suggests Brighthouse Financial is undervalued by 67.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

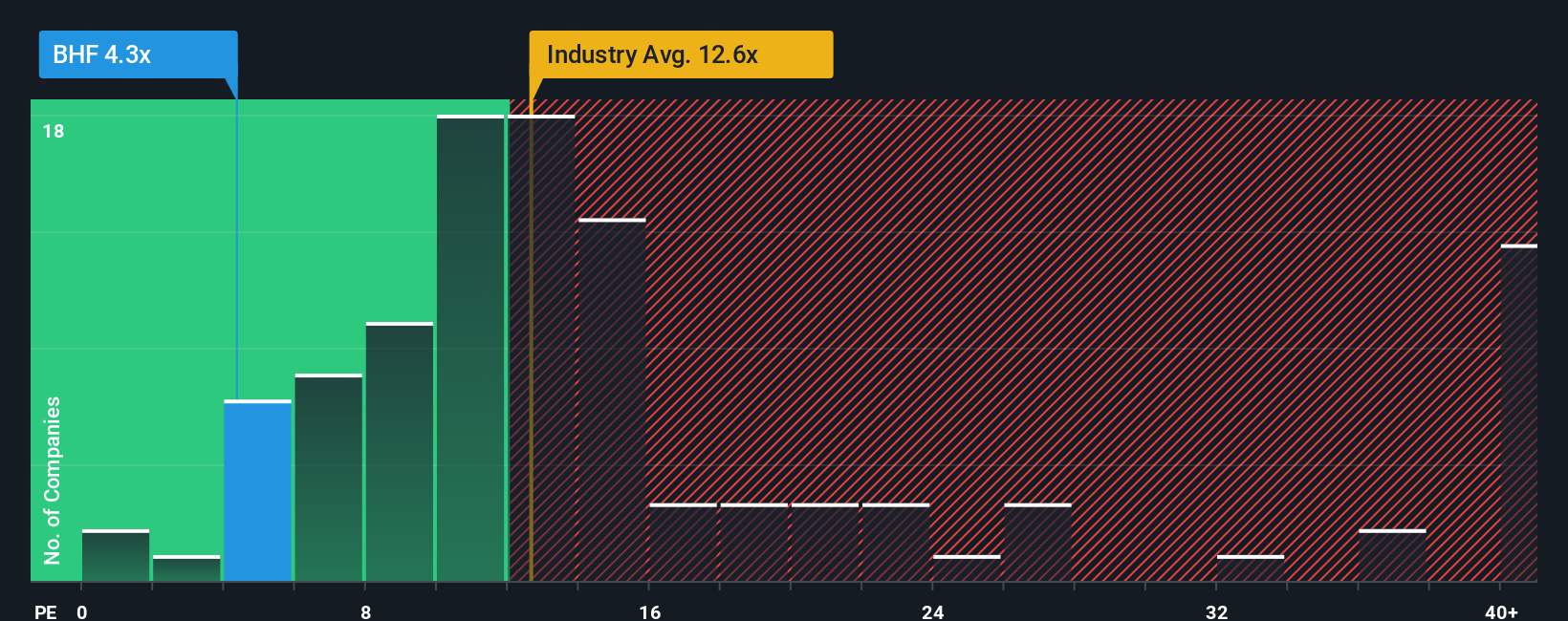

Approach 2: Brighthouse Financial Price vs Earnings

For consistently profitable companies like Brighthouse Financial, the price-to-earnings (PE) ratio is one of the most widely recognized valuation tools. It helps investors quickly gauge how much they are paying for each dollar of earnings. Generally, companies with higher growth prospects or lower risk command higher PE multiples, while slower growth or elevated risks warrant lower ratios.

Currently, Brighthouse Financial trades at a PE ratio of 4.74x. In context, this is significantly lower than both the peer average of 12.32x and the broader insurance industry average of 13.90x. On paper, this suggests the stock is deeply discounted compared to many competitors, possibly reflecting investor caution or overlooked earnings potential.

However, raw averages do not capture the full story. Simply Wall St's proprietary "Fair Ratio" provides deeper analysis by adjusting for Brighthouse Financial's earnings growth, margins, market capitalization, risk profile, and position within the industry. The Fair Ratio for Brighthouse is determined to be 20.93x, which is substantially above the company's current 4.74x multiple. Because this custom benchmark accounts for the nuanced financial reality of Brighthouse rather than just basic comparisons, it offers a more robust assessment of value.

With the actual PE ratio well below the Fair Ratio, this method indicates that Brighthouse Financial’s shares appear undervalued on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Brighthouse Financial Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative combines your perspective on a company with the numbers; in other words, it is your story behind the assumptions: what you believe about Brighthouse Financial's industry, future revenue, earnings, and profit margins, all linked to a fair value estimate.

This approach connects the company's story to its financial forecast, then ties those expectations directly to a fair value, helping you judge if the current share price represents opportunity or risk. Narratives are designed to be easy and accessible; millions of investors use them on Simply Wall St’s Community page to test their own assumptions or learn from others’ thinking, all within a few minutes.

By comparing your Narrative’s Fair Value to the market price, and seeing how that changes dynamically when there is new news or earnings, you can make more informed decisions about when to buy or sell. For Brighthouse Financial, one Narrative sees rising annuity demand and technology investment justifying a price as high as $72, while a more cautious perspective points to tougher competition and volatility, pegging fair value at $42. Narratives allow you to decide which story fits your own outlook best, giving you a smarter, more personal way to invest.

Do you think there's more to the story for Brighthouse Financial? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.