Please use a PC Browser to access Register-Tadawul

Simmons First National (SFNC): Valuation Spotlight Following $325 Million Subordinated Note Offering

Simmons First National Corporation Class A SFNC | 19.48 | +0.57% |

If you have been watching Simmons First National (SFNC) lately, you probably noticed a new reason for investors to talk about the stock. The company just announced and wrapped up a $325 million fixed-to-floating rate subordinated note offering. This material move adds a substantial chunk of capital to its balance sheet. The structure of these notes, with variable rate features and junior, unsecured status, signals a nuanced approach to funding that is aimed at maximizing flexibility while potentially boosting future earnings capacity.

This capital raise comes at a time when Simmons First National has seen mixed momentum in its share price over the past year. Despite a positive run over the past three months, with a gain of about 8%, the stock is still down 3% over the last year and has slipped nearly 8% since January. These shifts follow a surge in annual net income growth, which jumped 56%, and a 20% increase in annual revenue, suggesting that the business fundamentals may not be fully reflected in the latest price moves.

Now that Simmons has raised fresh capital and the stock price is lagging its recent fundamental gains, the question remains whether the market is overlooking an opportunity or is anticipating more muted growth ahead.

Most Popular Narrative: 12% Undervalued

The prevailing narrative suggests Simmons First National's shares are trading below what analysts estimate as fair value, implying a compelling opportunity if their assumptions prove correct.

Demand for both consumer and commercial banking services is expected to be supported by strong population growth and urbanization trends throughout southern and midwestern U.S. regions where Simmons operates. This is anticipated to help drive sustained loan and deposit growth and bolster revenues.

What is the logic behind this narrative’s bullish price target? There is a bold mix of revenue acceleration, shifting profit margins and a valuation multiple usually reserved for sector standouts. Want to discover the key drivers and most surprising growth assumptions that fuel this story? Explore the narrative to see the full playbook on how analysts arrive at their aggressive fair value.

Result: Fair Value of $22.8 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising expenses and ongoing pressure in loan pricing could constrain Simmons’ earnings growth if market conditions shift or if cost controls falter.

Find out about the key risks to this Simmons First National narrative.Another View: Valuation by Industry Comparison

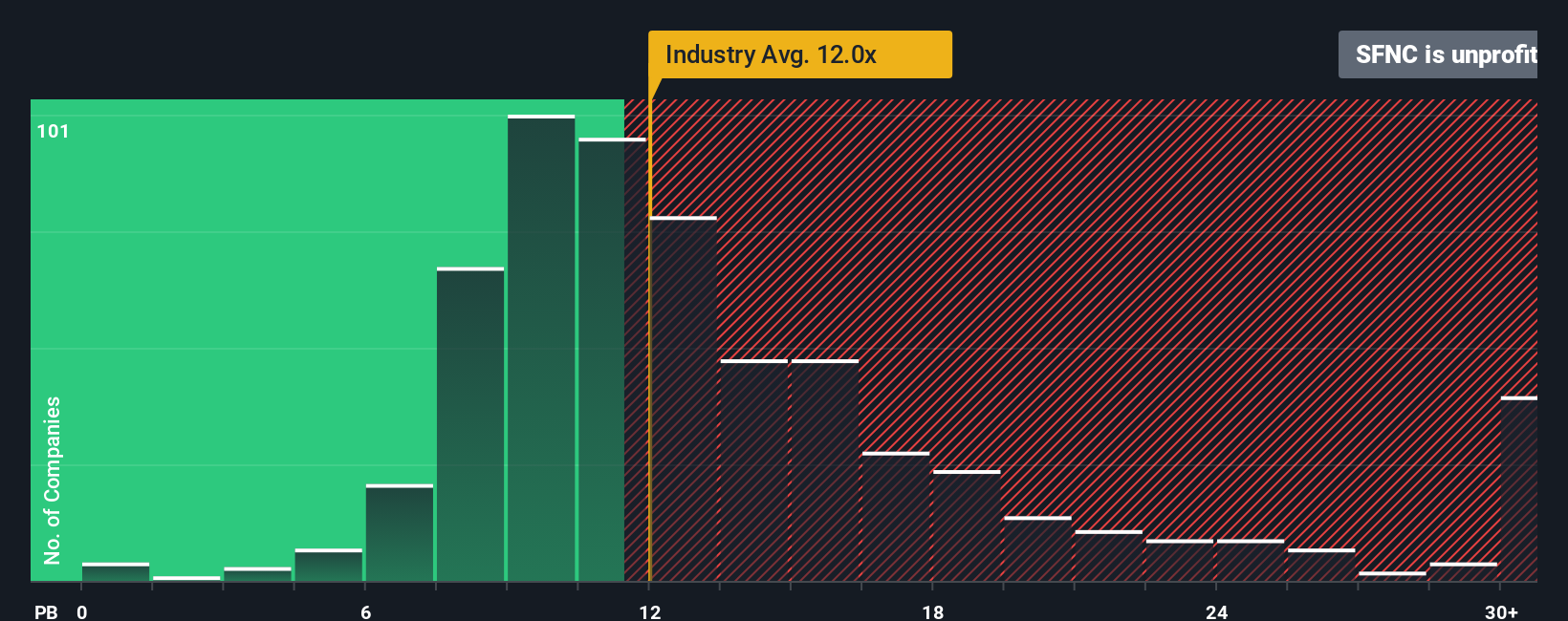

Looking at Simmons First National from an industry perspective, its current price suggests a higher valuation than many of its peers. This raises the question: are investors paying up for growth, or is value being overlooked?

Build Your Own Simmons First National Narrative

Keep in mind, if these narratives do not align with your outlook or you would rather run your own numbers, building a personal scenario is quick and easy. Do it your way.

A great starting point for your Simmons First National research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t put your portfolio on pause. Now is your chance to uncover unique opportunities beyond Simmons First National, all tailored by the data-driven screener tools at Simply Wall Street.

- Boost your search for hidden value by sifting through undervalued stocks using insights from undervalued stocks based on cash flows.

- Capitalize on rapidly emerging trends by tapping into a curated lineup of AI-focused stocks with AI penny stocks.

- Step up your passive income strategy by finding companies offering strong, consistent dividends thanks to dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.