Please use a PC Browser to access Register-Tadawul

Slammed 77% Yueda Digital Holding (NASDAQ:YDKG) Screens Well Here But There Might Be A Catch

Yueda Digital Holding. Ordinary Shares - Class A YDKG | 1.14 | -8.80% |

Unfortunately for some shareholders, the Yueda Digital Holding (NASDAQ:YDKG) share price has dived 77% in the last thirty days, prolonging recent pain. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

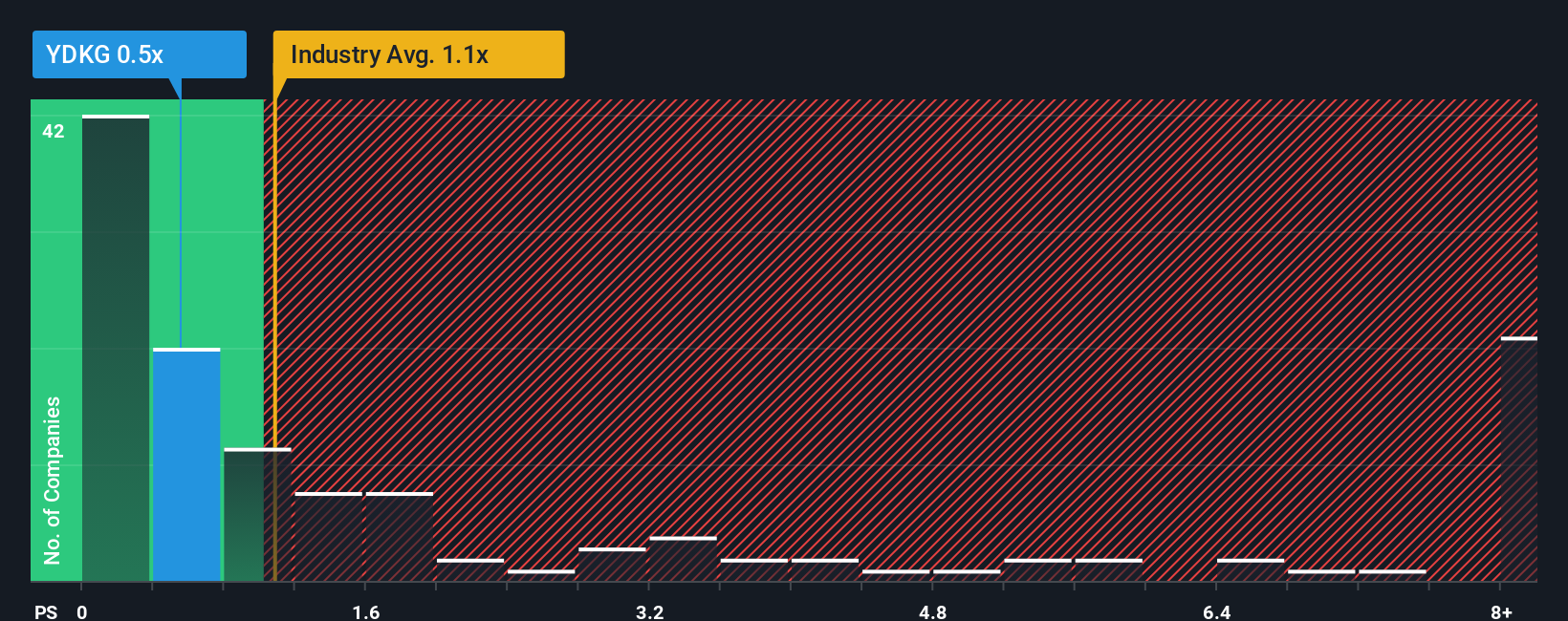

Since its price has dipped substantially, Yueda Digital Holding's price-to-sales (or "P/S") ratio of 0.5x might make it look like a buy right now compared to the Media industry in the United States, where around half of the companies have P/S ratios above 1.1x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Has Yueda Digital Holding Performed Recently?

Recent times have been quite advantageous for Yueda Digital Holding as its revenue has been rising very briskly. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Yueda Digital Holding's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Yueda Digital Holding's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. The latest three year period has also seen an excellent 143% overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 1.7%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's peculiar that Yueda Digital Holding's P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does Yueda Digital Holding's P/S Mean For Investors?

The southerly movements of Yueda Digital Holding's shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Yueda Digital Holding revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

If these risks are making you reconsider your opinion on Yueda Digital Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.