Please use a PC Browser to access Register-Tadawul

Snap Analysts Lower Their Forecasts After Q2 Results

Snap SNAP | 7.31 | -4.32% |

Snap Inc (NYSE:SNAP) reported better-than-expected second quarter sales on Tuesday.

Snap reported second-quarter revenue of $1.345 billion, up 9% year-over-year. The revenue total beat a Street consensus estimate of $1.344 billion according to data from Benzinga Pro. The company reported a loss of 16 cents per share, which was in line with estimates from analysts.

“Our global community continued to grow in Q2, reaching 932 million Monthly Active Users as we continued to invest in AI and augmented reality,” Snap CEO Evan Spiegel said. “With meaningful inventory and conversions growth this quarter, including the broader rollout of Sponsored Snaps, we’re excited about the opportunity to translate improved advertiser performance into topline acceleration.”

Snap shares fell 0.8% to close at $9.39 on Tuesday.

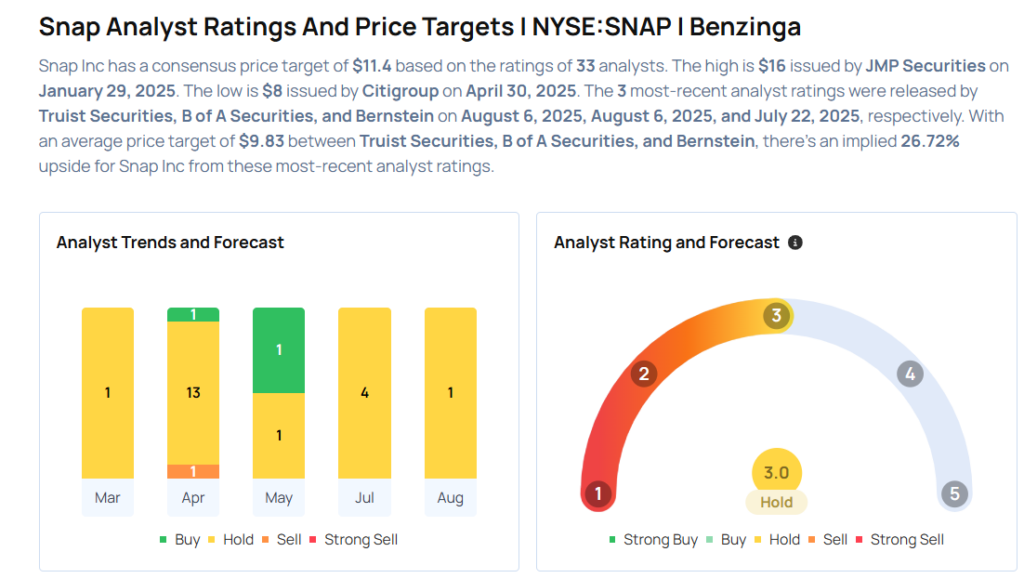

These analysts made changes to their price targets on Snap following earnings announcement.

- B of A Securities analyst Justin Post maintained Snap with a Neutral and lowered the price target from $10 to $9.5.

- Truist Securities analyst Youssef Squali maintained Snap with a Hold and lowered the price target from $11 to $10.

Considering buying SNAP stock? Here’s what analysts think:

Read This Next:

- Top 2 Health Care Stocks You May Want To Dump In Q3

Photo via Shutterstock