Please use a PC Browser to access Register-Tadawul

Snowflake (SNOW) Valuation in Focus After Bold AI Expansion and Key Financial Services Launch

Snowflake SNOW | 217.93 | -1.17% |

Following its introduction of Cortex AI for Financial Services, Snowflake (SNOW) is making a meaningful push into specialized AI tools designed for highly regulated industries. This new offering is gaining traction as a result of recent partnerships and product rollouts, generating enthusiasm from investors.

Snowflake’s shares have surged in 2025, recently hitting a 52-week high as investors responded enthusiastically to new product launches like Cortex AI and strategic partnerships with automation leaders. The 1-year total shareholder return stands at an impressive 95%, underlining strong momentum and optimism around Snowflake’s growth prospects. Some warn, however, that the valuation remains elevated compared to historical norms.

Curious which other tech stocks are catching attention thanks to AI breakthroughs and bold moves? Explore the market’s rising stars with our See the full list for free..

Yet with Snowflake trading near all-time highs and some analysts cautioning that its valuation is stretched, the key question for investors is whether the current price leaves room for future gains or if all the upside is already factored in.

Most Popular Narrative: 8% Undervalued

Snowflake's most widely followed narrative places its fair value at $263, roughly 8% above the last close price of $242. This fair value reflects high expectations for continued platform expansion, heavy AI adoption, and future profit potential.

Accelerating enterprise adoption of AI and advanced analytics is fueling incremental demand for Snowflake's platform, as evidenced by nearly 50% of new customers citing AI as a primary driver, and over 25% of all deployed use cases leveraging AI. This is setting up higher future revenue growth as companies increasingly budget for AI-driven workloads.

Want to know which bold financial projections put this company above the rest? The narrative leans on aggressive growth and profitability forecasts not seen in your average tech story. Eager to uncover the assumptions that justify these sky-high expectations? There’s more behind the numbers than meets the eye.

Result: Fair Value of $263 (UNDERVALUED)

However, if migration activity slows or competition further intensifies, Snowflake’s robust growth narrative could face real challenges in the future.

Another View: Assessing Value Through Sales Ratio

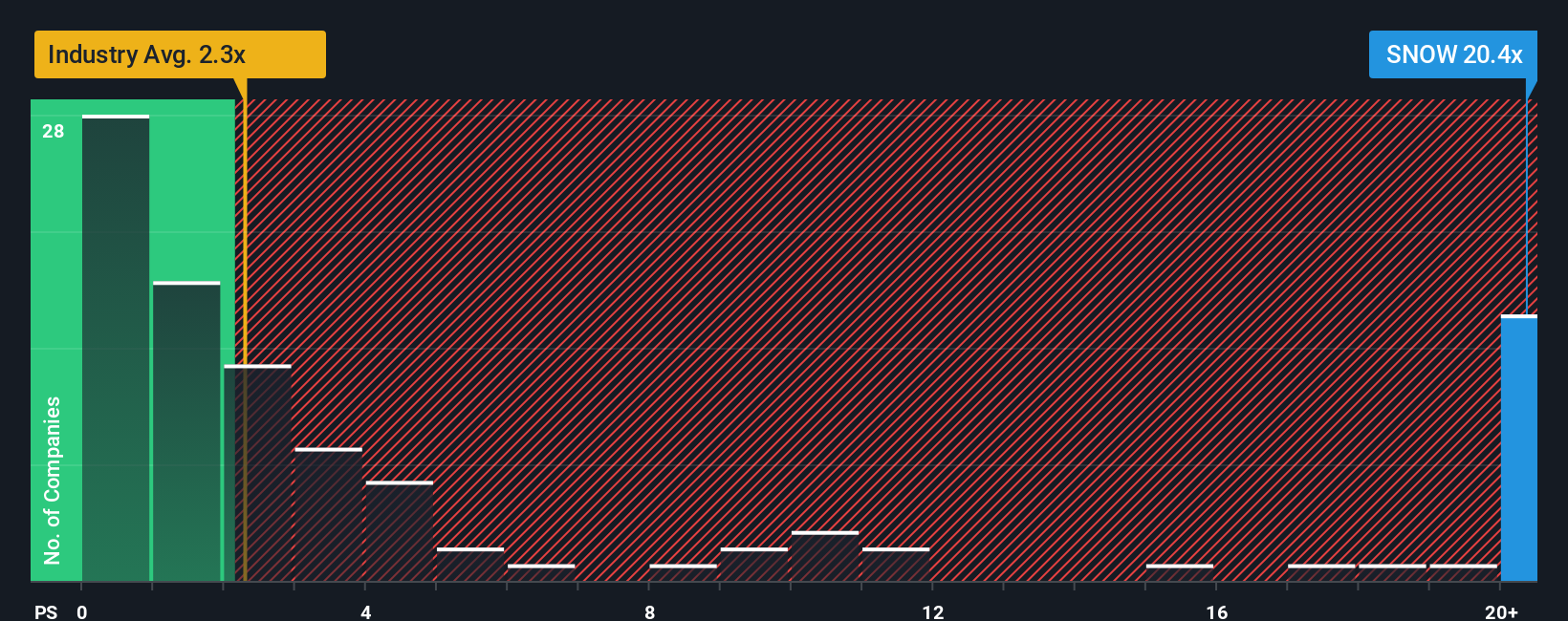

Taking a different approach, Snowflake’s price relative to sales sits at 19.9 times. This is much higher than the US IT industry average of 2.3 times and also above its own fair ratio of 15.3 times. This suggests the stock carries a premium investors should think carefully about. Is the market confidence justified, or will reality catch up?

Build Your Own Snowflake Narrative

If you have a different view or prefer to draw your own conclusions, you can craft your personal take using the data in just a few minutes. So why not Do it your way?

A great starting point for your Snowflake research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always have an eye on what’s next. Take advantage of unique opportunities others miss by using these powerful screeners to unlock fresh stocks and future leaders across different sectors.

- Uncover hidden value opportunities with strong cash flow potential by checking out these 898 undervalued stocks based on cash flows.

- Take your search global with these 79 cryptocurrency and blockchain stocks to tap into innovative companies riding the blockchain and cryptocurrency wave.

- Get ahead of the trend and spot healthcare pioneers shaping AI medicine through these 33 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.