Please use a PC Browser to access Register-Tadawul

SoFi Technologies (NasdaqGS:SOFI) Expands Crypto Capabilities With New Global Financial Services

SoFi SOFI | 20.86 | +7.19% |

SoFi Technologies (NasdaqGS:SOFI) made significant strides in the past quarter with a notable price increase of 32%, primarily driven by its expansion of digital financial services, particularly its integration of crypto-powered capabilities and blockchain innovations. This move potentially strengthened investor confidence, positioning the company as a modernized financial services provider. Though the broader market rose 1.7% last week and 12% over the past year, SoFi's substantial growth outpaced these averages. Additionally, the partnership with Benzinga to enhance market insights could have reinforced investor optimism, complementing the company's broader strategic developments in digital services and investments.

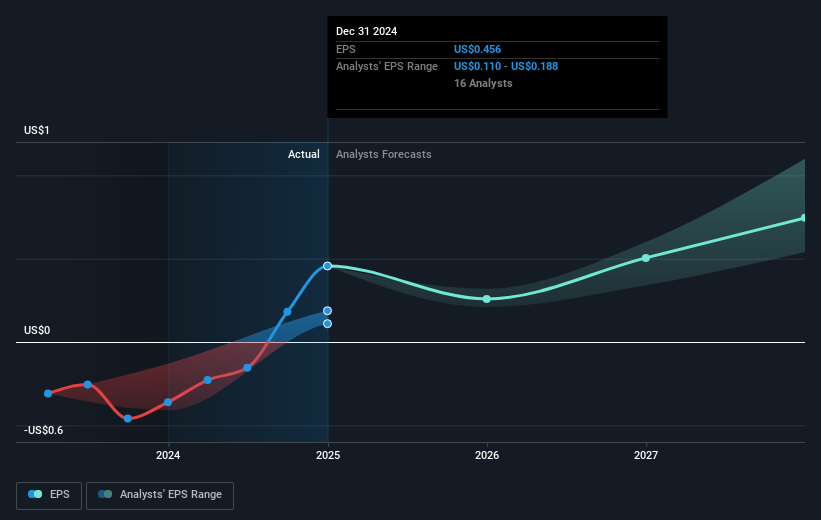

The recent developments at SoFi Technologies, including its strides in digital financial services like crypto integration, could further bolster the company's position in the financial sector. This strategic move may enhance SoFi's revenue from their capital-light loan platform and SoFi Money, contributing to projected growth. Analysts foresee a revenue increase to US$4.4 billion and earnings reaching US$912.2 million by 2028, suggesting a robust outlook, though economic uncertainties and market volatility remain potential obstacles.

In a broader context, SoFi's share performance over the past three years, with a total return of 190.25%, indicates significant long-term investor confidence. This return substantially outperformed both the US Market's 12% and the Consumer Finance industry's 34.7% returns over the past year, underscoring SoFi's remarkable growth trajectory and competitive edge.

Despite a recent share price of US$13.27, slightly below the consensus price target of US$14.45, the company's rapid growth signals a closer alignment with analyst expectations of future profitability. The potential impact of new partnerships, such as with Benzinga and ESPN, alongside continued enhancements in SoFi's financial offerings, will be crucial in sustaining and possibly exceeding these forecasts. As SoFi continues to expand its product suite and strengthen its market presence, its capacity to meet and surpass revenue and earnings projections will be pivotal.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.