SolarEdge Technologies (NasdaqGS:SEDG) Stock Surges 42% Over Past Month

SolarEdge Technologies, Inc. SEDG | 0.00 |

SolarEdge Technologies (NasdaqGS:SEDG) recently launched a solar-powered EV charging solution and a new controller for the German market, marking key product advancements. Over the past month, the company's stock price surged 42%, significantly outpacing the broader market's 3% rise. This substantial increase suggests that investors responded positively to SolarEdge's innovations, reinforced by favorable quarterly earnings results that showed improved financial metrics, despite ongoing net losses. The recent amendment in corporate bylaws to limit officer liability may have also provided a layer of investor assurance, contributing to confidence in the company's strategic direction.

SolarEdge Technologies' recent product advancements and amendments in corporate bylaws could potentially shift investor sentiment. These developments might support the narrative of disciplined cash management and an ambition to reclaim market share through innovative offerings. Over the past year, however, the company experienced a total shareholder return decline of 66.23%. In contrast, the broader market gained 11.6%, highlighting a challenging year for SolarEdge. The company's share price is 9.3% below the estimated fair value, reflecting investor caution despite recent positive news.

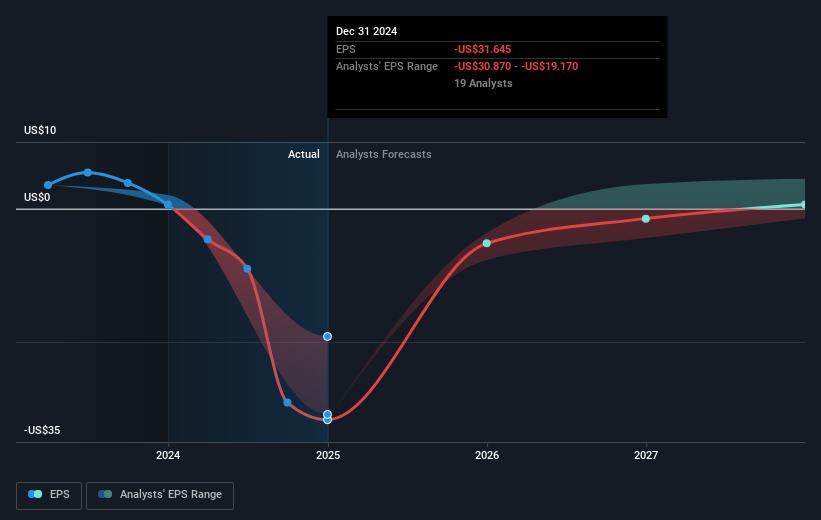

The introduction of a solar-powered EV charging solution and a new controller could positively impact revenue by capturing a larger share in both residential and commercial solar markets. However, maintaining competitiveness in an industry marked by high operational costs and competition from Chinese competitors remains a concern. Analysts forecast annual revenue growth of 17.7%, underscoring a slower pace compared to the US market average but faster than industry growth. Despite optimistic earnings forecasts, SolarEdge remains unprofitable, with current earnings at US$1.75 billion losses. The share price movement should be seen in context with the analyst's consensus price target of US$15.44, a 16.9% potential upside from the current US$12.84, providing a measured outlook for investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Simply Wall St 23/11 00:25

Does Recent Analyst Optimism Signal a Good Entry Point for Applied Materials in 2025?

Simply Wall St 23/11 21:18Why LexinFintech Shares Are Trading Higher By Over 15%; Here Are 20 Stocks Moving Premarket

Benzinga News 24/11 10:23Datavault AI Announces $7M Minting Deal And 30% Perpetual Royalty Partnership With MTB Mining To Digitize Mineral Resources

Benzinga News 24/11 14:14Kopin Unveils Wireless Simulated Binoculars at I/ITSEC 2025

Reuters 24/11 14:15Kerrisdale Capital Publishes Update On ACM Research, Says 'The story has only gotten better since January'

Benzinga News 1hUBS Upgrades Applied Mat to Buy, Raises Price Target to $285

Benzinga News 1hThis Brinker International Analyst Turns Bullish; Here Are Top 5 Upgrades For Tuesday

Benzinga News 13m