Some BARK, Inc. (NYSE:BARK) Shareholders Look For Exit As Shares Take 30% Pounding

The Original BARK Company Common Stock BARK | 0.00 |

The BARK, Inc. (NYSE:BARK) share price has fared very poorly over the last month, falling by a substantial 30%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 46% in that time.

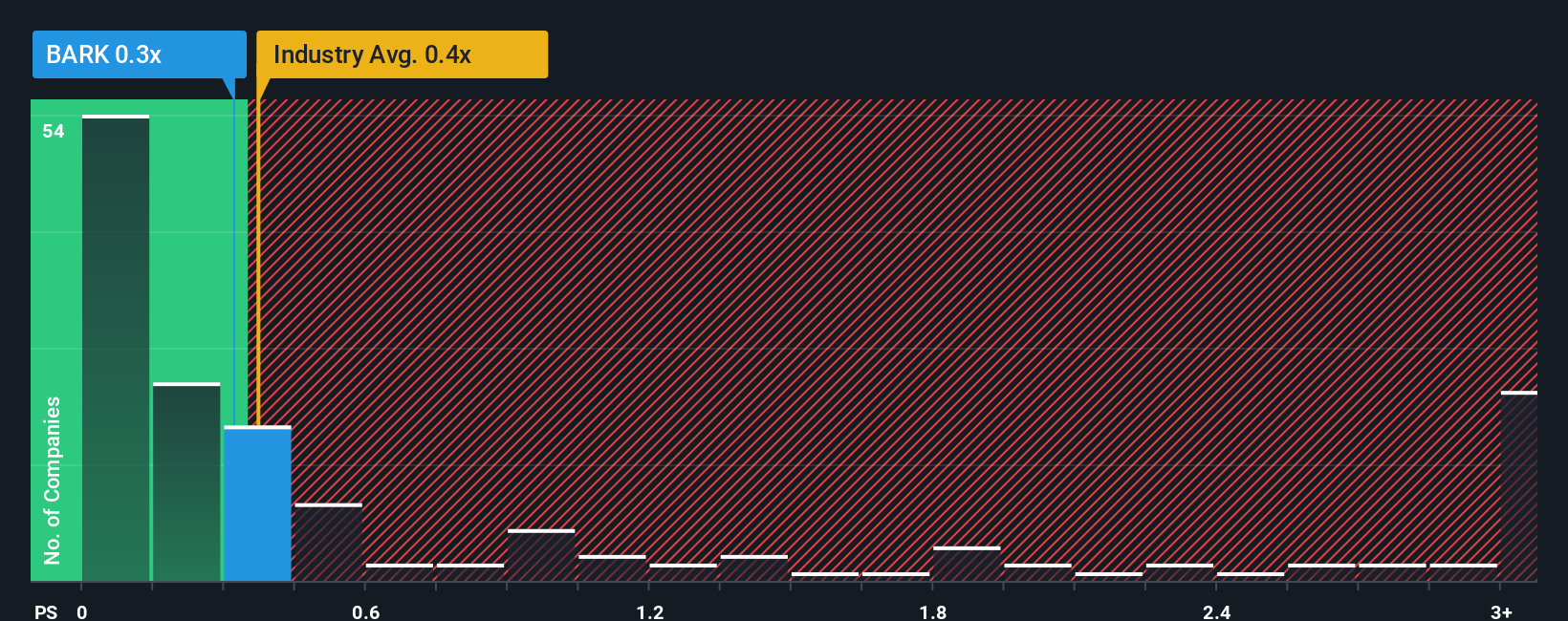

Even after such a large drop in price, you could still be forgiven for feeling indifferent about BARK's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Specialty Retail industry in the United States is also close to 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How BARK Has Been Performing

While the industry has experienced revenue growth lately, BARK's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think BARK's future stacks up against the industry? In that case, our free report is a great place to start.How Is BARK's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like BARK's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.2%. As a result, revenue from three years ago have also fallen 4.6% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 2.5% each year over the next three years. With the industry predicted to deliver 6.3% growth per annum, the company is positioned for a weaker revenue result.

With this information, we find it interesting that BARK is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On BARK's P/S

Following BARK's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

When you consider that BARK's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks.

If these risks are making you reconsider your opinion on BARK, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Benzinga News 19/11 12:34

Target's Pain Is TJX's Gain, These ETFs Are Making Holiday Bets On The Winner

Benzinga News 19/11 20:30Boqii Holding Files For Mixed Shelf Of Up To $230M

Benzinga News 19/11 21:36UK Stocks-Factors to watch on November 20

Reuters 20/11 05:32E-Commerce Today - WeShop Redefines Retail with U.S. Social Commerce Expansion

Simply Wall St 20/11 12:07Pattern Group Expands Its Fulfillment And Logistics Services Portfolio With Launch Of Pattern Transportation, Pattern ReLo, Pattern Reimbursements Services

Benzinga News 20/11 13:07Dillard's Declares Special Dividend Of $30/Share

Benzinga News 20/11 21:16It's Down 27% But Groupon, Inc. (NASDAQ:GRPN) Could Be Riskier Than It Looks

Simply Wall St 51m