Please use a PC Browser to access Register-Tadawul

Some Confidence Is Lacking In Fox Factory Holding Corp.'s (NASDAQ:FOXF) P/S

Fox Factory Holding Corp. FOXF | 17.04 | +1.61% |

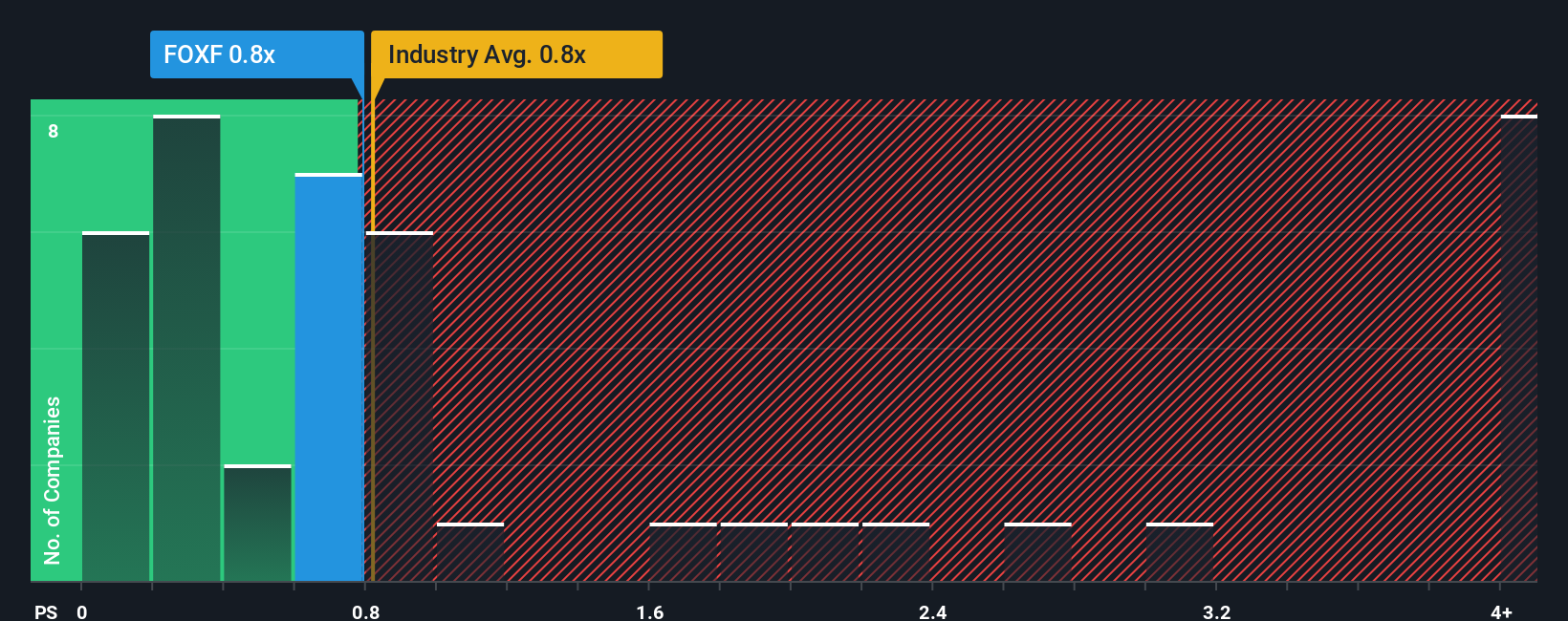

It's not a stretch to say that Fox Factory Holding Corp.'s (NASDAQ:FOXF) price-to-sales (or "P/S") ratio of 0.8x seems quite "middle-of-the-road" for Auto Components companies in the United States, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Fox Factory Holding Has Been Performing

Recent times have been advantageous for Fox Factory Holding as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Fox Factory Holding will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Fox Factory Holding's to be considered reasonable.

Retrospectively, the last year delivered a decent 7.0% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 2.2% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 6.2% over the next year. Meanwhile, the rest of the industry is forecast to expand by 10%, which is noticeably more attractive.

With this information, we find it interesting that Fox Factory Holding is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Fox Factory Holding's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at the analysts forecasts of Fox Factory Holding's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.