Please use a PC Browser to access Register-Tadawul

Somnigroup All Stock Bid For Leggett And Platt Puts Valuation In Focus

Somnigroup International Inc. SGI | 87.85 | -2.52% |

- Somnigroup International (NYSE:SGI) has proposed an all stock acquisition of Leggett & Platt.

- The potential transaction is at a preliminary stage and remains subject to due diligence.

- Investors are watching for updates that could clarify terms, timing, and regulatory considerations.

Somnigroup International, trading at $92.71, is in focus as the market digests this potential tie up with Leggett & Platt. The stock has delivered a 56.7% return over the past year and a very large gain over five years, which puts added attention on how a deal of this size could influence the company’s profile and risk balance.

For shareholders or prospective investors, the key questions will center on deal structure, expected integration plans, and any impact on Somnigroup International’s capital allocation. As management progresses through due diligence, future disclosures around rationale and financial details will be important for assessing how this proposal could affect NYSE:SGI over the medium to long term.

Stay updated on the most important news stories for Somnigroup International by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Somnigroup International.

Quick Assessment

- ❌ Price vs Analyst Target: At US$92.71, SGI trades about 9% below the US$102.29 analyst target, so the upside implied is limited rather than extreme.

- ✅ Simply Wall St Valuation: Simply Wall St flags SGI as trading close to its estimated fair value.

- ✅ Recent Momentum: The 30 day return of roughly 1.0% shows modest positive momentum into the all stock proposal.

Check out Simply Wall St's in depth valuation analysis for Somnigroup International.

Key Considerations

- 📊 Because this is an all stock proposal, your exposure is tied to how the combined company is valued rather than to cash flowing into SGI.

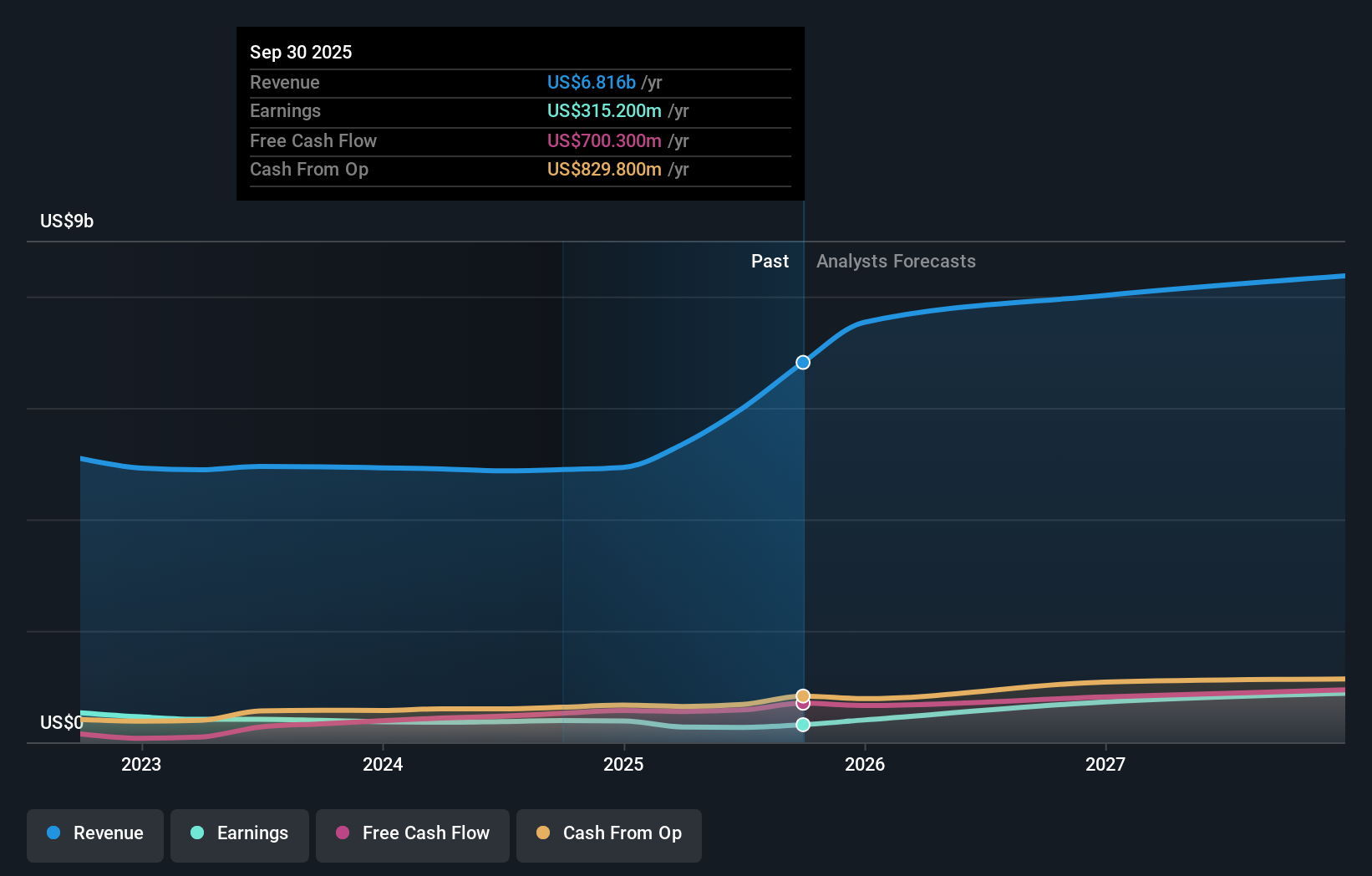

- 📊 Keep an eye on any commentary about expected earnings and margin profile post deal, especially given SGI's current 4.6% net margin and 61.7x P/E.

- ⚠️ Interest payments are not well covered by earnings, so adding Leggett & Platt could matter for leverage and financing risk if the deal moves ahead.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Somnigroup International analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.