Please use a PC Browser to access Register-Tadawul

Sonos (SONO) Is Up 10.1% After Restructuring to Boost Product Pipeline and Shift Global Production—Has the Bull Case Changed?

SONOS INC SONO | 18.42 | -0.32% |

- Sonos recently announced a reorganization to accelerate product development and cut over US$100 million in annual operating expenses, while launching new offerings like the Sonos Ace headphones, Arc Ultra soundbar, and Sub 4 subwoofer as part of its plan for two new hardware releases each year through at least 2026.

- An interesting insight is that Sonos is increasing its global presence, particularly in Asia, while proactively relocating production out of China to manage tariff risks, which will also lead to certain price hikes in 2025.

- We'll explore how Sonos's organizational overhaul and rapid hardware launch cadence could impact its future growth and financial story.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Sonos Investment Narrative Recap

Being a Sonos shareholder today means believing in the company's plan to accelerate product launches and global expansion to regain momentum in consumer audio, especially amid shifting consumer demand and heightened competition. The recent reorganization, combined with upcoming price hikes tied to manufacturing shifts, directly affects the near-term risk that higher prices or cost absorption could weigh on demand and margins, making the short-term impact material for both risk and opportunity.

Among Sonos's latest developments, the launch of the Sonos Ace headphones stands out, as it moves the brand into a new product category and may support broader customer engagement just as hardware innovation accelerates, potentially serving as a catalyst to offset recent sales declines and inject fresh energy into the growth narrative.

But it pays to remember, while Sonos is planning for growth, investors should be aware that if consumers balk at new pricing or low-cost competitors gain share...

Sonos' outlook anticipates $1.6 billion in revenue and $120.2 million in earnings by 2028. This scenario is based on a 5.0% annual revenue growth rate and a $196.6 million improvement in earnings from the current -$76.4 million.

Uncover how Sonos' forecasts yield a $13.62 fair value, a 24% downside to its current price.

Exploring Other Perspectives

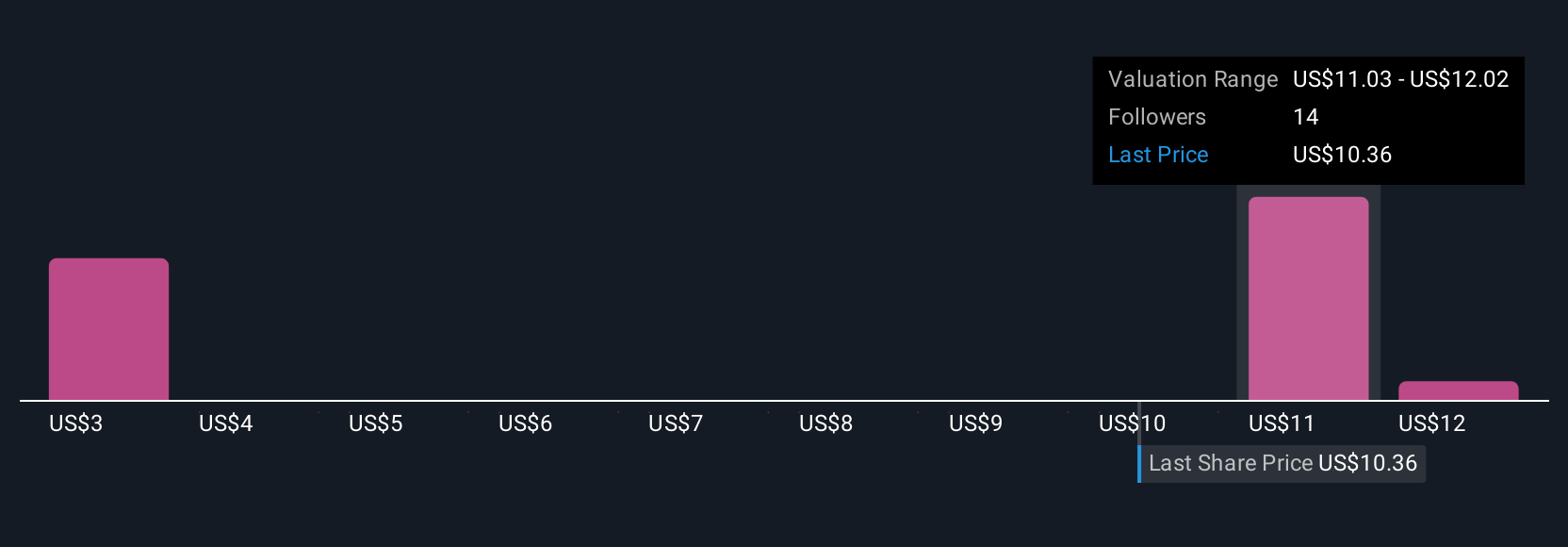

Five different fair value estimates from the Simply Wall St Community for Sonos range from US$0.39 to US$17 per share. With manufacturing shifts driving meaningful price increases, how these diverse expectations play out will shape performance, explore several alternative viewpoints for a full picture.

Explore 5 other fair value estimates on Sonos - why the stock might be worth as much as $17.00!

Build Your Own Sonos Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free Sonos research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sonos' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.