Please use a PC Browser to access Register-Tadawul

Sotera Health (SHC): Valuation in Focus After Barclays and Goldman Sachs Upgrade Outlook

Sotera Health Company SHC | 16.83 16.83 | -0.41% 0.00% Pre |

Recent moves from Barclays and Goldman Sachs have caught investors’ attention, as both firms expressed renewed confidence in Sotera Health (SHC). These upgraded ratings reflect a wave of optimism about the company’s future prospects.

Sotera Health's share price has quietly built momentum in recent months, with a nearly 40% gain over the past quarter. This likely reflects growing optimism after upbeat analyst endorsements and solid business fundamentals. While its three-year total shareholder return sits at an impressive 133%, recent events suggest sentiment around growth and risk perception is shifting in the company’s favor.

If this renewed momentum sparks your curiosity about companies with similar breakout potential, it might be time to discover fast growing stocks with high insider ownership

But with the share price now hovering just below analyst targets after strong gains, investors must ask whether Sotera Health is still undervalued or if the recent optimism is already priced in, leaving little room for upside.

Most Popular Narrative: 0.7% Undervalued

Sotera Health’s last close at $16.22 sits just below the narrative fair value estimate of $16.33, highlighting a market nearly in sync with the prevailing growth outlook. The difference is slim, but the underpinning logic reveals significant projections for earnings expansion and margin improvement.

Continued investments in high-efficiency and expanded sterilization capacity, including recently launched and planned facility expansions, will enhance Sotera Health's ability to capture incremental market share and drive margin improvement as new capacity comes online. This is expected to have a positive impact on EBITDA and net margins.

Want to know why just a slight margin separates the current share price from “fair” territory? The narrative is powered by bold predictions about future profitability and cash flow strength. But what are the numbers driving this razor-thin discount? You’ll want to see the full earnings expectations, margin leaps, and market share moves behind this calculated fair value estimate.

Result: Fair Value of $16.33 (UNDERVALUED)

However, intensifying regulatory scrutiny or a major shift toward alternative sterilization technologies could quickly challenge these optimistic earnings projections.

Another View: Sizing Up Against the Market

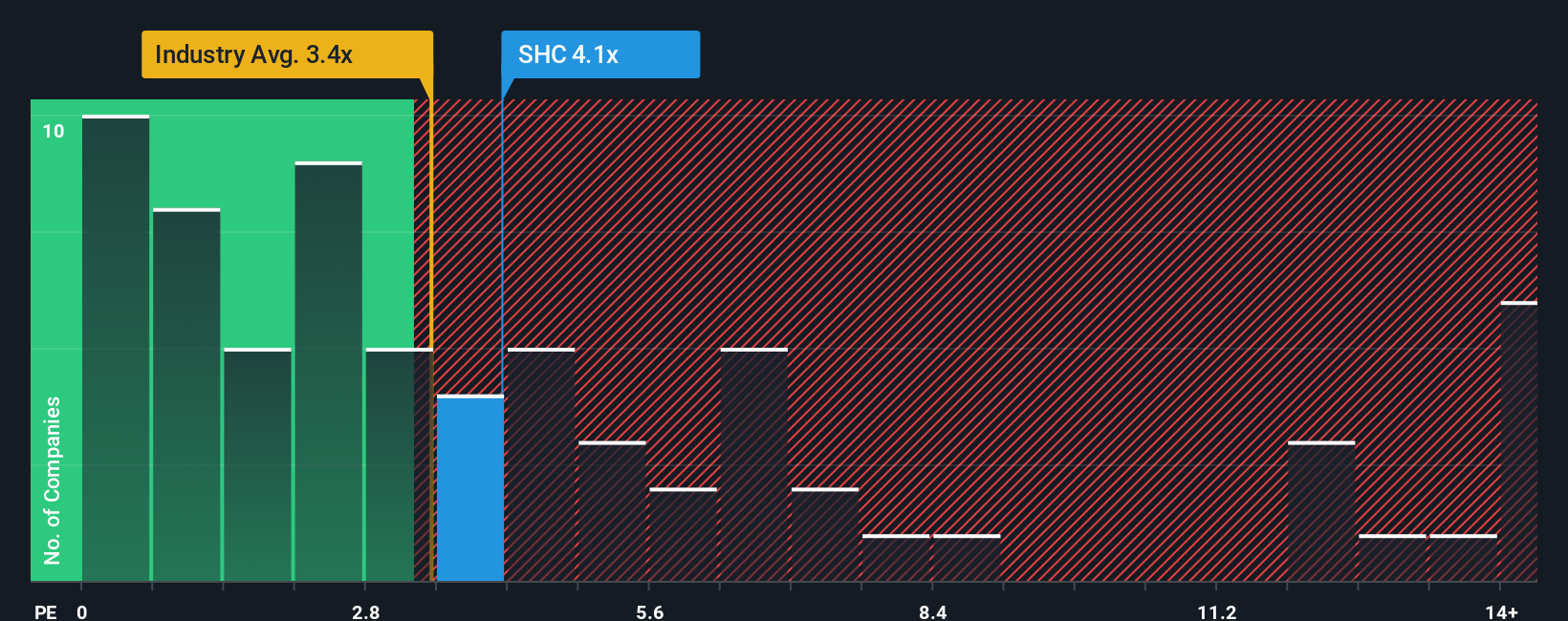

While narrative-based fair value suggests Sotera Health is almost perfectly priced, looking at the price-to-sales ratio tells a different story. At 4.1x, the company's multiple is higher than both the US Life Sciences industry average (3.8x) and its fair ratio of 3.6x. This signals that the stock could be at a premium and leaves less margin for error if growth slows. Is there still a bargain here, or are investors taking on more risk than they realize?

Build Your Own Sotera Health Narrative

If these perspectives do not quite align with your own or you would rather dive into the numbers yourself, you can shape your own narrative in just a few minutes with Do it your way

A great starting point for your Sotera Health research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Confident investors do not wait on the sidelines while opportunities pass by. Make the most of the market’s momentum and see what else is out there using these powerful tools:

- Unlock growth potential by targeting undervalued businesses poised for a rebound. Start with these 894 undervalued stocks based on cash flows for companies trading below their intrinsic value.

- Capitalize on the rise of artificial intelligence with these 25 AI penny stocks, featuring ambitious companies building the next wave of smart technology.

- Capture reliable returns with these 19 dividend stocks with yields > 3% focused on stocks delivering above-average yields and consistent income.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.