Please use a PC Browser to access Register-Tadawul

SoundHound AI Acquisition And Partnerships Reframe Agentic AI Growth Outlook

SoundHound AI, Inc Class A SOUN | 7.82 | -0.13% |

- SoundHound AI (NasdaqGM:SOUN) announced plans to acquire Interactions, targeting a larger role in agentic AI and voice commerce.

- The company also introduced new products and partnerships at CES 2026, including a fresh integration with TomTom.

- These moves expand SoundHound AI's reach across customer service, automotive, and consumer technology markets.

SoundHound AI, trading at $10.45, sits at an interesting crossroads as it pushes further into AI driven voice solutions. The stock has seen a 36.7% decline over the past year, following a very large gain over the prior three years. As a result, many investors are reassessing the balance between past momentum and current expectations.

The planned Interactions acquisition and CES 2026 partnerships provide additional information to assess how SoundHound AI is positioning in agentic AI and voice commerce. As these transactions close and integrations progress, key considerations will likely include execution, customer adoption, and how effectively the company turns its expanded footprint into durable revenue streams.

Stay updated on the most important news stories for SoundHound AI by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on SoundHound AI.

Quick Assessment

- ✅ Price vs Analyst Target: At US$10.45, the price sits below the US$16.31 average analyst target and the US$11 low target.

- ❌ Simply Wall St Valuation: DCF data is not available, so there is no clear valuation signal to lean on yet.

- ❌ Recent Momentum: The 30 day return of about 5.2% decline shows recent momentum has been negative.

Check out Simply Wall St's in depth valuation analysis for SoundHound AI.

Key Considerations

- 📊 The Interactions acquisition and CES partnerships expand SoundHound AI's reach in agentic AI and voice commerce, which could influence how you think about its long term revenue potential.

- 📊 Keep an eye on how quickly new partnerships convert into customer wins and revenue, and whether margins move closer to the Software industry average profit margin of 12.7%.

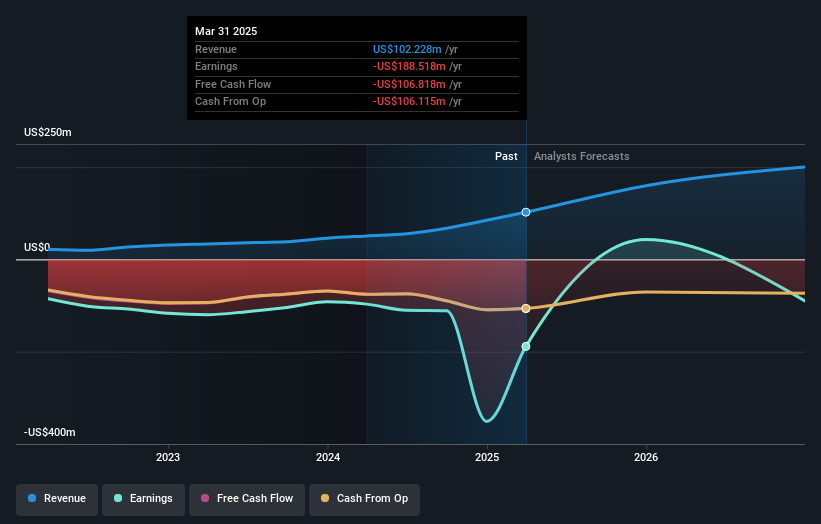

- ⚠️ The company remains loss making, with a net income margin of 210.7% loss and forecasts indicating it is not expected to be profitable over the next 3 years.

Dig Deeper

For the full picture including more risks and rewards, check out the complete SoundHound AI analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.