Please use a PC Browser to access Register-Tadawul

SoundHound AI And Bridgepointe Deal Puts Enterprise Adoption In Focus

SoundHound AI, Inc Class A SOUN | 7.82 | -0.13% |

- SoundHound AI partnered with Bridgepointe Technologies to expand enterprise use of its agentic AI platforms, including Amelia 7 and Autonomics.

- The agreement targets wider deployment across Bridgepointe's large client base, including major brands.

- The collaboration is intended to support end to end AI powered solutions for complex enterprise needs.

For investors tracking NasdaqGM:SOUN, this partnership highlights SoundHound AI's push into larger enterprise accounts through a well connected channel partner. The stock closed at $9.85, with a 3 year return of about 4x, alongside a 30.0% decline over the past year and negative returns over the past week and month.

A key consideration now is how effectively SoundHound AI can convert Bridgepointe's relationships into deployments of its multi agent AI and autonomous IT platforms. The degree of adoption across prominent brands in Bridgepointe's network may influence how this agreement is viewed as a reference point for the company's execution on broader commercial opportunities.

Stay updated on the most important news stories for SoundHound AI by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on SoundHound AI.

For SoundHound AI, plugging Amelia 7 and Autonomics into Bridgepointe’s network of more than 12,000 enterprise clients gives its multi agent and autonomics platforms a much wider sales channel, especially into large brands that already rely on Bridgepointe for IT decisions. The key question for you as an investor is how many of those relationships can realistically convert into live deployments that generate recurring usage and expand beyond initial pilots.

How This Fits Into The SoundHound AI Narrative

Recent commentary around SoundHound has focused on its push to become an end to end, voice first and agentic AI provider across sectors like automotive, healthcare, and financial services, while still working toward profitability. This Bridgepointe deal lines up with that story by giving the company another route to enterprise contracts at a time when investors are watching how fast its AI agents and autonomics offerings gain traction in real world customer service and IT operations.

Risks and Rewards To Keep In Mind

- Bridgepointe’s large client base, including brands such as Marriott, Dunkin', and Toyota, could support broader exposure for SoundHound’s agentic AI and autonomics products across multiple industries.

- Revenue is forecast to grow 29.2% per year, so additional channel deals like this may help the company pursue those growth expectations if they convert into meaningful contracts.

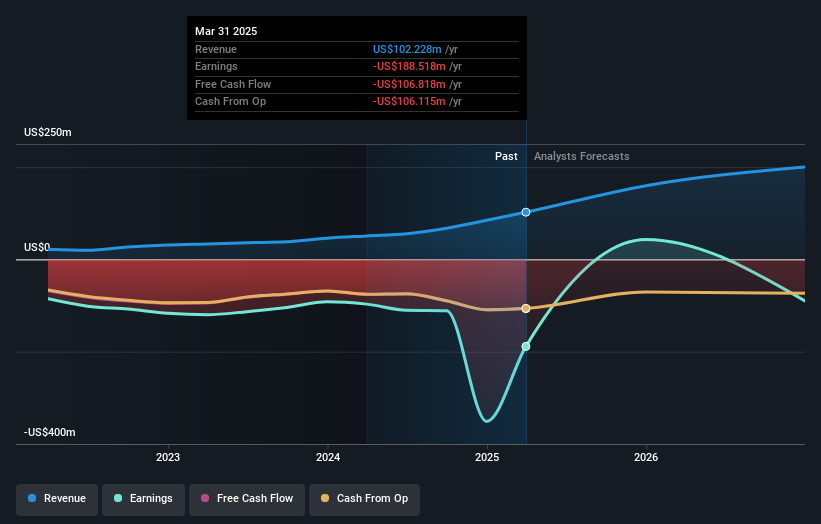

- The company is currently unprofitable and not forecast to become profitable over the next 3 years, so heavier enterprise onboarding could also mean sustained investment and cash burn.

- There has been significant insider selling over the past 3 months, which some investors may view cautiously when weighing the execution risk around new partnerships.

What To Watch Next

From here, it makes sense to watch for concrete disclosures on the number and size of Bridgepointe related wins, especially any reference customers that showcase Amelia 7 or Autonomics handling complex, high volume interactions without human intervention. If you want a broader sense of how others are thinking about this partnership and the stock’s long term story, you can read what the community is saying in this narrative hub.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.