Please use a PC Browser to access Register-Tadawul

SoundHound AI And Bridgepointe Deal Tests Enterprise Scale Story

SoundHound AI, Inc Class A SOUN | 7.82 | -0.13% |

- SoundHound AI partnered with Bridgepointe Technologies to promote its enterprise AI platforms, including the Amelia 7 agentic AI, to large corporate clients.

- The collaboration targets rollout across brands such as Marriott, Dunkin', and Toyota, aiming to widen adoption of voice driven and agentic AI tools.

- The deal focuses on expanding SoundHound AI's reach in multiple industries by using Bridgepointe's established customer relationships and advisory network.

For investors watching NasdaqGM:SOUN, this agreement comes as the stock trades at $9.94 and has delivered a very large 3 year return, alongside a 30.1% decline over the past year. That combination of strong multi year performance and recent pullback may be relevant as you consider execution risk and potential opportunity around new commercial partnerships.

The Bridgepointe relationship could be an important test of how scalable SoundHound AI's voice and agentic AI platforms are with large enterprises. As you track the situation, you might focus on the pace of customer deployments across brands like Marriott, Dunkin', and Toyota, and any updates on how these use cases expand or deepen over time.

Stay updated on the most important news stories for SoundHound AI by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on SoundHound AI.

This Bridgepointe deal plugs SoundHound AI directly into a large enterprise sales channel, giving its Amelia 7 agentic AI and Autonomics platforms a shot at scale with companies that already work with Bridgepointe on cost reduction and IT projects. For you as an investor, the key question is whether Bridgepointe’s 12,000-plus client base turns SoundHound from a series of one off deployments into broader, repeatable rollouts across sectors like hospitality, restaurants, and autos where it already has traction.

How this fits the SoundHound AI narrative

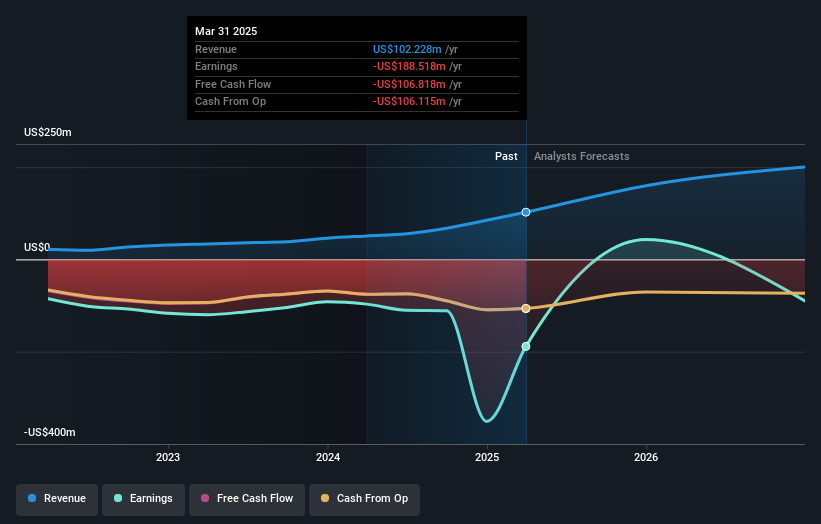

The partnership lines up with the existing thesis that SoundHound is trying to build a diversified revenue base across automotive, restaurant, and enterprise customers, rather than relying on a single use case. It also speaks directly to the idea of using channel partners to widen adoption of its voice first, agent based AI at lower customer acquisition cost, which is important when the company is still unprofitable and investing heavily in growth.

Risks and rewards to keep in mind

- Access to Bridgepointe’s large enterprise network could support higher recurring usage of SoundHound’s AI platforms if deployments expand across multiple brands.

- Deeper use of agent based AI in areas like ordering, customer support, and IT automation may help the company make better use of prior acquisitions that built its end to end service offering.

- SoundHound remains loss making with a history of high cash burn and stock based dilution, so scaling through partnerships does not remove financing or profitability risks.

- Competition from larger players such as Alphabet, Microsoft, and Apple in voice and conversational AI could limit pricing power or contract size, even if Bridgepointe helps open doors.

What to watch next

From here, you may want to track how many Bridgepointe advised customers move from pilots to production, whether SoundHound starts reporting larger contract counts or higher usage from hospitality and auto clients, and how this sits alongside recent product efforts in areas like in vehicle Vision AI. If you want to see how other investors connect deals like this to the longer term story, you can check community narratives on SoundHound AI here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.