Please use a PC Browser to access Register-Tadawul

SoundHound AI Bridgepointe Deal Puts Enterprise Adoption In Investor Focus

SoundHound AI, Inc Class A SOUN | 7.82 | -0.13% |

- SoundHound AI (NasdaqGM:SOUN) has partnered with Bridgepointe Technologies to expand enterprise use of its AI agent and IT automation platforms.

- The partnership targets more than 12,000 Bridgepointe client companies across sectors including hospitality, automotive, and retail.

- The collaboration focuses on deploying SoundHound’s Amelia 7 AI agent for customer interaction and its Autonomics platform for IT operations automation.

For investors tracking NasdaqGM:SOUN, this move comes with the stock trading around $10.33 and a very large 3 year return, reflecting major swings in sentiment over time. Over the past year, the share price is down 34.8%, and year to date it is down 2.5%. This frames the partnership against a backdrop of recent pressure on the stock and offers a fresh data point on how the company is working to deepen its presence in enterprise AI.

What matters now is how effectively SoundHound and Bridgepointe turn that universe of more than 12,000 clients into active deployments of Amelia 7 and Autonomics. The degree of adoption across sectors such as hospitality, automotive, and retail may influence how investors view SoundHound’s position in enterprise AI and the durability of its platform in real world use cases.

Stay updated on the most important news stories for SoundHound AI by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on SoundHound AI.

The Bridgepointe agreement plugs SoundHound’s Amelia 7 and Autonomics platforms directly into a large pool of enterprise buyers, with advisors who already help those companies cut IT costs and roll out new tools. For you as an investor, the key question is whether that access and integration support SoundHound’s push to sell more complex, transaction capable agents and IT automation outside its existing footholds in areas like automotive and restaurants.

SoundHound AI narrative, now with a broader enterprise angle

Commentary around SoundHound has often focused on rapid revenue growth and voice AI use cases in cars and restaurants, and this deal adds a clearer line into sectors like hospitality and retail where automation of customer and employee interactions can be scaled across large networks. For anyone following the story around its AI agent platform, Bridgepointe’s role in guiding deployments may be seen as a test of how well SoundHound’s technology can support real world workloads across many different enterprises.

Risks and rewards to keep in mind

- Tapping Bridgepointe’s 12,000 plus clients gives SoundHound a broad channel to place Amelia 7 and Autonomics in front of enterprises that are already used to buying advanced IT solutions.

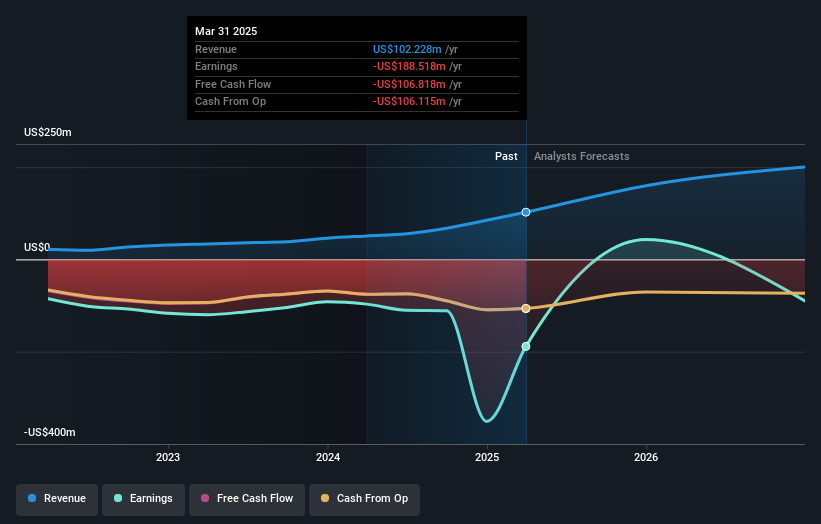

- The company is currently unprofitable and is not forecast to become profitable over the next 3 years, so scaling through partners still has to be balanced against heavy R&D and go to market spending.

- There has been significant insider selling over the past 3 months, which some investors may treat as a caution flag even as new commercial agreements are announced.

- Revenue is forecast to grow 29.2% per year, so successful rollouts through Bridgepointe could help support that growth path if adoption materializes.

What to watch from here

From here, it will be useful to watch for concrete deployment metrics such as named customer rollouts within Bridgepointe’s base, usage levels across Amelia 7 and Autonomics, and any commentary on how these deals affect SoundHound’s path toward better operating leverage. Check how other investors are framing the SoundHound AI story in the latest community narratives to see how this partnership fits into the bigger picture.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.