Please use a PC Browser to access Register-Tadawul

SoundHound AI Partnerships Grow While Stock Trades Below Analyst Targets

SoundHound AI, Inc Class A SOUN | 7.82 | -0.13% |

- SoundHound AI extended its relationship with Five Guys to roll out AI ordering across more restaurant locations.

- The company also entered a new collaboration with Bridgepointe Technologies to bring its AI solutions to Bridgepointe’s large enterprise client base.

- These partnerships expand SoundHound AI’s presence in both quick service restaurants and broader corporate environments.

SoundHound AI (NasdaqGM:SOUN) is gaining more real world exposure as it brings voice and conversational AI into everyday ordering and enterprise workflows. The stock last closed at $8.42, with returns of 108.9% over 3 years and a 40.9% decline over the past year, which highlights how volatile investor sentiment has been. For anyone tracking the name, these new agreements add fresh data points about how its technology is being adopted outside the lab.

Expanded deployment with Five Guys puts SoundHound AI directly into high volume restaurant operations, while the Bridgepointe Technologies deal connects it with a wide mix of enterprise buyers. Investors watching NasdaqGM:SOUN can use these contracts to follow how the company converts product interest into broader commercial rollouts and potential revenue streams.

Stay updated on the most important news stories for SoundHound AI by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on SoundHound AI.

Quick Assessment

- ✅ Price vs Analyst Target: At US$8.42, the price sits about 48% below the US$16.31 analyst target, so the stock trades at a sizable discount to consensus.

- ⚖️ Simply Wall St Valuation: Simply Wall St's DCF view is currently unknown, so there is no clear under or overvaluation signal from that model.

- ❌ Recent Momentum: The 30 day return of roughly 20.6% decline flags weak short term momentum despite the partnership news.

Check out Simply Wall St's in depth valuation analysis for SoundHound AI.

Key Considerations

- 📊 The expanded Five Guys rollout and Bridgepointe partnership show SoundHound AI pushing its voice platform into both high traffic restaurants and large enterprises.

- 📊 If you track the stock, keep an eye on how these deals translate into revenue, customer retention and any updates around profitability given the current losses.

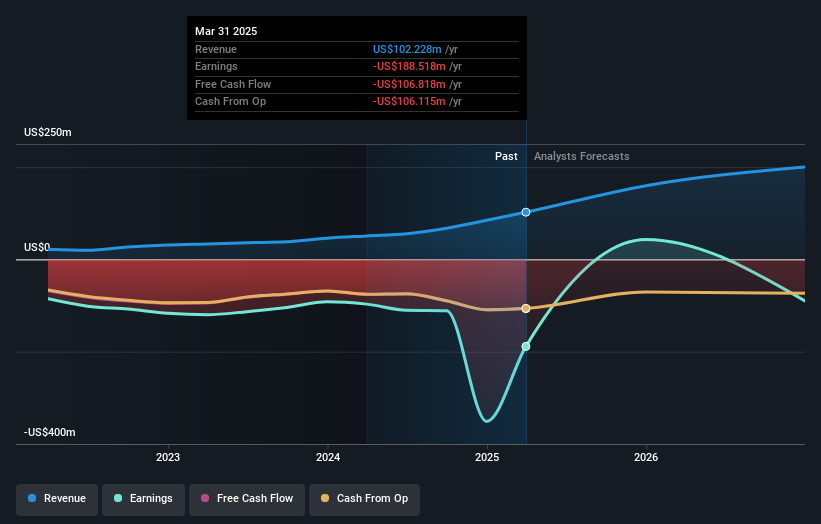

- ⚠️ The company remains loss making, with a net income margin of 211% in the red and flagged as not expected to reach profitability in the near term.

Dig Deeper

For the full picture including more risks and rewards, check out the complete SoundHound AI analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.