Please use a PC Browser to access Register-Tadawul

SoundHound AI’s Expanding Voice Deals Test Recurring Revenue Potential

SoundHound AI, Inc Class A SOUN | 7.82 | -0.13% |

- SoundHound AI (NasdaqGM:SOUN) expanded its partnership with Five Guys, extending voice AI ordering across more of the burger chain’s locations.

- The company also announced new enterprise deals in financial services, including expanded services with top global financial institutions.

- SoundHound added a new agreement with a leading French insurance firm focused on call center automation and customer support.

For you as an investor, these updates give a clearer picture of how SoundHound AI is trying to build a business around its voice technology, not just its research. The quick service restaurant sector is one of the most active testing grounds for AI driven ordering, and an expanded rollout with Five Guys suggests SoundHound is moving from pilots toward broader deployment. At the same time, the new financial services and insurance deals show that the company is targeting higher value, back office and customer service use cases.

Looking ahead, the key questions are how widely these contracts roll out, how quickly they translate into recurring revenue, and how sticky the relationships become once systems are integrated. For anyone tracking NasdaqGM:SOUN, it is worth watching how the mix between restaurant, financial services, and insurance customers evolves, because that will shape the company’s exposure to different end markets and spending cycles.

Stay updated on the most important news stories for SoundHound AI by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on SoundHound AI.

Quick Assessment

- ✅ Price vs Analyst Target: At US$8.07 versus a US$16.31 analyst target, the price sits around 50% below consensus.

- ⚖️ Simply Wall St Valuation: Valuation is currently marked as unknown because DCF inputs are not available.

- ❌ Recent Momentum: The 30 day return of about 26.6% decline signals weak short term momentum.

Check out Simply Wall St's in depth valuation analysis for SoundHound AI.

Key Considerations

- 📊 The expanded Five Guys rollout plus new financial and insurance wins point to broader commercial use of SoundHound AI's voice products across multiple sectors.

- 📊 Keep an eye on how much of future revenue is tied to recurring enterprise contracts and how that compares with the current US$8.07 share price and US$16.31 target.

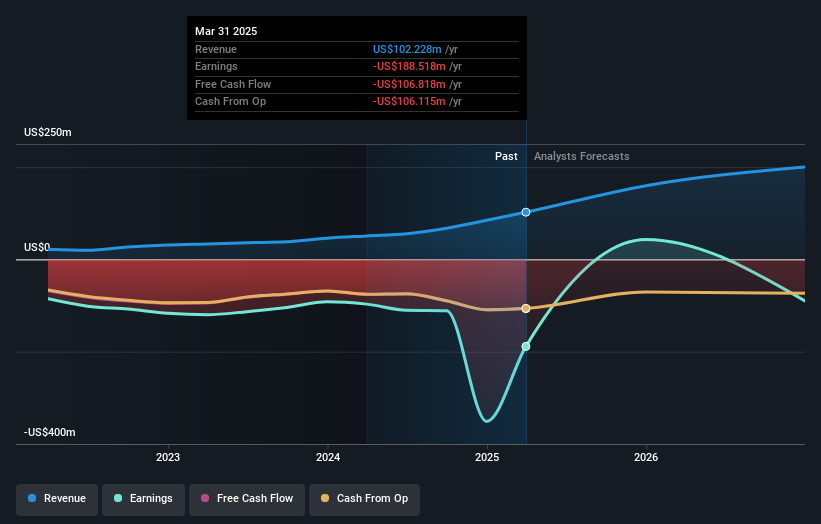

- ⚠️ The company is loss making with a net income margin of about 211% in the red, so execution risk around turning these contracts into sustainable profits remains high.

Dig Deeper

For the full picture including more risks and rewards, check out the complete SoundHound AI analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.