Please use a PC Browser to access Register-Tadawul

Southern Copper Tia Maria Progress Highlights 2026 Revenue And Supply Risks

Southern Copper Corporation SCCO | 201.01 | +3.58% |

- Southern Copper (NYSE:SCCO) reports progress on its Tia Maria copper project in Peru.

- The company links this advance to an expected uplift in revenues from 2026.

- Industry voices warn of a potential global copper supply crisis driven by rising demand.

Southern Copper is a major integrated copper producer, and its update on Tia Maria comes at a time when copper is central to electrification, renewable power build outs and data heavy technologies. For you as an investor, the combination of project expansion and sector wide concern about supply tightness makes this development worth watching.

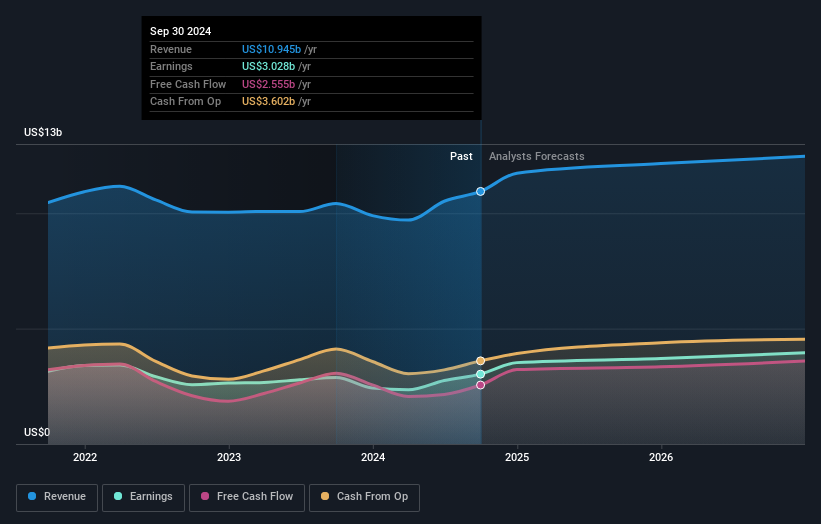

The company identifies 2026 as a key year for higher revenue expectations, tied to its growth pipeline and industry demand trends. If copper deficits materialize alongside project execution, SCCO’s production profile and pricing environment could become a core focus for anyone tracking copper exposed names.

Stay updated on the most important news stories for Southern Copper by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Southern Copper.

The update on Tia Maria comes on top of a period of strong reported results, with 2025 sales of US$13.4b and net income of US$4.3b, and management now pointing to US$16b of expected revenue in 2026 supported by a projected global copper deficit. For you, the key takeaway is that Southern Copper is leaning into a tight-supply copper market with a multi year project pipeline, positioning itself as a large-scale supplier at a time when peers such as Freeport McMoRan and BHP are also pushing copper focused growth plans.

How This Fits Into The Southern Copper Narrative

The new commentary on Tia Maria and 2026 revenue ties directly into existing investor narratives that focus on capital-heavy growth projects across Peru and Mexico and the role of copper in electrification trends. Bulls see Tia Maria, Los Chancas and other projects as reinforcing the idea that Southern Copper can use its integrated, low cost model to capture volumes if copper deficits play out, while more cautious views highlight that the company is already committing substantial capital and has to balance that against dividends and potential project delays.

Risks And Rewards To Keep In Mind

- Tight copper supply expectations and a 2027 start target for Tia Maria position Southern Copper to benefit if demand for grid upgrades, EVs and data centers keeps copper usage elevated.

- Recent earnings and dividend decisions, including a US$1 cash dividend plus a stock dividend, show that management is currently comfortable sharing cash flows while funding growth projects.

- Large multi year projects in Peru carry execution, permitting and community related risks that could affect timing, capital spending and ultimately the production profile investors are counting on.

- Analysts have flagged operational costs and geopolitical exposure in Peru and Mexico as ongoing watchpoints, which could matter if copper prices or demand trends do not match current expectations.

What To Watch Next

From here, it is worth tracking whether Southern Copper hits its Tia Maria milestones, sticks close to its capital spending plans and keeps dividend and cash generation aligned, especially as other copper producers adjust their own projects to potential supply gaps. If you want to see how different investors are thinking about these moving pieces, have a look at the community narratives for SCCO and compare the bullish and cautious cases against your own expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.