Please use a PC Browser to access Register-Tadawul

Southern Missouri Bancorp (SMBC) Q2 EPS Strength Reinforces Bullish Profitability Narratives

Southern Missouri Bancorp, Inc. SMBC | 65.49 | +1.02% |

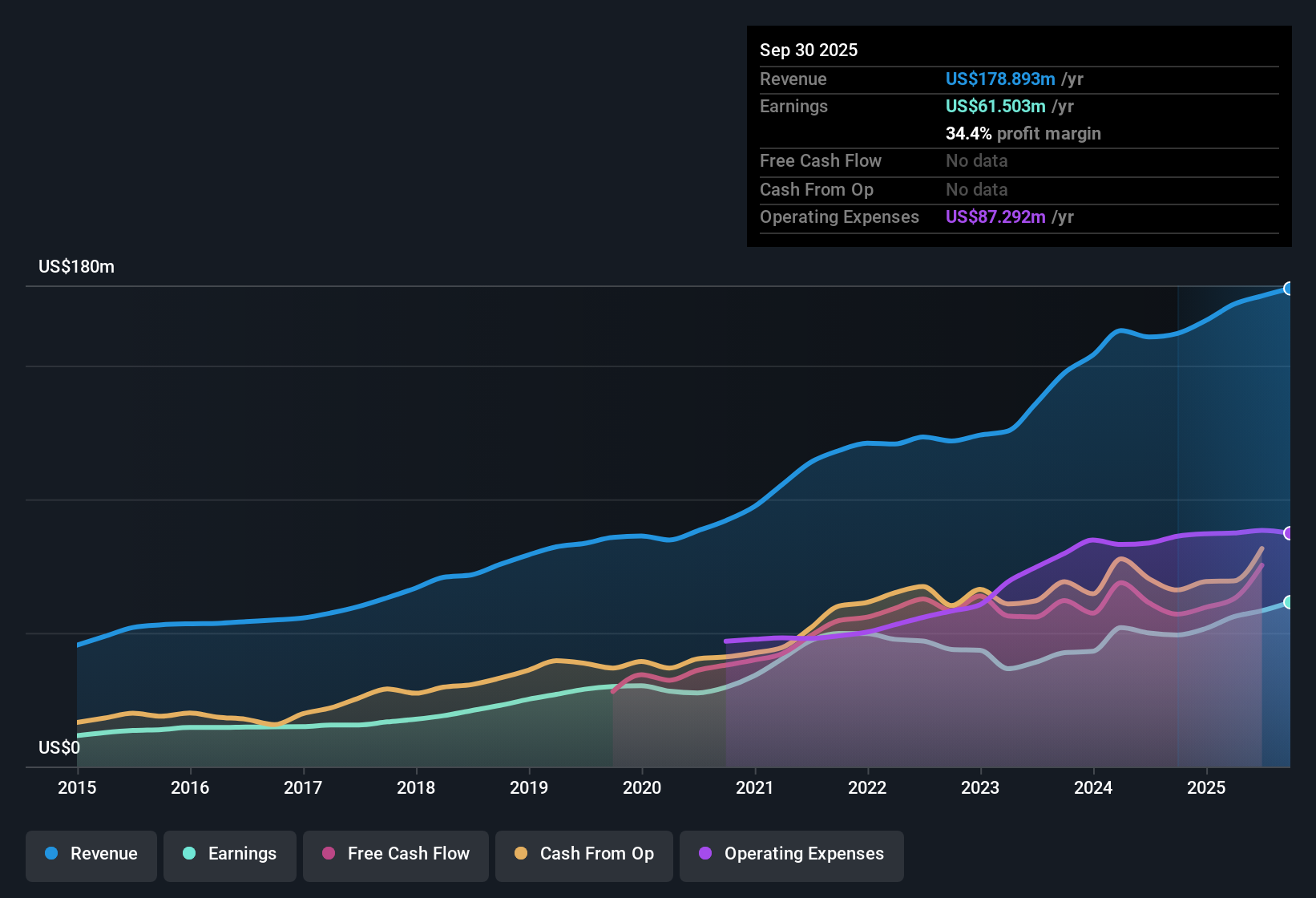

Southern Missouri Bancorp (SMBC) has just posted Q2 2026 results with total revenue of US$48.0 million and basic EPS of US$1.62, alongside trailing twelve month EPS of US$5.79 supported by net income of US$65.0 million on revenue of US$182.8 million. The company has seen quarterly revenue move from about US$44.1 million in Q2 2025 to US$48.0 million in Q2 2026, while basic EPS over that span has ranged from US$1.30 to US$1.62. This latest print comes against a backdrop of higher trailing net margin at 35.6% and faster earnings growth than its recent history. With that mix of revenue progression, EPS strength and improved profitability, investors are likely to focus on how durable these margins appear from here.

See our full analysis for Southern Missouri Bancorp.With the headline numbers on the table, the next step is to line them up against the key narratives around Southern Missouri Bancorp to see which stories the latest earnings support and which ones start to look out of sync.

25.7% TTM earnings growth changes the recent pattern

- Over the last 12 months, earnings grew 25.7% while trailing EPS reached US$5.79 and net income was US$65.0 million on US$182.8 million of revenue.

- What stands out for a bullish view is that this 25.7% earnings growth compares to a 7.5% five year average, which supports the idea of stronger profitability right now. It also raises the question of whether this pace is a one year surge or something that could settle closer to that longer run 7.5% figure.

Margins at 35.6% with higher non performing loans

- The trailing net margin sits at 35.6% compared with 31.0% last year, while non performing loans in the periodical data move from US$8.2 million in Q1 2025 to US$26.0 million in Q1 2026.

- What is interesting for a more cautious take is that higher margins and net income of US$18.1 million in Q2 2026 sit alongside this rise in non performing loans, so bears may argue the stronger 35.6% margin needs to be read together with credit quality metrics rather than viewed in isolation.

- Quarterly net income moved from US$14.6 million in Q2 2025 to US$18.1 million in Q2 2026, while loan balances grew from about US$4,027.2 million in Q2 2025 to US$4,191.7 million in Q1 2026.

- At the same time, non performing loans rose from US$8.3 million in Q2 2025 to US$26.0 million in Q1 2026, so critics might focus on how much of the improved margin and EPS story is supported by stable asset quality over time.

P/E of 11x and DCF fair value gap

- SMBC trades on a trailing P/E of 11x, a share price of US$63.87 and a DCF fair value cited at US$105.26, while peers on average are at 11.3x and the broader US Banks group at 12.1x.

- Supporters of a bullish stance can point out that the trailing P/E sits below both peer and industry averages and that the current price is described as about 39.3% below the DCF fair value of US$105.26. The modest 1.57% dividend yield and forecast revenue growth of 9.1% per year compared with 10.6% for the wider US market give investors a reason to weigh how much of that modeled upside they want to factor in.

- Consensus narrative notes that this mix of stronger trailing profitability and below average multiples can be attractive to investors who focus on valuation and earnings quality together.

- What might give more patient investors pause is that revenue growth is expected to run below the broader US market at 9.1% versus 10.6%, which can make the DCF fair value gap at US$105.26 something to cross check against those growth assumptions.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Southern Missouri Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Southern Missouri Bancorp pairs a higher 35.6% net margin with a sharp rise in non performing loans, which leaves the quality of recent earnings open to question.

If that tension between profitability and credit quality makes you uneasy, use our solid balance sheet and fundamentals stocks screener (389 results) today to focus on companies with sturdier finances and cleaner balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.