Please use a PC Browser to access Register-Tadawul

Spotlight On Promising Penny Stocks In July 2025

PetMed Express PETS | 3.70 | -5.13% |

As the U.S. stock market continues to reach new highs, with the S&P 500 and Nasdaq setting records, investors are keenly observing opportunities beyond the major indices. For those willing to explore outside of well-known names, penny stocks—often representing smaller or newer companies—remain a relevant investment area despite their somewhat outdated label. This article will spotlight three penny stocks that exhibit financial strength and potential for growth, offering intriguing possibilities for investors seeking hidden value in quality companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| ATRenew (RERE) | $3.37 | $810.62M | ✅ 3 ⚠️ 1 View Analysis > |

| Waterdrop (WDH) | $1.98 | $658.23M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.55 | $268.34M | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (MAPS) | $0.951 | $164.19M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.48 | $259.71M | ✅ 3 ⚠️ 0 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $100.75M | ✅ 3 ⚠️ 1 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.886 | $6.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.72 | $109.16M | ✅ 3 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.47 | $29.28M | ✅ 2 ⚠️ 2 View Analysis > |

Below we spotlight a couple of our favorites from our exclusive screener.

PetMed Express (PETS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PetMed Express, Inc., along with its subsidiaries, operates as a pet pharmacy in the United States and has a market cap of approximately $77.56 million.

Operations: The company generates revenue through its online retail operations, amounting to $247.01 million.

Market Cap: $77.56M

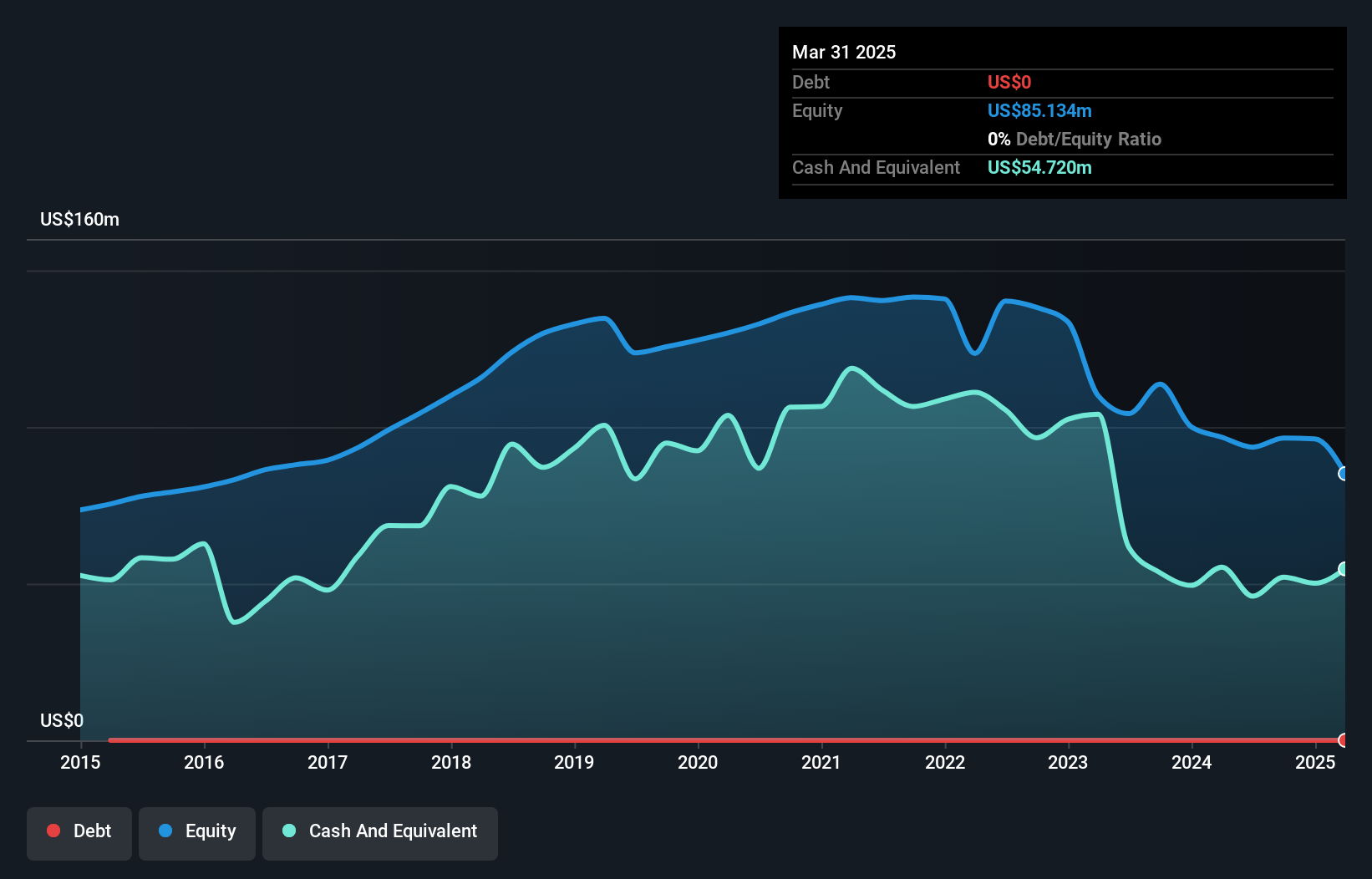

PetMed Express, Inc. operates with a market cap of US$77.56 million and generates revenue of US$247.01 million through its online pet pharmacy services. Despite becoming profitable recently, the company faces challenges including a large one-off loss impacting recent financial results and an inexperienced board and management team with average tenures of 2.2 and 1.1 years, respectively. The company's short-term assets exceed both its short- and long-term liabilities, indicating solid liquidity despite no debt concerns. Recent delays in SEC filings have led to Nasdaq compliance issues but do not currently affect trading activities or stock listing status.

Mega Matrix (MPU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mega Matrix Inc. operates a streaming platform called FlexTV, specializing in vertical screen entertainment, with a market cap of $107.33 million.

Operations: The company's revenue is primarily derived from the Asia-Pacific region ($17.26 million), followed by the United States and Canada ($11.66 million), Europe, Middle East and Africa ($4.54 million), and Latin America ($1.76 million).

Market Cap: $107.33M

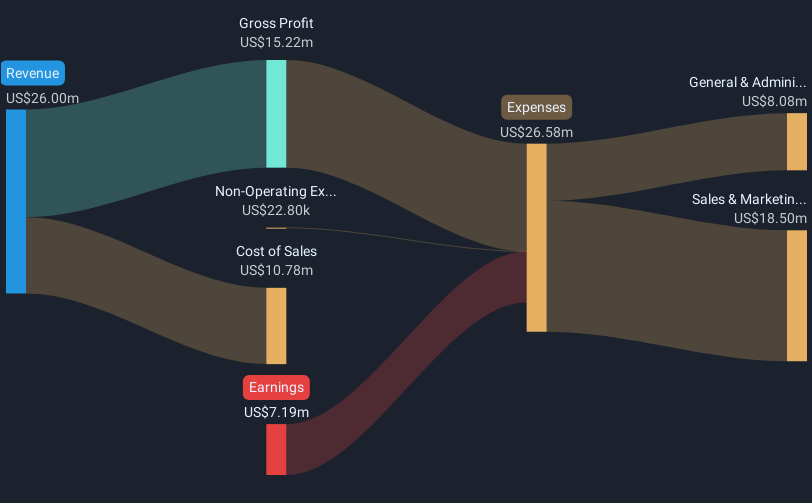

Mega Matrix Inc., with a market cap of US$107.33 million, operates FlexTV, focusing on vertical screen entertainment. The company is unprofitable but maintains a strong cash runway exceeding three years and has no debt. Its recent strategic alliance with Wardour Studios to form AIFLIX LLC aims to leverage AI for short drama production, potentially enhancing its content offerings and global reach. Despite increased volatility and declining sales from US$8.69 million to US$7.74 million year-over-year, the appointment of seasoned investor Yaman Demir as an executive director may bolster its strategic direction in digital assets and innovation initiatives.

Tilly's (TLYS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tilly's, Inc. is a specialty retailer in the United States offering casual apparel, footwear, accessories, and hardgoods for young men and women as well as boys and girls, with a market cap of $49.15 million.

Operations: The company generates revenue from its retail segment focused on apparel, totaling $561.21 million.

Market Cap: $49.15M

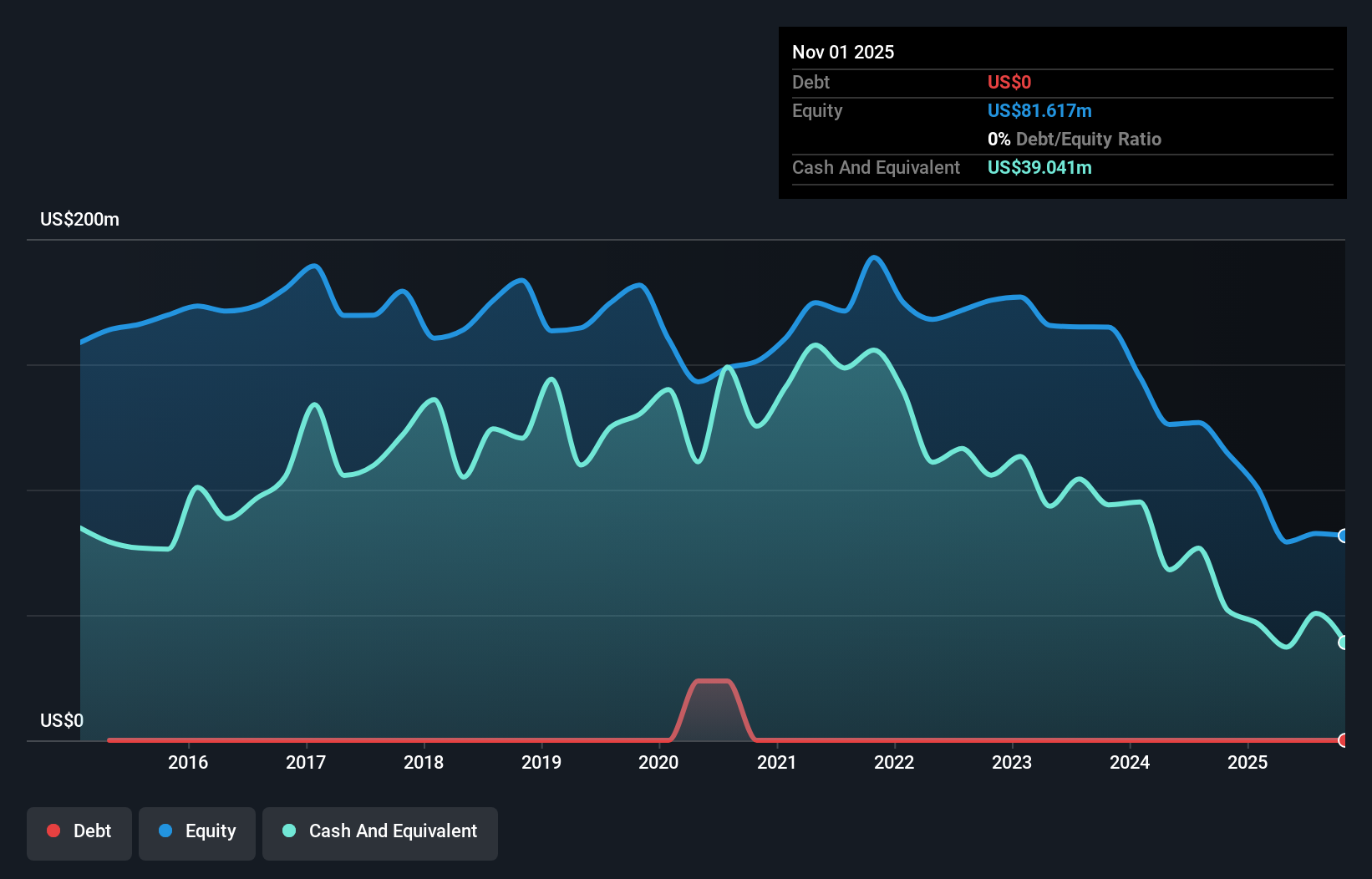

Tilly's, Inc., with a market cap of US$49.15 million, has faced challenges as evidenced by its removal from multiple Russell indices. Despite generating US$561.21 million in revenue from its retail segment, the company remains unprofitable with losses increasing over the past five years. Its short-term assets of US$127 million exceed short-term liabilities but fall short of covering long-term liabilities of US$138.5 million. The management and board are experienced, averaging over 10 years tenure each, while the company benefits from being debt-free and trading at good value compared to peers despite high volatility and negative return on equity.

Seize The Opportunity

- Click here to access our complete index of 412 US Penny Stocks.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.