Please use a PC Browser to access Register-Tadawul

Sprouts Farmers Market, Inc.'s (NASDAQ:SFM) Business Is Trailing The Market But Its Shares Aren't

Sprouts Farmers Markets, Inc. SFM | 79.23 | -1.44% |

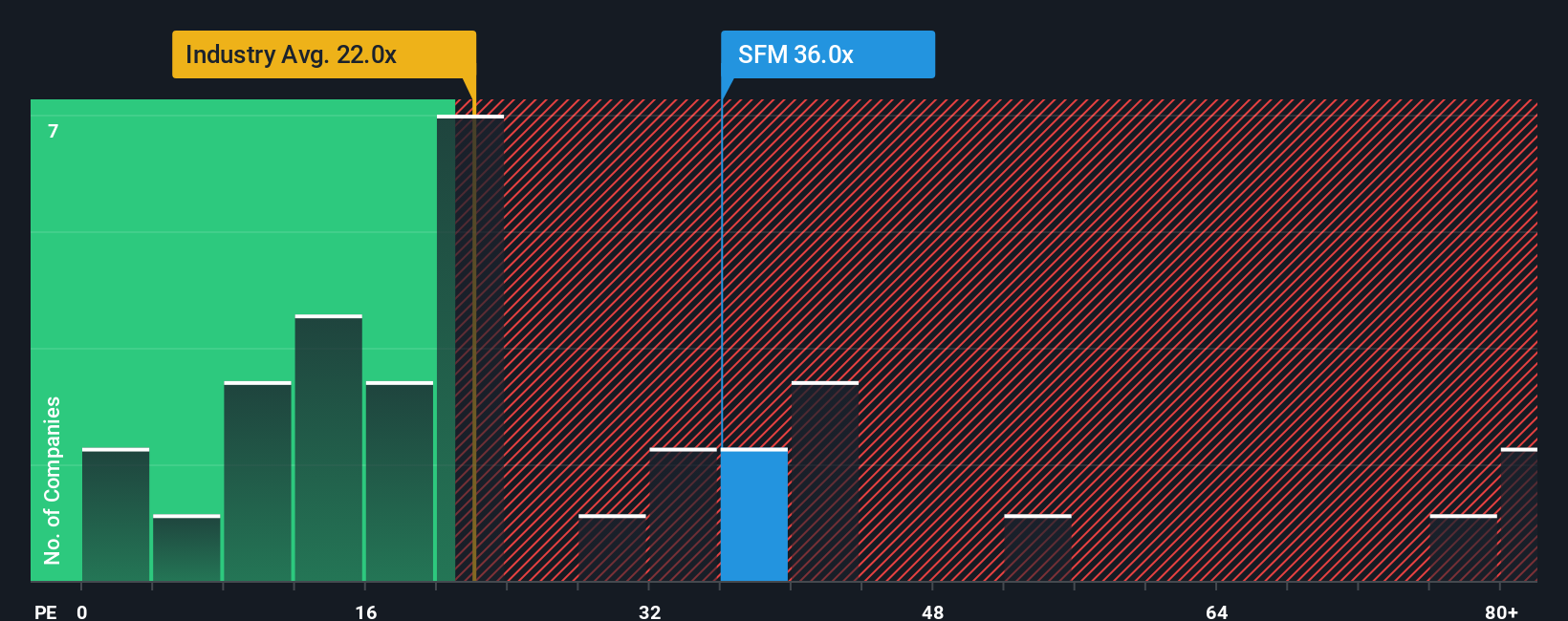

With a price-to-earnings (or "P/E") ratio of 36x Sprouts Farmers Market, Inc. (NASDAQ:SFM) may be sending very bearish signals at the moment, given that almost half of all companies in the United States have P/E ratios under 18x and even P/E's lower than 11x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's superior to most other companies of late, Sprouts Farmers Market has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

How Is Sprouts Farmers Market's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Sprouts Farmers Market's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 54% gain to the company's bottom line. Pleasingly, EPS has also lifted 108% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 11% per annum over the next three years. That's shaping up to be similar to the 11% per annum growth forecast for the broader market.

In light of this, it's curious that Sprouts Farmers Market's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Bottom Line On Sprouts Farmers Market's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Sprouts Farmers Market's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.