Please use a PC Browser to access Register-Tadawul

SS Innovations International (SSII) Advances FDA Pathway for SSi Mantra Robotics After Johns Hopkins Study Completion

AVRA Medical Robotics, Inc. SSII | 5.49 | -5.67% |

- SS Innovations International recently announced the successful completion of a human factors validation study for its SSi Mantra surgical robotic system at Johns Hopkins Hospital, with plans to submit a 510(k) premarket notification to the FDA in the fourth quarter of 2025.

- This development marks a key milestone in advancing U.S. market access, as the SSi Mantra has already achieved regulatory approval and adoption across six countries, with over 6,000 procedures performed to date.

- We'll explore how reaching this important regulatory milestone for the SSi Mantra could influence SS Innovations International's investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is SS Innovations International's Investment Narrative?

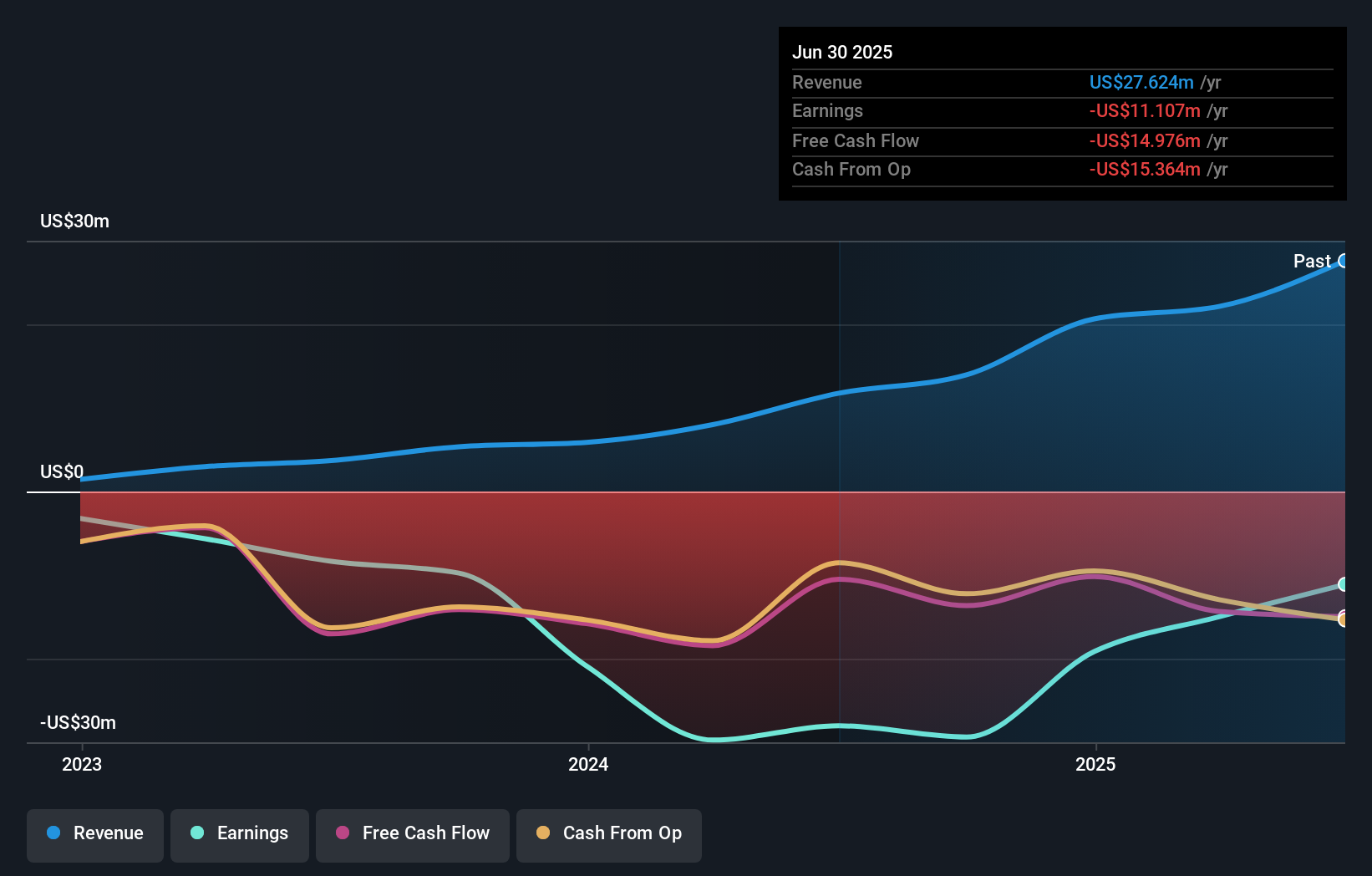

For shareholders of SS Innovations International, the big-picture appeal has been the potential for the SSi Mantra surgical robotic system to earn regulatory green lights in key global markets, unlocking new revenue pools and path to profitability. The just-announced completion of the human factors validation study at Johns Hopkins, with an FDA submission now planned for late 2025, represents a material shift in the company’s short-term catalysts. This milestone could bring US market access squarely into view, increasing the odds that a positive FDA outcome might galvanize future sales momentum. Yet, beneath this significant step forward, meaningful risks remain unchanged: limited cash runway, ongoing net losses, and concerns flagged by auditors on the company's ability to stay afloat weigh heavily on the investment case. Valuation also remains stretched, and leadership changes point to an organization still in transition, even as product milestones arrive. On the other hand, worries about financial health are not getting less important.

Our valuation report unveils the possibility SS Innovations International's shares may be trading at a premium.Exploring Other Perspectives

Explore another fair value estimate on SS Innovations International - why the stock might be worth as much as $0.31!

Build Your Own SS Innovations International Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SS Innovations International research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free SS Innovations International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SS Innovations International's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.