Please use a PC Browser to access Register-Tadawul

Stagwell Inc. (NASDAQ:STGW) Looks Just Right With A 26% Price Jump

Stagwell, Inc. Class A STGW | 4.63 | -2.32% |

Stagwell Inc. (NASDAQ:STGW) shares have continued their recent momentum with a 26% gain in the last month alone. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 3.7% in the last twelve months.

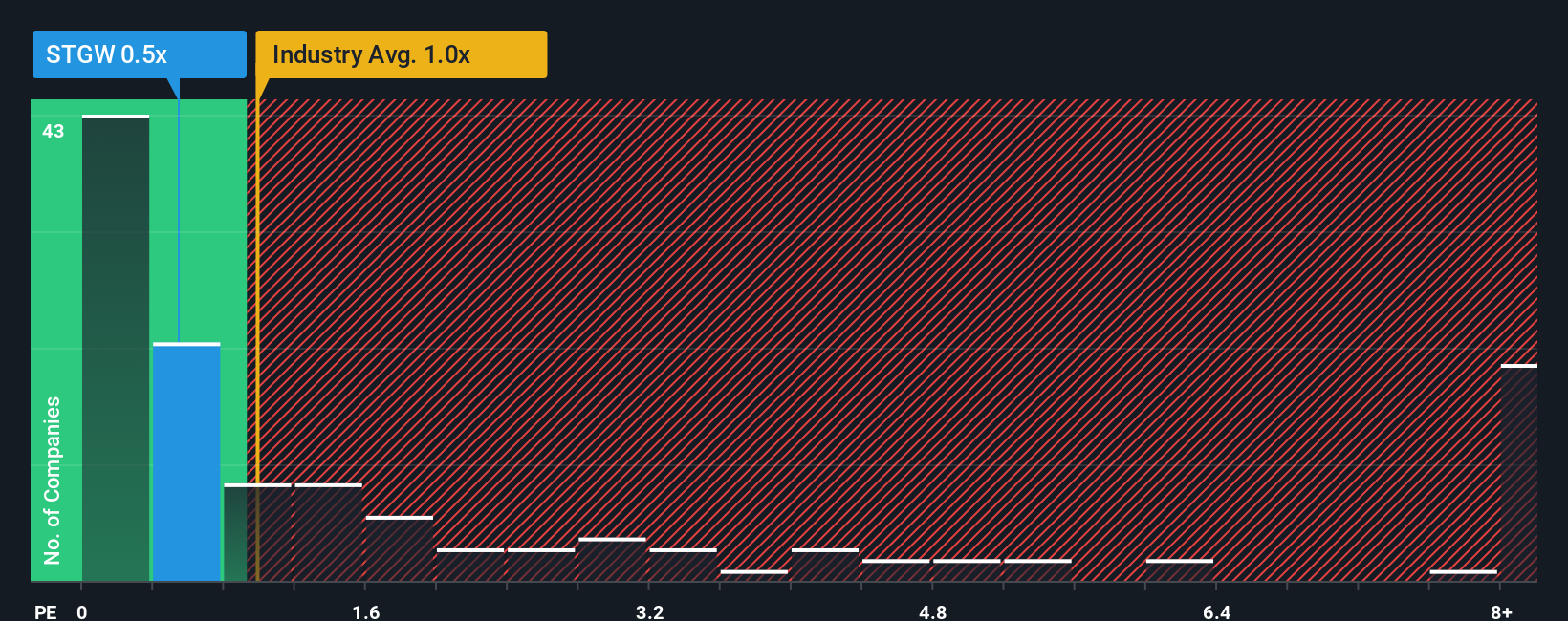

In spite of the firm bounce in price, it's still not a stretch to say that Stagwell's price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Media industry in the United States, where the median P/S ratio is around 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Stagwell Has Been Performing

Stagwell could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Stagwell.Is There Some Revenue Growth Forecasted For Stagwell?

In order to justify its P/S ratio, Stagwell would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.8% last year. Revenue has also lifted 12% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 6.2% per year over the next three years. That's shaping up to be similar to the 6.3% per annum growth forecast for the broader industry.

With this information, we can see why Stagwell is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Its shares have lifted substantially and now Stagwell's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that Stagwell maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Stagwell, and understanding should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.