Please use a PC Browser to access Register-Tadawul

Starbucks (SBUX) Declares Quarterly Dividend of US$0.61 Per Share

Starbucks Corporation SBUX | 85.08 | -0.37% |

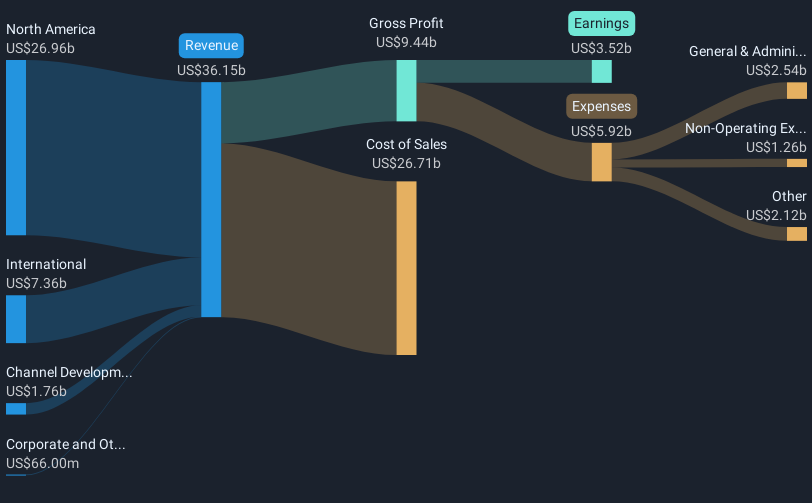

Starbucks (SBUX) recently affirmed its commitment to value by maintaining a cash dividend of $0.61 per share, reflecting its ongoing focus on shareholder returns. The company's stock rose 14% last quarter, which coincided with dividend announcements amidst broader market highs. Meanwhile, market trends were generally positive, with major indexes approaching record levels. Starbucks' ongoing M&A discussions regarding its China business added some strategic forward-looking interest, even as the company faced legal challenges. As the broader market gained 12% over the past year, Starbucks' recent moves align with its peers, reinforced by strategic updates and expanded credit facilities.

The recent dividend announcement by Starbucks, coupled with the stock's rise last quarter, underscores its commitment to shareholder returns, aligning well with its peers as major indexes trend high. This affirmative move helps solidify investor confidence amidst ongoing M&A discussions focused on its China operations. The alignment with broader market trends, which saw a 12% gain in the past year, supports Starbucks' strategic initiatives aimed at enhancing shareholder value through dividends and potential revenue growth from operational efficiencies in China.

Over the past five years, Starbucks has achieved a total shareholder return of 33.56%, including both share price increases and dividend payments. While this represents solid growth, it is essential to contextualize it against the backdrop of recent underperformance relative to the US Hospitality industry, which returned 27% over the past year. This suggests potential room for Starbucks to explore further competitive strategies to enhance market performance.

The company's ongoing strategic focus on the Back to Starbucks and Green Apron initiatives is expected to potentially bolster revenue and earnings, aligning with analyst forecasts that predict a 7.1% annual revenue growth over the next three years. However, challenges such as rising labor costs and economic uncertainties may impact profit margins, necessitating carefully managed implementations. With the current share price at approximately US$92.51 and an analyst price target of US$93.95, the stock is trading close to its estimated fair value, reflecting a slight discount and suggesting limited upside potential in the near term as per consensus analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.