Please use a PC Browser to access Register-Tadawul

StepStone Deepens Senior Housing Focus With $250 Million Vehicle

StepStone Group, Inc. Class A STEP | 69.60 | -1.54% |

- StepStone Group's real estate arm, together with Blue Moon Capital Partners, closed a $250 million continuation vehicle focused on senior housing communities.

- The partners intend to use the vehicle to acquire additional senior housing properties over time.

StepStone Group (NasdaqGS:STEP) is expanding its presence in senior housing, a niche within real estate that is closely tied to demographic trends such as aging populations. For you as an investor, this move sits at the intersection of private markets, real assets, and long term demand for care oriented housing, an area many institutions watch closely.

The new continuation vehicle points to a focus on building scale in a specific asset class, alongside a specialist partner. If you follow NasdaqGS:STEP, this kind of transaction can be a useful data point for understanding how the firm is shaping its real estate exposure and where it may concentrate attention in future capital deployment.

Stay updated on the most important news stories for StepStone Group by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on StepStone Group.

This $250 million continuation vehicle gives StepStone more exposure to senior housing within its real estate platform, while leaning on Blue Moon’s development and operating experience and the three operating partners already in place. For you, it frames StepStone as a capital partner focused on stabilized, Class A communities. This can matter if you are trying to understand how much of its real estate book is tied to income focused, demographic driven assets versus other property types.

StepStone Group Narrative, What This Deal Adds To The Story

Even without a formal narrative already set out, this transaction feeds into a common view of StepStone as an allocator that partners with specialists rather than going it alone. If you have been following analyst commentary around alternative asset managers more broadly, this type of targeted real estate exposure may be one ingredient investors watch when thinking about how resilient or diversified StepStone’s fee streams could be over time.

Risks and rewards to keep in mind

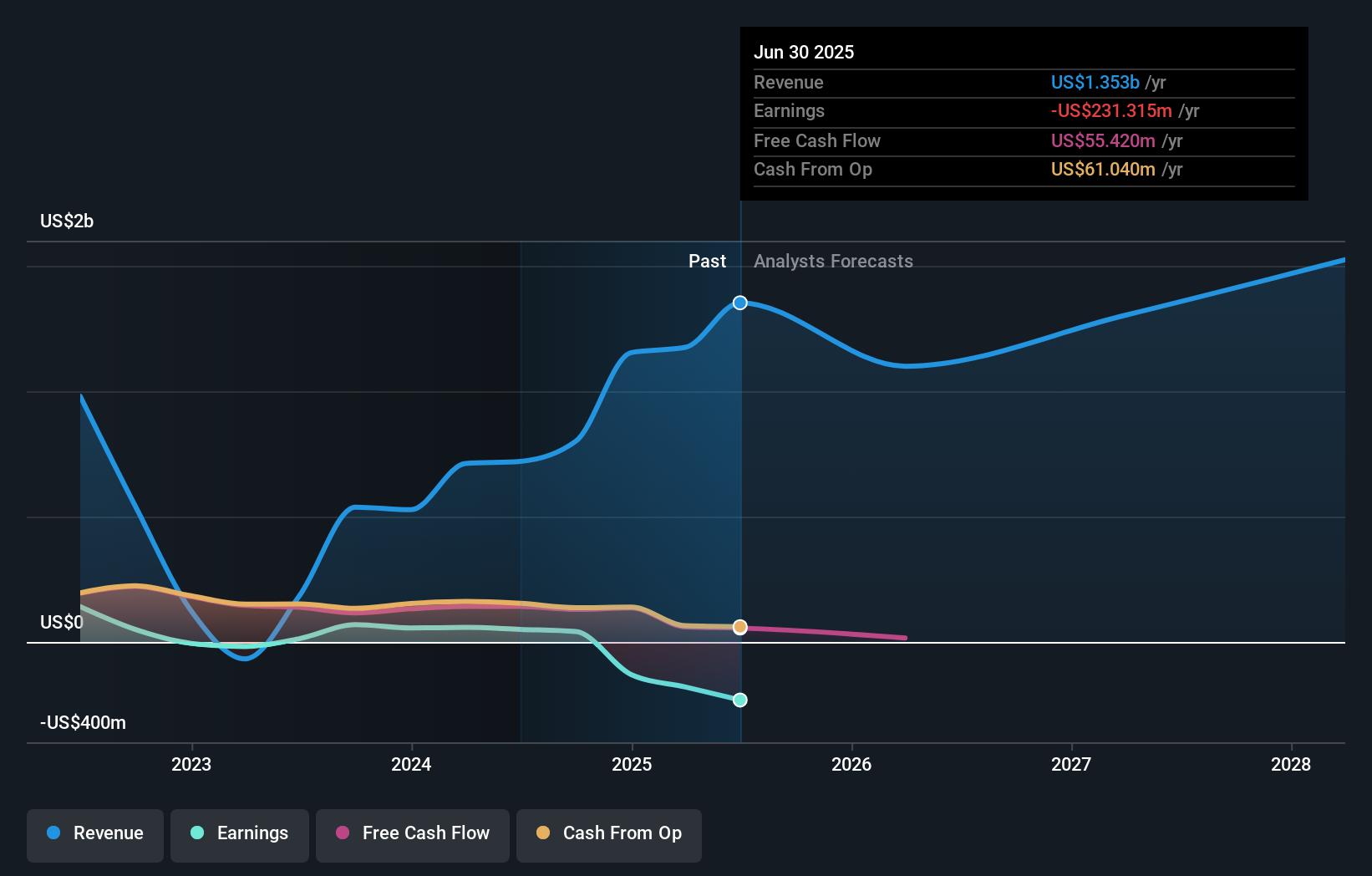

- ⚠️ Analysts have flagged 3 key risks for StepStone overall, including a dividend that is described as not well covered by earnings or free cash flows. This may shape how you think about payout sustainability as capital is committed to new vehicles.

- ⚠️ Earnings have declined by 68.5% per year over the past 5 years, so any new real estate initiatives, including this senior housing platform, sit against a backdrop of historically pressured profitability.

- ⚠️ There has been significant insider selling over the past 3 months, which some investors treat as an extra caution signal when the company is also committing to longer dated real estate strategies.

- 🎁 On the potential upside, the continuation vehicle gives StepStone a defined route to scale in a focused real estate niche that is tied to long term demographic demand for senior housing.

What to watch next

From here, you might want to watch how quickly StepStone and Blue Moon add properties to the vehicle, what fee structures are disclosed over time, and whether senior housing becomes a larger talking point on upcoming earnings calls. If you want broader context on how other investors frame StepStone’s long term story, you can check out community views in this narratives hub.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.