Please use a PC Browser to access Register-Tadawul

StepStone Utmost Tie Up Expands UK Access To Evergreen Private Markets

StepStone Group, Inc. Class A STEP | 50.07 | -6.93% |

- StepStone Group (NasdaqGS:STEP) has partnered with Utmost to offer UK clients access to evergreen global private markets strategies.

- The collaboration focuses on giving a wider range of UK investors exposure to diversified private markets portfolios.

- The partnership aligns with government-backed efforts in the UK to broaden access to private markets investing.

For you as an investor, this move highlights how StepStone Group, a global private markets firm, is positioning its evergreen products for a broader UK audience. Evergreen structures, which are designed to provide ongoing access rather than fixed-life funds, have been drawing interest from investors looking for more flexible private markets exposure. The tie-up with Utmost points to growing demand for packaged solutions that can sit alongside traditional portfolios.

Looking ahead, this kind of partnership could influence how other managers approach distribution of private markets strategies in the UK. If investor interest in evergreen structures continues, you may see more collaborations between asset managers and insurance or platform providers, with StepStone’s agreement serving as an early example to watch.

Stay updated on the most important news stories for StepStone Group by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on StepStone Group.

For StepStone, the Utmost deal sits squarely in its push to grow private-wealth distribution, especially outside the US. Utmost gives the firm access to UK-based clients who are already using insurance-based wealth solutions, which can be a natural fit for evergreen private-markets products in Private Equity, Venture Capital & Growth, Private Credit, and Private Infrastructure. For you as an investor, this means more of StepStone’s future growth potential could come from recurring fee streams tied to diversified, long-term portfolios rather than one-off fundraising cycles. The partnership also lines up with UK policy efforts to channel more capital into unlisted assets, which may help uptake across a broader range of investors than traditional private-equity funds typically reach.

The Risks and Rewards Investors Should Consider

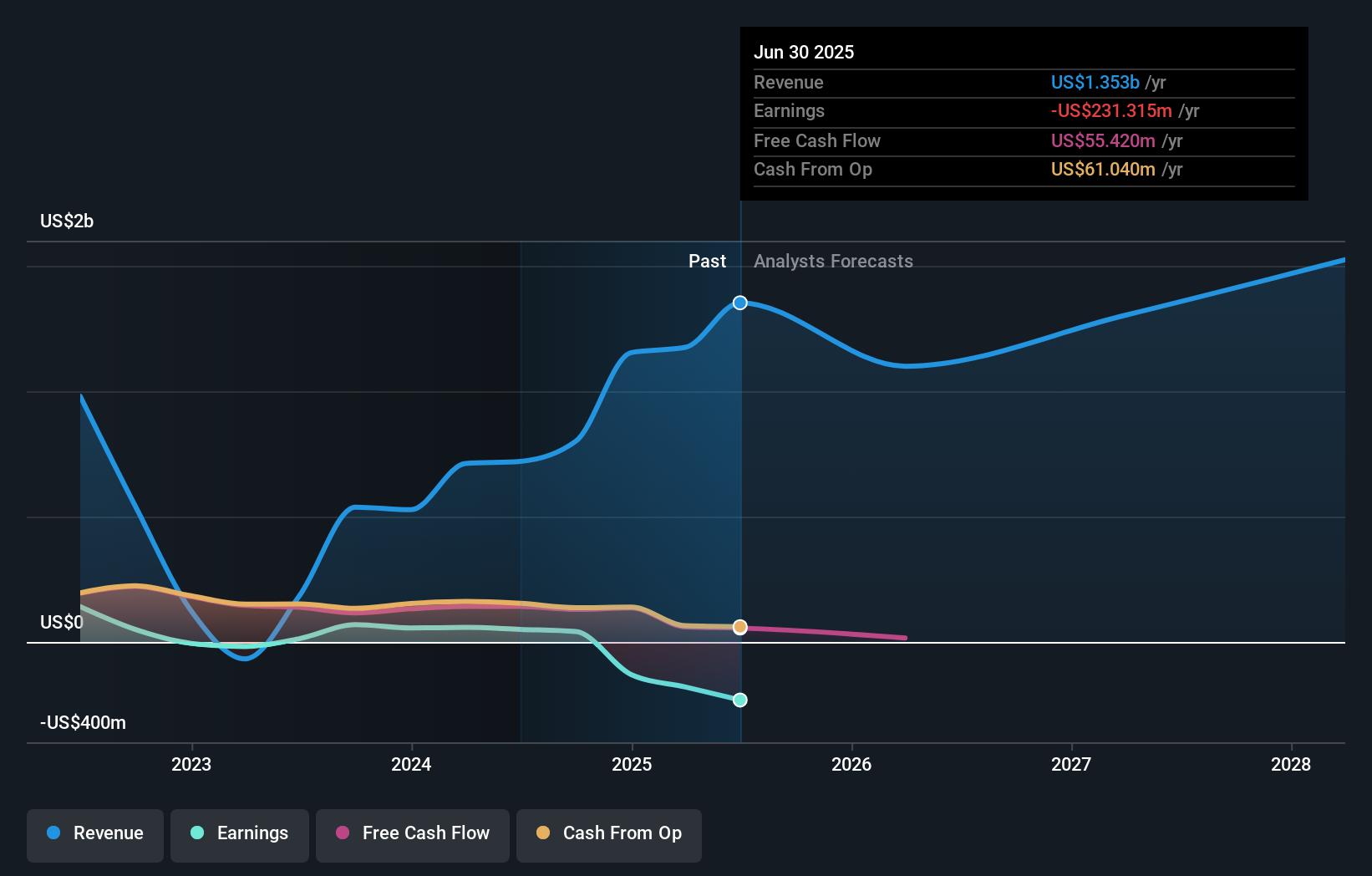

- ⚠️ The company reported a net loss of US$123.45 million for the third quarter and US$528.02 million for the nine months ended 31 December 2025, so investors may want to watch how new partnerships translate into profitability over time.

- ⚠️ Analysts have flagged 3 key risks for StepStone, including that the dividend is not well covered by earnings or free cash flows, which can limit flexibility if market conditions or fundraising slow.

- 🎁 The Utmost partnership broadens access to StepStone’s evergreen private-markets range in the UK, which could help diversify its client base and fee sources compared with peers like Blackstone, KKR, or Apollo that also target wealth channels.

- 🎁 Management has reported strong momentum in core fee-related earnings and a record year for fundraising, which provides some support for the firm’s push into international distribution and evergreen structures.

What To Watch Going Forward

From here, it will be useful to track how quickly assets are raised through the Utmost channel, how that shows up in fee-related earnings, and whether StepStone can narrow its losses while maintaining the dividend. Comparing its progress with other private-markets managers that are expanding in wealth channels, such as Blackstone or KKR, can also help you gauge whether StepStone is gaining or giving up ground in this part of the industry.

To ensure you're always in the loop on how the latest news impacts the investment narrative for StepStone Group, head to the community page for StepStone Group to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.