Please use a PC Browser to access Register-Tadawul

Steris Reshapes Portfolio Around Healthcare And AST As Shares Lag Target

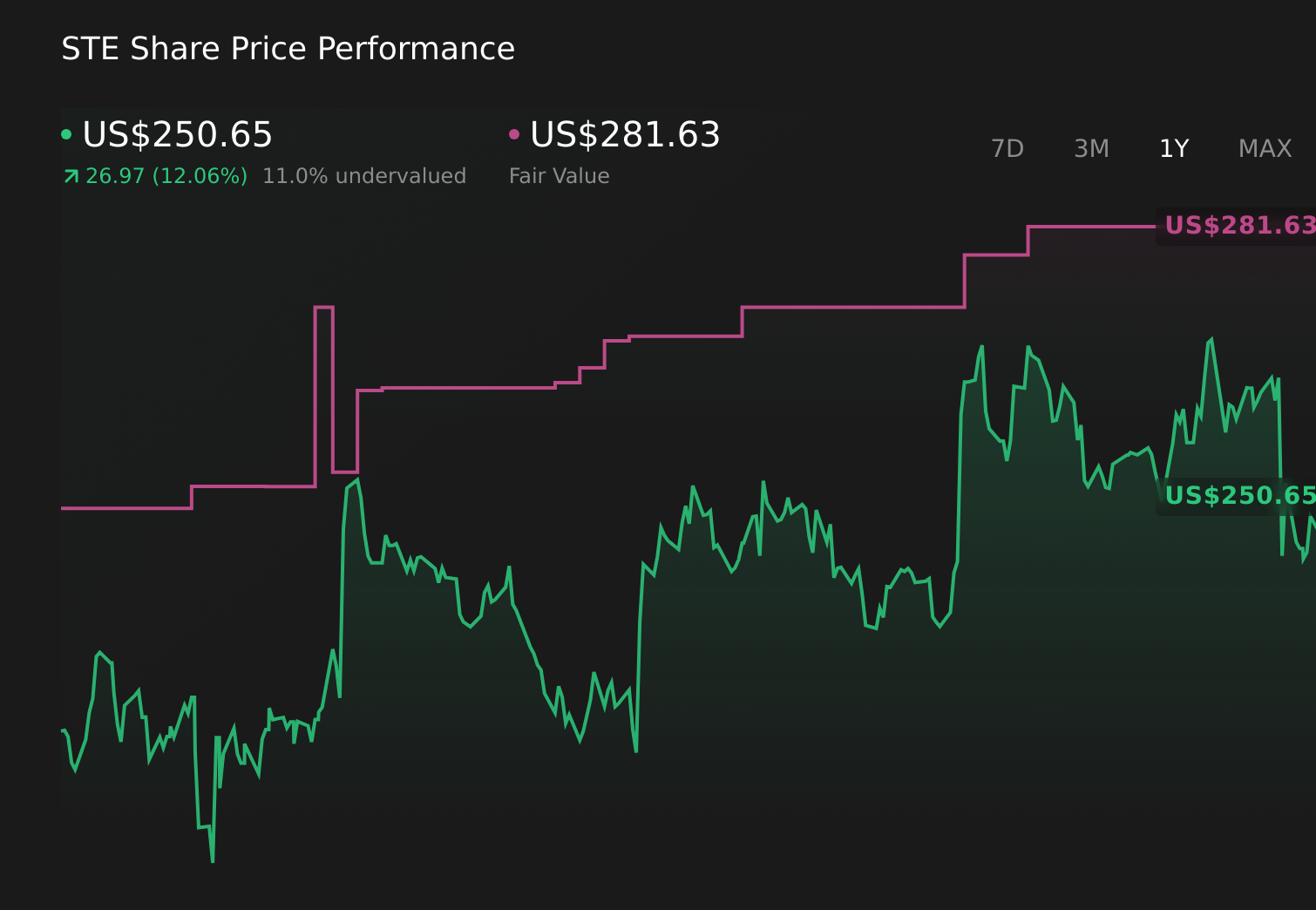

STERIS plc STE | 250.65 | -0.21% |

- STERIS (NYSE:STE) is reshaping its business through ongoing restructuring efforts across its operations.

- The company is integrating recent acquisitions into its existing portfolio to refine its operating model.

- Healthcare and AST segments are reporting growth and performance that are central to the current business shift.

For you as an investor, STERIS sits at the crossroads of medical equipment and sterilization services, areas that are closely tied to hospital procedure volumes and infection prevention standards. The latest restructuring and acquisition activity indicates that management is actively reworking how the company is organized to support these core lines of business. Healthcare and AST now appear increasingly central to how NYSE:STE positions itself within the broader medical technology space.

These moves also raise questions about integration costs, execution risk, and potential efficiency gains over time. As STERIS refines its structure around its Healthcare and AST segments, the effects on margins, capital allocation, and competitive positioning will likely be important points for investors to monitor in upcoming updates.

Stay updated on the most important news stories for STERIS by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on STERIS.

Quick Assessment

- ⚖️ Price vs Analyst Target: At US$245.40, the share price is about 13% below the US$281.63 analyst target, which is just outside the 10% band.

- ⚖️ Simply Wall St Valuation: Shares are described as trading close to estimated fair value, so they are not flagged as clearly cheap or expensive.

- ❌ Recent Momentum: The 30 day return of about 4.4% decline shows recent weakness despite the restructuring and segment growth story.

Check out Simply Wall St's in depth valuation analysis for STERIS.

Key Considerations

- 📊 The restructuring and acquisitions make your thesis more dependent on how effectively Healthcare and AST are run as the core of the business.

- 📊 Watch execution on integration costs, segment margins, and whether Healthcare and AST revenue and earnings stay aligned with the new focus.

- ⚠️ The key risk is that restructuring fails to deliver efficiency gains, which could weigh on profitability even if revenue holds up.

Dig Deeper

For the full picture including more risks and rewards, check out the complete STERIS analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.