Stock Of The Day: Is Palantir Breaking Out Again?

Palantir PLTR | 0.00 |

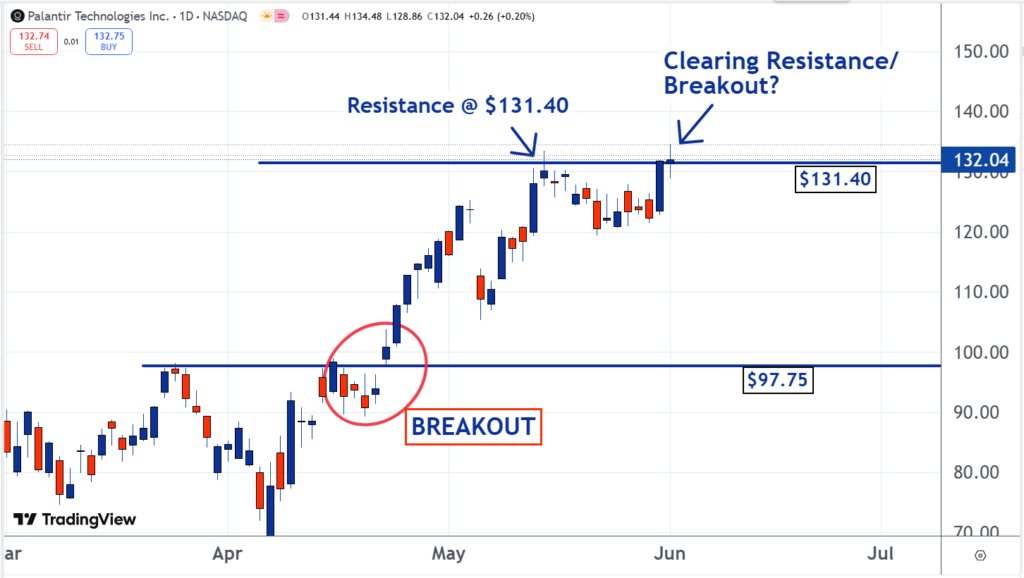

Trading in Palantir Technologies Inc. (NASDAQ:PLTR) is quiet Tuesday, but the shares continue to trend higher. They may be about to break out again.

Breakouts can illustrate bullish dynamics. They are often followed by uptrends, which is why Palantir is Benzinga’s Stock of the Day.

As you can see on the chart, this happened with Palantir in April. After resistance around the $97.75 level was broken, a rapid and large move higher followed.

Technical analysis has a dubious reputation on Wall Street. But sometimes it deserves it. Many analysts mindlessly look for patterns on charts without understanding the trading and price action that makes these patterns form.

If understood and applied correctly, technical analysis is the study of psychology and supply and demand in a market.

If a stock is trending higher, it is because there is more demand than supply. There are more shares to be bought than there are to be sold.

Read Also: May’s 20 Most-Searched Tickers On Benzinga Pro — Where Do Apple, Palantir, CoreWeave, Nvidia Rank?

Buyers must be willing to outbid each other and pay premiums to draw sellers off the sidelines if they wish to acquire shares. This results in the stock going into an uptrend.

The dynamic changes when resistance is reached.

There are enough, or more than enough, sell orders to fill all the buy orders. Investors and traders who wish to acquire shares can do so without forcing the price higher. This is why rallies end or pause when they reach resistance.

Sometimes, stocks reverse and head lower after reaching resistance. This happens when some of the sellers become concerned that other sellers will undercut them. They know buyers will go to whoever is willing to sell at the lowest price.

So, they reduce the prices they will sell for. This price action can result in a snowball effect that forces the shares down.

But sometimes, when a stock reaches resistance, the buyers eventually overpower the sellers and push the price higher. The resistance breaks.

This can be a bullish dynamic. It could mean that the people who wanted to sell have either finished or canceled their orders. With this large amount of supply removed from the market, the stage could be set for a new uptrend to form.

New buyers will be forced to outbid each other and pay premiums. This could force the shares higher, and it may be about to happen again with Palantir.

Read Next:

- Is A Bond-Market Crash Coming? Jamie Dimon, BlackRock, Ray Dalio And Others Sound The Alarm

Photo: Shutterstock

Recommend

- Sahm Platform 03/12 06:36

Option Signals | Boeing Calls Jump 10x; Intel Options Volume Soars 1.7x, 70% Bullish!

Sahm Platform 03/12 07:50The Big Short Has A Big Heart: Burry To Donate 5% Of Subs To Charity

Benzinga News 03/12 21:06Options Corner: Despite The Bubble Talk, Palantir Stock's Risk Curve Favors The Bulls

Benzinga News 03/12 21:17Palantir Director Alexander D. Moore Reports Disposal of Common Shares

Reuters Today 01:02Option Signals | Trump Goes All In on Robotics! Tesla Calls Jump 4x; Microsoft Options Volume Doubles

Sahm Platform Today 08:39Palantir teams with Nvidia, CenterPoint Energy for software to speed up AI data center construction

Reuters Today 09:30US Market Preview | KALA Surges 61.9%; NVIDIA Chips Unblocked? Reports: China Sales Ban Overturned; BofA Sees S&P 500 at 7,100 by 2026

Sahm Platform 21m