Please use a PC Browser to access Register-Tadawul

Stocks to Watch | Forecast for Nvidia GTC 2024 Event: What to Expect & How to Invest?

Super Micro Computer, Inc. SMCI | 32.33 | -4.97% |

SoundHound AI SOUN | 11.65 | -3.16% |

Pure Storage, Inc. Class A PSTG | 71.32 | -6.00% |

VERTIV HOLDINGS LLC VRT | 161.27 | -9.73% |

Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR TSM | 292.04 | -4.20% |

The anticipation is building for a significant event in the technology sector, with NVIDIA Corporation(NVDA.US) at the forefront. The company's upcoming GPU Technology Conference (GTC) is marked on calendars for March 18, drawing attention from investors and the tech community alike, especially those with a keen interest in artificial intelligence (AI). This event is notable not only for its focus on AI, a field where Nvidia has established leadership, but also for the opportunity it presents for in-person engagement. Attendees are particularly looking forward to a keynote speech by CEO Jensen Huang, alongside a series of workshops and demonstrations.

The impact of Nvidia's GTC extends beyond the event itself, influencing the broader AI market and related stocks. Nvidia's stock performance has seen a significant uptick over the past six months, fueled by the ongoing AI surge. Market expects the GTC event holds the promise of further elevating Nvidia's stock value, making it a pivotal moment for investors to watch. This conference is renowned as the premier gathering for AI developers, underscoring its importance in the tech community and its potential implications for the investment landscape.

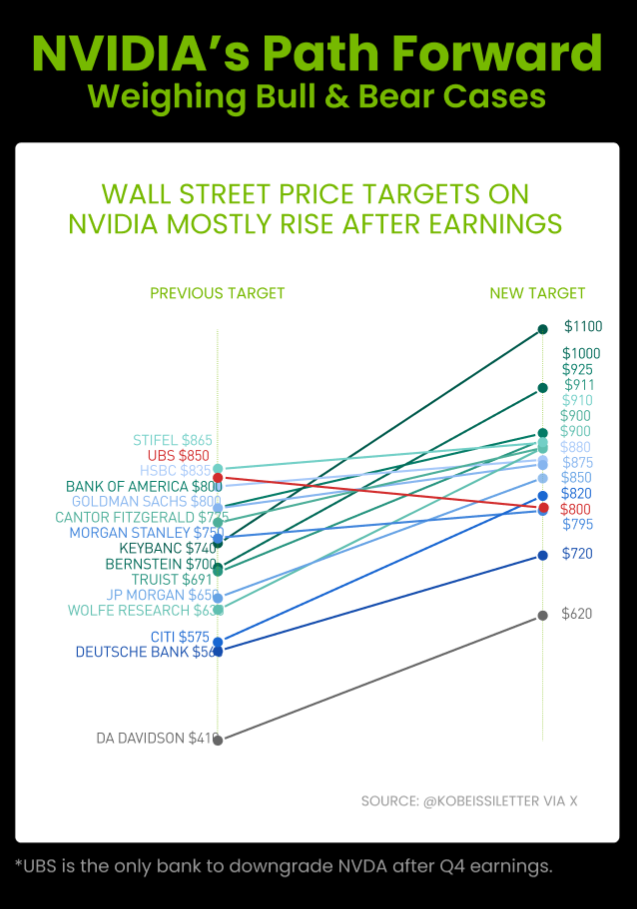

Following the last six GTC events, NVIDIA's stock has typically gone up by 6% in a day, compared to the S&P 500's 1% increase. This shows the market usually responds positively to the GTC conference, with stock prices rising afterward, according to Vivek Arya, an analyst from Bank of America.

NVIDIA and Its Partners

Be sure to keep an eye on NVIDIA and its partners as they take center stage at the GTC conference. For those concerned about NVIDIA's high valuation, the following companies are definitely worth watching.

| Company | Collaboration |

|---|---|

| Super Micro Computer, Inc.(SMCI.US) | Specialises in high-performance servers and storage solutions. |

| SoundHound AI(SOUN.US) | Provides voice AI solutions, with NVIDIA as a shareholder. |

| Pure Storage, Inc. Class A(PSTG.US) | Offers advanced data storage technology and services. |

| VERTIV HOLDINGS LLC(VRT.US) | Provides cooling systems for data centres. |

| Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR(TSM.US) | Manufacturing partner for AI chip production, serving as a foundry. |

| Equinix, Inc.(EQIX.US) | Data centre operator. |

| Synopsys, Inc.(SNPS.US) | Provides design software for AI chips. |

| CDW Corp.(CDW.US) | Installs NVIDIA AI and visualisation solutions for businesses. |

| Oracle Corporation(ORCL.US) | Cloud computing giant, customising AI servers for enterprises. |

| Insight Enterprises, Inc.(NSIT.US) | Provides solutions and services for digital innovation, and cloud/data centre transformation. |

| Arrow Electronics, Inc.(ARW.US) | Provides end-to-end NVIDIA AI technology for businesses. |

| ANSYS, Inc.(ANSS.US) | Provides CAE simulation software for AI chips. |

| Snowflake(SNOW.US) | Cloud computing giant, customising AI models for enterprises. |

Despite skepticism from some quarters about Nvidia's growth prospects following its remarkable performance during the 2023 AI boom, the company's stock has impressively surged by over 90% in the last six months. This robust performance underscores two critical points: Nvidia's potential for further growth and the sustained momentum within the AI market, which continues to attract significant investor interest. The upcoming GPU Technology Conference (GTC) presents an opportune moment for Nvidia to share crucial updates, potentially influencing its stock value positively as anticipation grows around the company's announcements.

The GTC is viewed as an essential event for those tracking the fast-paced developments in AI, promising to be a focal point for the latest innovations and insights. The question on many attendees' minds is how Nvidia plans to utilize its substantial resources to drive technological advancements, particularly in the face of competition from rivals like Advanced Micro Devices (AMD), who are keen on narrowing Nvidia's lead in the market.

Industry's Key Focus Areas

| Field | Segment | Company |

|---|---|---|

| AI+ Cinematic | Cuebric | Netflix, Inc.(NFLX.US) |

| Walt Disney Company(DIS.US) | ||

| AI+ Automotive | AI Vehicle-Infotainment | VOLVO(AB)(VLVLY.US) |

| General Motors Company(GM.US) | ||

| Polestar Automotive Holding UK PLC ADR Class A(PSNY.US) | ||

| Uber Technologies,Inc.(UBER.US) | ||

| AI+ Robotics | Humanoid Robot / Industrial Robotic Arm | GXO Logistics, Inc. Common Stock(GXO.US) |

| Alphabet Inc. Class A(GOOGL.US) | ||

| Intuitive Surgical, Inc.(ISRG.US) | ||

| iRobot(IRBT.US) | ||

| Tesla Motors, Inc.(TSLA.US) | ||

| AI+ Biologics | Biology Drug Discovery | Medtronic Plc(MDT.US) |

| Amgen Inc.(AMGN.US) | ||

| RECURSION PHARMACEUTICALS, INC.(RXRX.US) | ||

| AI Software-Infrastructure | Cloud Services | ServiceNow, Inc.(NOW.US) |

| Palantir Technologies(PLTR.US) | ||

| Oracle Corporation(ORCL.US) | ||

| Snowflake(SNOW.US) | ||

| Adobe Systems Incorporated(ADBE.US) |

As a primary beneficiary of the AI boom, NVIDIA has reached a market capitalization of $2 trillion after a record-breaking quarter, becoming the third-largest technology company by market cap, trailing only behind Apple and Microsoft. Since the beginning of this year, NVIDIA's stock price has surged by 66%. While NVIDIA's share price has soared in the past week, the chip industry is known for its cyclical fluctuations influenced by investment trends, which can result in substantial pullback. However, we are still in the early stages of the AI boom, and forecasting market trends remains uncertain.