Please use a PC Browser to access Register-Tadawul

Stronger Revenue But Softer Net Interest Income Might Change The Case For Investing In Atlantic Union (AUB)

Atlantic Union Bankshares Corporation AUB | 40.65 | +1.83% |

- Atlantic Union Bankshares recently reported quarterly results showing US$380.2 million in revenue, up very strongly year on year and roughly matching analyst expectations, but with net interest income coming in below forecasts.

- This mix of headline revenue growth alongside weaker core lending income has sharpened investor focus on how the bank balances growth, funding costs, and profitability in a challenging regional banking landscape.

- We’ll now examine how the significant miss in net interest income, despite solid revenue growth, may influence Atlantic Union Bankshares’ investment narrative.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Atlantic Union Bankshares Investment Narrative Recap

To own Atlantic Union Bankshares, you need to believe in a Mid‑Atlantic regional bank that can turn its expanded footprint into steady loan, deposit, and fee income while keeping funding costs in check. The latest quarter’s strong top line but weaker net interest income sharpens attention on that balance, yet does not appear to materially change the near term catalyst of integrating growth initiatives or the key risk around margin pressure.

The recent Q3 2025 earnings update, with net interest income of US$319.21 million and revenue of US$380.2 million, is central to this story because it highlights how core lending profitability is tracking against expectations. Against the backdrop of prior guidance for full year 2025 net interest income of about US$1.160–1.165 billion, this miss keeps investors focused on how funding costs, deposit competition, and loan pricing interact with the bank’s expansion plans.

But investors also need to be aware of how prolonged pressure on net interest income could interact with...

Atlantic Union Bankshares' narrative projects $1.9 billion revenue and $806.7 million earnings by 2028. This requires 28.7% yearly revenue growth and a $614.8 million earnings increase from $191.9 million today.

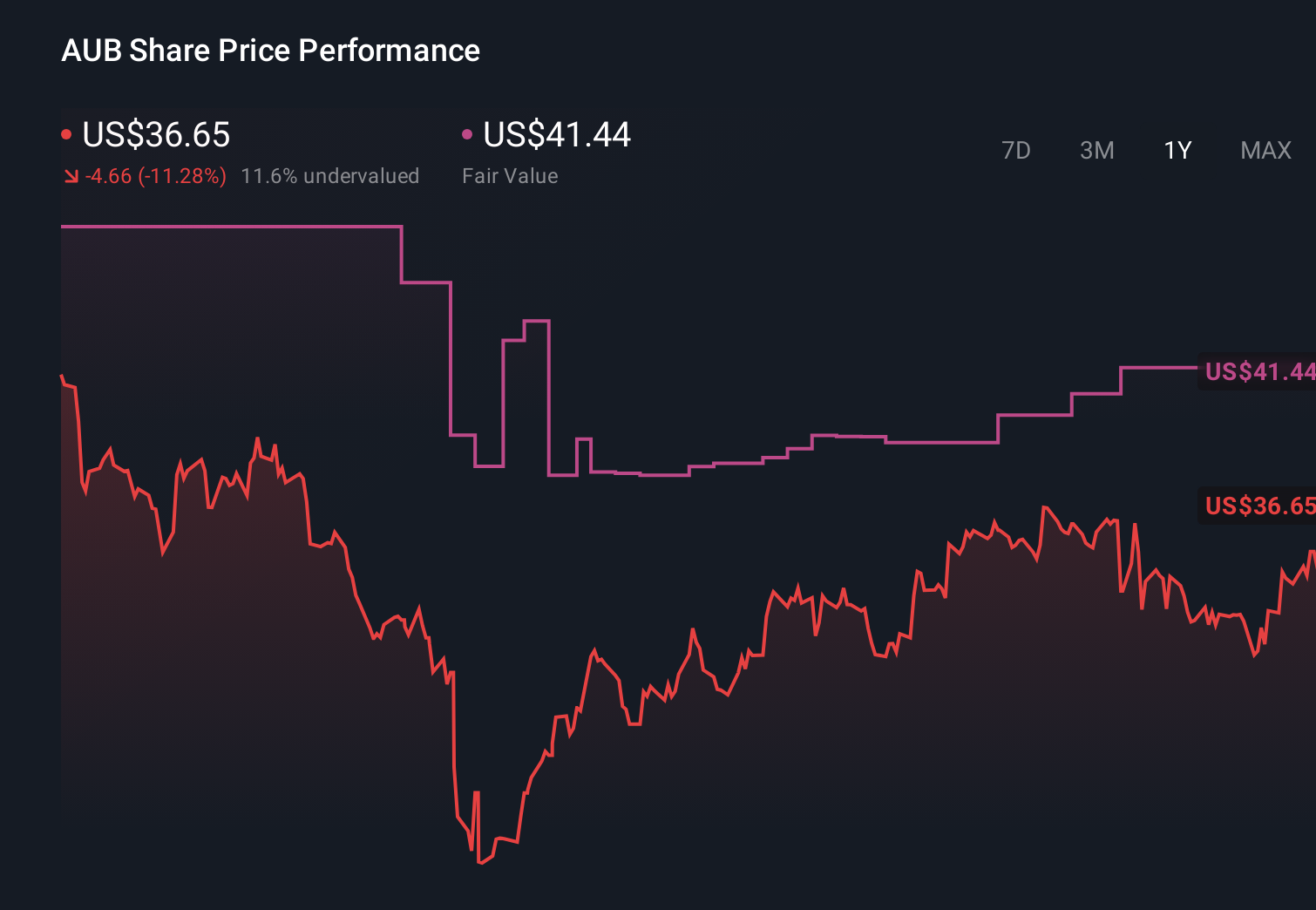

Uncover how Atlantic Union Bankshares' forecasts yield a $42.44 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span roughly US$30.79 to US$54.69 per share, showing how widely views can differ. When you set that against the recent net interest income shortfall, it underlines why many investors are closely watching how Atlantic Union manages funding costs and core profitability over the next few quarters.

Explore 3 other fair value estimates on Atlantic Union Bankshares - why the stock might be worth 16% less than the current price!

Build Your Own Atlantic Union Bankshares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atlantic Union Bankshares research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Atlantic Union Bankshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atlantic Union Bankshares' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 39 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.