Please use a PC Browser to access Register-Tadawul

Subdued Growth No Barrier To Erayak Power Solution Group Inc. (NASDAQ:RAYA) With Shares Advancing 35%

Erayak Power Solution Group Inc. RAYA | 4.10 | -0.09% |

The Erayak Power Solution Group Inc. (NASDAQ:RAYA) share price has done very well over the last month, posting an excellent gain of 35%. The last month tops off a massive increase of 175% in the last year.

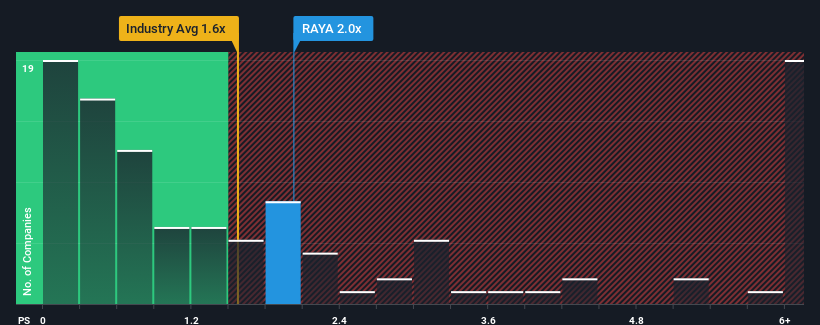

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Erayak Power Solution Group's P/S ratio of 2x, since the median price-to-sales (or "P/S") ratio for the Electrical industry in the United States is also close to 1.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

We've discovered 3 warning signs about Erayak Power Solution Group. View them for free.

How Has Erayak Power Solution Group Performed Recently?

For example, consider that Erayak Power Solution Group's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Erayak Power Solution Group will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Erayak Power Solution Group would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.3%. Still, the latest three year period has seen an excellent 43% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

This is in contrast to the rest of the industry, which is expected to grow by 21% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Erayak Power Solution Group is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Key Takeaway

Its shares have lifted substantially and now Erayak Power Solution Group's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Erayak Power Solution Group's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

If you're unsure about the strength of Erayak Power Solution Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.