Please use a PC Browser to access Register-Tadawul

Subdued Growth No Barrier To Mirum Pharmaceuticals, Inc. (NASDAQ:MIRM) With Shares Advancing 25%

Mirum Pharmaceuticals MIRM | 103.84 | +0.61% |

Despite an already strong run, Mirum Pharmaceuticals, Inc. (NASDAQ:MIRM) shares have been powering on, with a gain of 25% in the last thirty days. The last month tops off a massive increase of 105% in the last year.

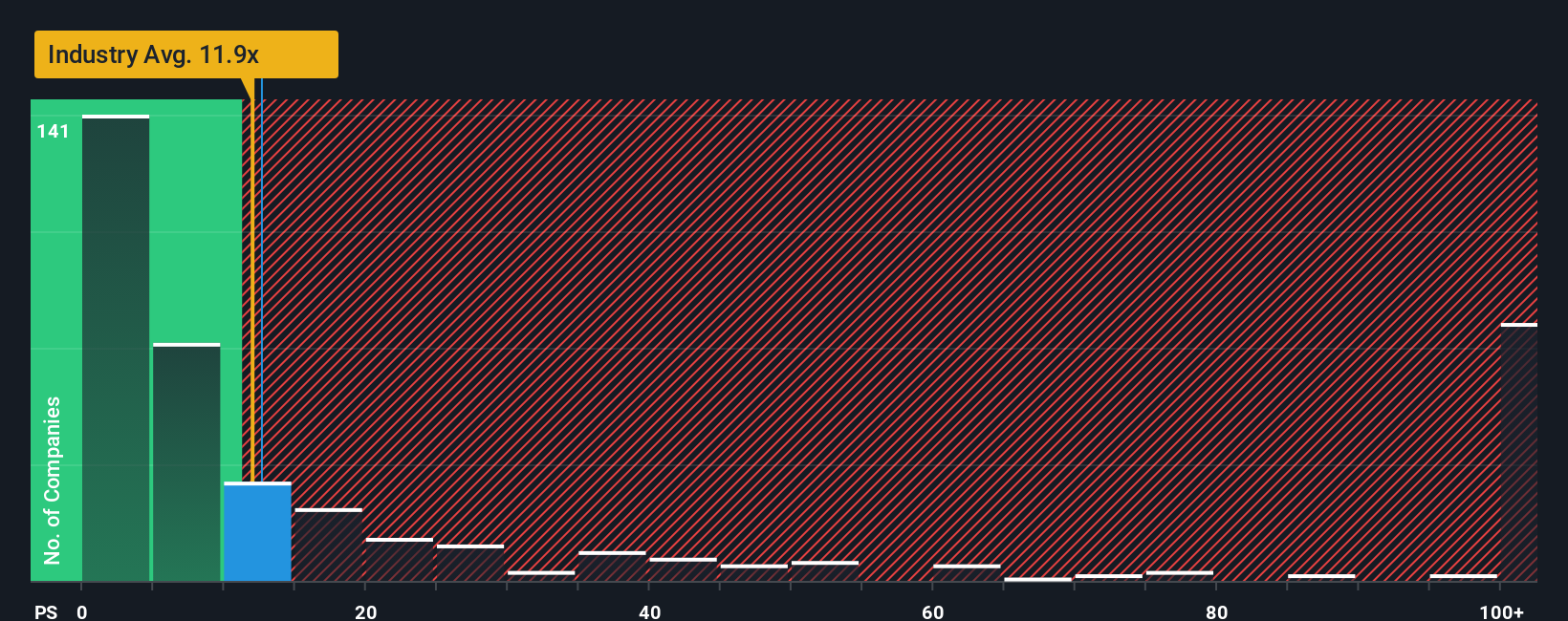

Although its price has surged higher, there still wouldn't be many who think Mirum Pharmaceuticals' price-to-sales (or "P/S") ratio of 12.6x is worth a mention when the median P/S in the United States' Biotechs industry is similar at about 11.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

What Does Mirum Pharmaceuticals' Recent Performance Look Like?

Recent times haven't been great for Mirum Pharmaceuticals as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Mirum Pharmaceuticals.How Is Mirum Pharmaceuticals' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Mirum Pharmaceuticals' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 54% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 22% each year over the next three years. With the industry predicted to deliver 133% growth per year, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Mirum Pharmaceuticals is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Mirum Pharmaceuticals' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at the analysts forecasts of Mirum Pharmaceuticals' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Don't forget that there may be other risks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.