Please use a PC Browser to access Register-Tadawul

Sunrun Expands Home Power Plants As HASI Venture Targets Solar Growth

Sunrun Inc. RUN | 20.47 | +5.84% |

- Sunrun (NasdaqGS:RUN) is expanding its residential distributed power plant programs, with customer participation reported at more than five times prior levels.

- The company is delivering grid services across multiple U.S. regions in partnership with utilities and technology companies.

- Sunrun and HA Sustainable Infrastructure Capital have formed a joint venture involving up to US$500 million to support residential solar and battery projects.

For you as an investor, Sunrun sits at the intersection of rooftop solar, home batteries, and grid services. The company focuses on turning households into small power plants. Residential solar and storage are increasingly tied to utility programs that pay for flexible capacity, especially in areas facing reliability concerns and high power demand. This places Sunrun’s core business in segments that are closely watched by energy providers and regulators.

The new distributed power plant growth and the joint venture with HA Sustainable Infrastructure Capital provide Sunrun with additional ways to pursue residential clean energy projects. As these programs mature, investors may want to monitor contract structures, the pace of capital deployment, and how reliably Sunrun can convert customer participation into recurring grid service revenues.

Stay updated on the most important news stories for Sunrun by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Sunrun.

Investor Checklist

Quick Assessment

- ⚖️ Price vs Analyst Target: Sunrun trades at US$19.16, around 14% below the US$22.19 consensus target. This places it within a moderate range of analyst expectations.

- ⚖️ Simply Wall St Valuation: Simply Wall St's DCF view is currently unknown, so valuation signals here are incomplete rather than clearly indicating that the stock is cheap or expensive.

- ✅ Recent Momentum: The 30 day return of roughly 1.4% is modest, but it indicates the share price has been edging higher rather than slipping.

There is only one way to know the right time to buy, sell or hold Sunrun. Head to Simply Wall St's company report for the latest analysis of Sunrun's Fair Value.

Key Considerations

- 📊 The expanded distributed power plant programs and the up to US$500m joint venture give Sunrun additional avenues to monetize residential solar and storage across multiple regions.

- 📊 It may be helpful to monitor how quickly joint venture capital is committed, the mix of grid service contracts and how customer participation levels relate to recurring service revenue per home.

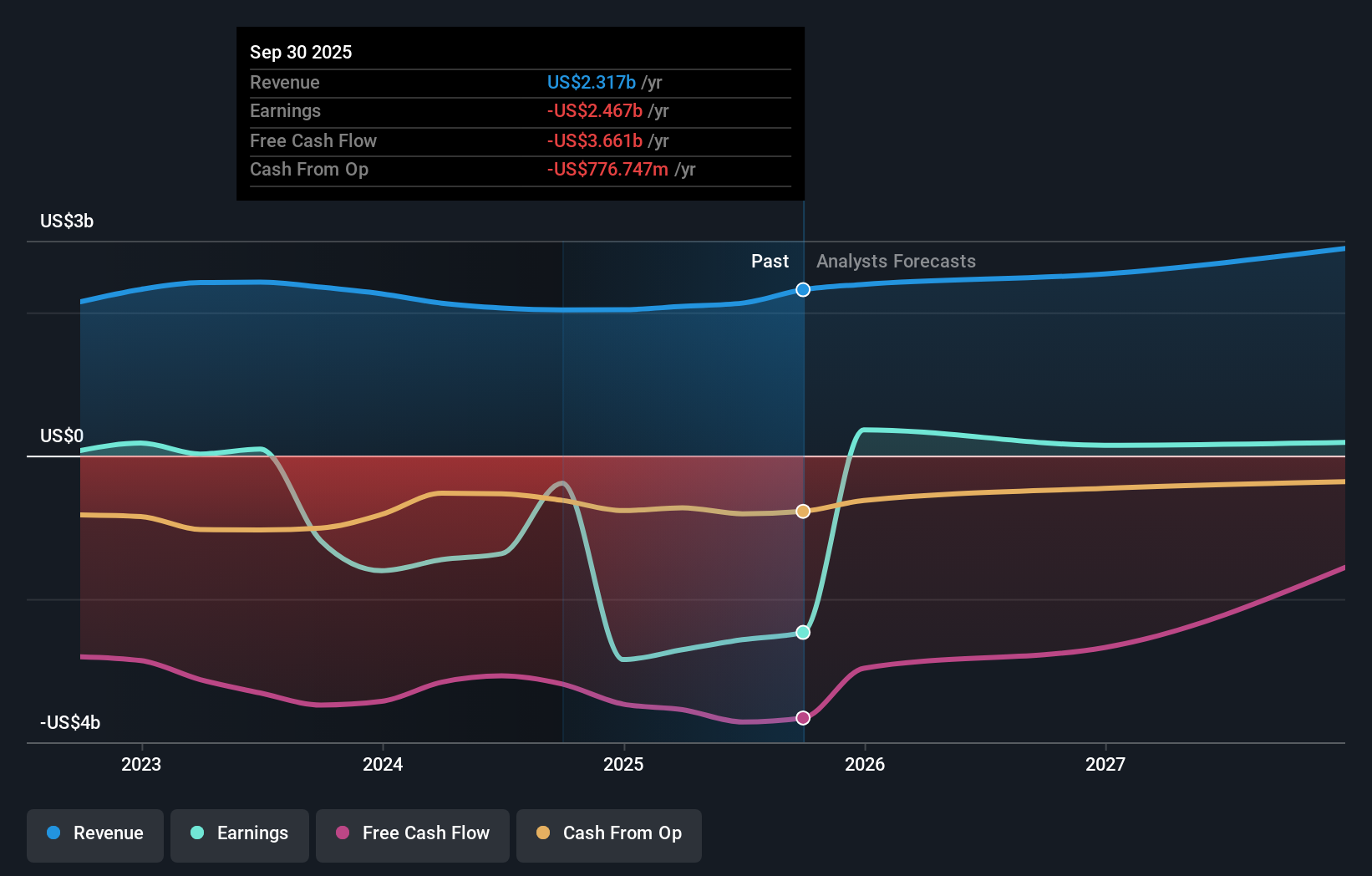

- ⚠️ Simply Wall St flags less than one year of cash runway, so funding needs and balance sheet resilience are key areas to watch alongside growth in long term project commitments.

Dig Deeper

For the full picture, including more risks and potential rewards, check out the complete Sunrun analysis. You can also visit the community page for Sunrun to see how other investors believe this latest news affects the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.