Please use a PC Browser to access Register-Tadawul

Sunrun Secures New Funding For Virtual Power Plant Growth And Risks

Sunrun Inc. RUN | 20.86 | +12.94% |

- Sunrun announced a new financing partnership with HA Sustainable Infrastructure Capital to support 300 megawatts of additional residential solar and storage capacity.

- The deal is expected to fund more than 40,000 new home installations that can participate in Sunrun’s virtual power plant programs.

- The partnership comes as utilities and industry face rising electricity demand from AI data centers and electric vehicles and are looking for distributed resources to support the grid.

Sunrun, traded as NasdaqGS:RUN, enters this agreement with a recent share price of $21.41 and a mixed return profile. The stock is up 20.1% over the past week and 8.5% over the past month, with a 10.1% gain year to date and a 128.0% return over the past year, while 3 year and 5 year returns show declines of 21.7% and 71.1% respectively.

The new capital for 300 megawatts of residential capacity gives Sunrun additional scale in virtual power plants at a time when utilities seek more flexible resources to manage grid stress. For investors watching how power demand from AI and electric vehicles is being met, this development offers another data point on how distributed solar and storage are being built into future grid planning.

Stay updated on the most important news stories for Sunrun by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Sunrun.

The HA Sustainable Infrastructure Capital partnership gives Sunrun a defined funding channel for 300 megawatts of additional residential solar and storage, which speaks directly to its role as a large-scale virtual power plant operator. By retaining ownership of the projects while securing up to US$500 million over 18 months, Sunrun keeps control over home-to-grid assets that can be aggregated and sold into capacity programs that utilities and large power users increasingly look for as electricity demand from AI data centers and electric vehicles grows.

How this fits the Sunrun bull and bear narratives

Bullish narratives around Sunrun focus on battery storage attachment, grid service monetisation and recurring, contract-based cash flows, and this deal lines up with that view by expanding the pool of home systems that can participate in virtual power plants. More cautious narratives point to financing dependence and policy risk, and this structure underlines that Sunrun is still reliant on third party capital and tax oriented vehicles even as it seeks to scale recurring grid services alongside competitors such as Tesla, Enphase Energy and Sunnova.

Risks and rewards to keep in mind

- 🎁 Additional 300 megawatts of financed capacity increases the installed base that can participate in virtual power plant programs, which may support Sunrun’s home-to-grid positioning.

- 🎁 The joint venture structure allows Sunrun to monetise long term customer cash flows while keeping a significant ownership interest in the projects.

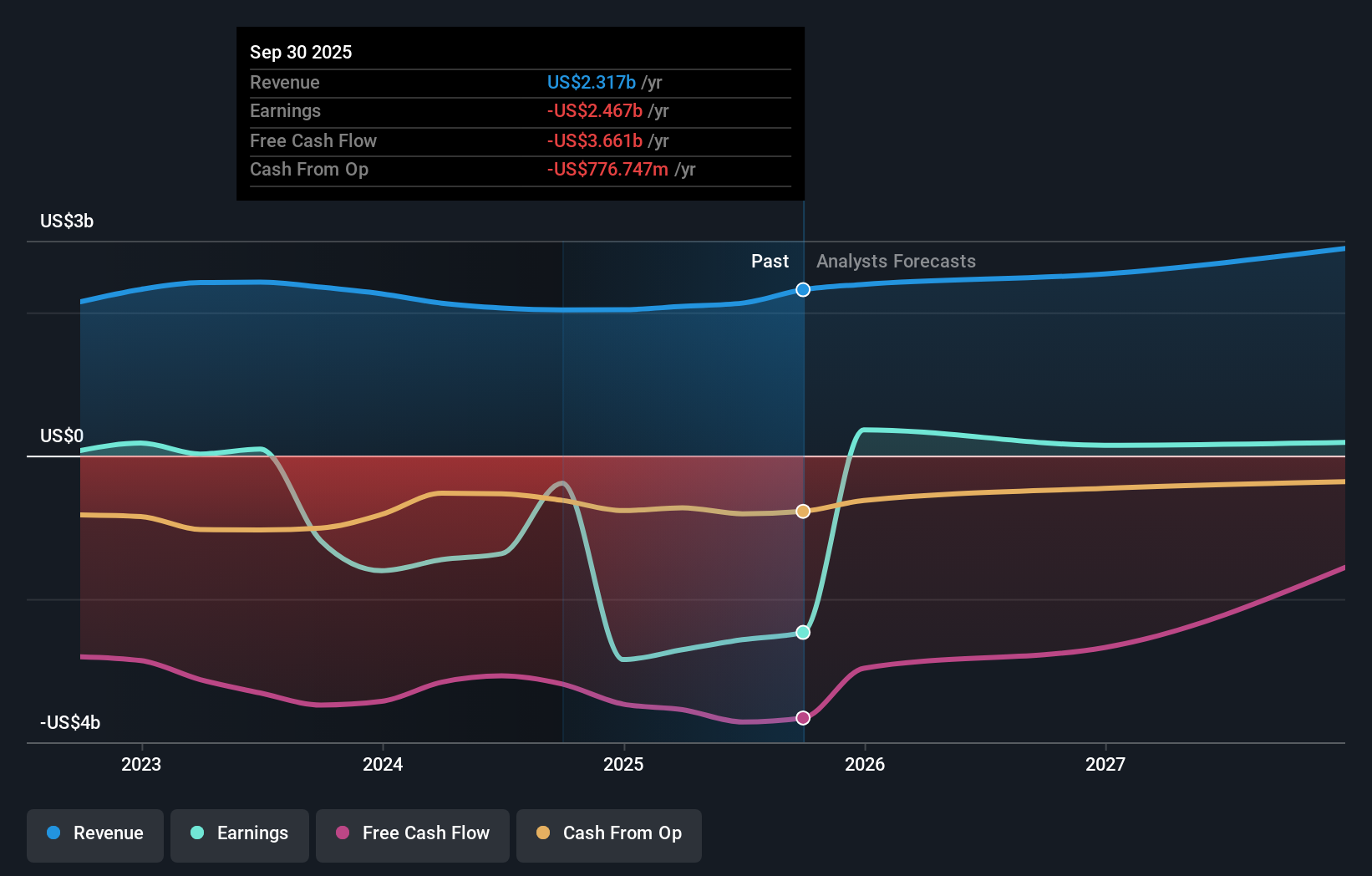

- ⚠️ Analysts have flagged that Sunrun has less than 1 year of cash runway, so adding new assets through capital-intensive financing may keep balance sheet risk in focus.

- ⚠️ Elevated short interest at 32.24% of float and high reliance on external funding mean execution or policy setbacks could quickly affect sentiment.

What to watch from here

From here, you may want to watch how quickly Sunrun converts the US$500 million commitment into installed systems, how often utilities call on these virtual power plants during peak events and how returns compare with other residential solar players such as Tesla and Sunnova. For a broader context on how different investors are thinking about Sunrun’s long term grid role and financing model, check community narratives on the Sunrun page on Simply Wall St.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.