Please use a PC Browser to access Register-Tadawul

Sunrun’s Growing Virtual Power Plant Recasts Rooftop Solar And Grid Services

Sunrun Inc. RUN | 19.09 | +4.89% |

- Sunrun reports transformative growth in its distributed power plant business, with customer participation in grid services growing more than fivefold over the past year.

- The company now operates what it describes as the nation's largest dispatchable home battery network, supplying grid support across multiple U.S. regions.

- Recent activity includes a record number of grid services dispatches, expanded utility partnerships, and progress in vehicle to grid capabilities.

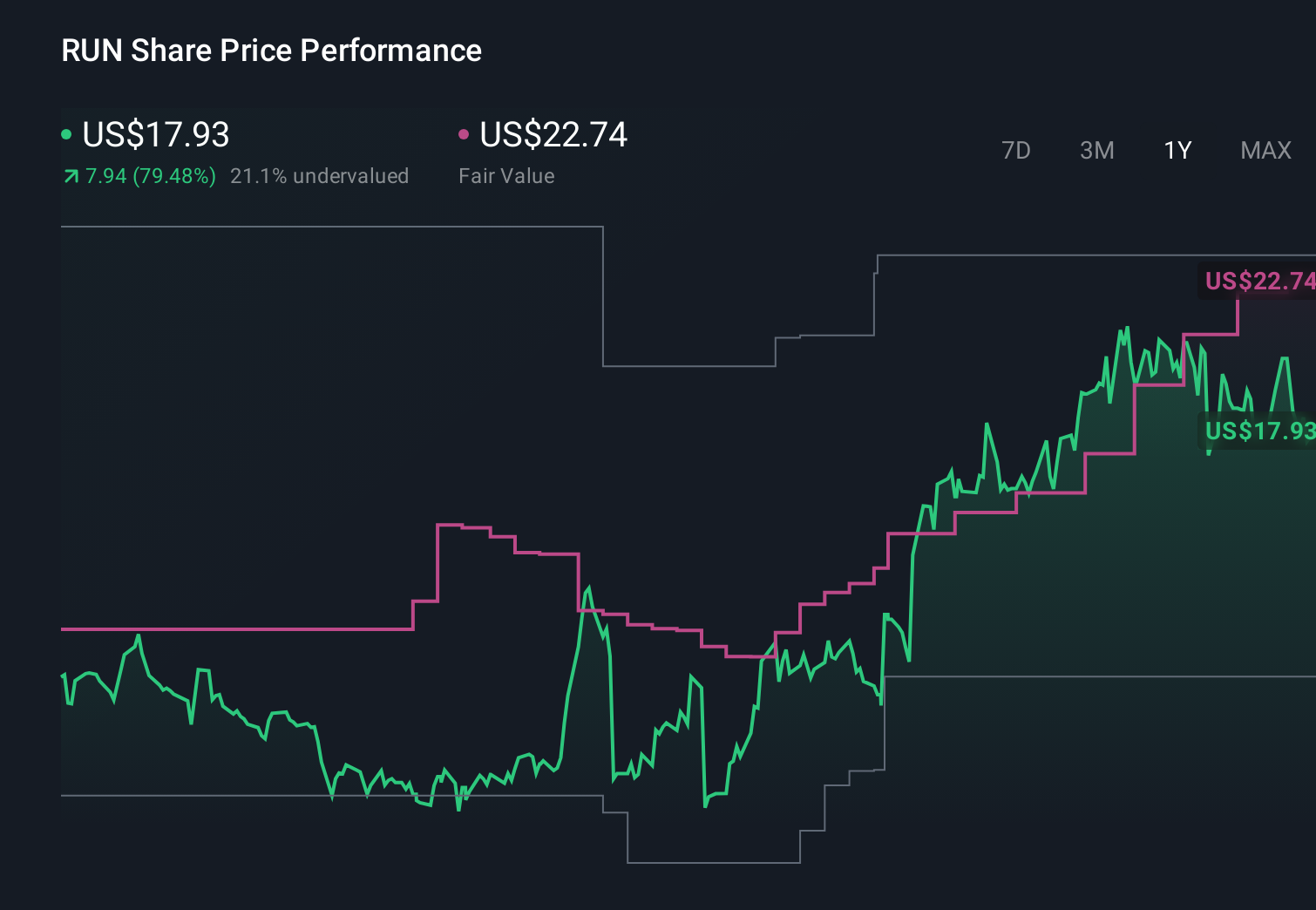

Sunrun (NasdaqGS:RUN), trading at $18.97, is shifting its center of gravity from being mainly a rooftop solar installer toward acting as a distributed energy utility that can aggregate and dispatch home batteries at scale. This development comes after a mixed multi year share price record, with a 119.6% return over the past year alongside a 17.6% decline over three years and a 76.9% decline over five years.

For investors, the build out of Sunrun's virtual power plant and grid services operations could change how you think about the business, its risks, and its potential revenue mix over time. The company is positioning itself around grid reliability and services tied to rising power demand and extreme weather, so future updates on contract wins, dispatch volumes, and technology partnerships are likely to be key reference points.

Stay updated on the most important news stories for Sunrun by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Sunrun.

For investors, the update that Sunrun dispatched nearly 18 GWh of battery power with 416 MW of peak output and over 1,300 dispatches in 2025 puts hard numbers around its shift from one-off rooftop installs toward recurring, grid-service style revenue. This positions Sunrun in a similar conversation to names like NextEra Energy, AES and Enphase Energy that are tied to grid reliability and energy services, not just hardware sales. It also helps explain why the stock has seen sharp swings in response to grid-services headlines.

How this fits the Sunrun narratives investors are watching

The bullish Sunrun narrative has long focused on battery attachment and virtual power plants as a way to support higher-margin, recurring cash flows, and this news directly speaks to that thesis by showing much higher customer participation and real-world dispatch volumes. The more cautious narrative flags reliance on policy support, financing conditions and long-term contracts. Those concerns remain relevant here because the distributed power plant model still depends on utility contracts, rate structures and access to low-cost capital even as operational metrics scale.

Risks and rewards coming into focus

- ⚠️ Scaling to 10 GWh of expected dispatchable capacity by 2028 and building out 17 programs increases capital needs, and analysts have flagged Sunrun’s limited cash runway as a key financial risk.

- ⚠️ The business is exposed to regulatory and utility decisions on virtual power plants and compensation structures, which could affect future contract economics even if technical performance is strong.

- 🎁 The market has highlighted Sunrun’s earnings growth potential and assessment as good relative value, and growing grid-services activity is directly tied to those expectations.

- 🎁 A larger fleet of 217,000 home batteries and partnerships in regions like Texas, California and the Northeast give Sunrun more ways to earn from each customer beyond the initial solar installation.

What to watch next

From here, it is worth watching how often utilities like PJM, ERCOT and California programs call on Sunrun capacity, what pricing terms are disclosed for new contracts with partners such as NRG and Tesla, and how these translate into segment-level revenue and cash flow in upcoming results. If you want to see how different investors connect this grid-services story with long-term growth, risk and valuation, have a look at the community narratives for Sunrun and compare how the bull and bear cases line up with these new operational milestones.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.