Please use a PC Browser to access Register-Tadawul

Sunrun’s National-Scale Power Plants Reshape Grid Role And Investor Focus

Sunrun Inc. RUN | 20.43 | +5.64% |

- Sunrun announced that its distributed power plant programs have reached national scale, with participation growing roughly fivefold.

- The company reported record grid support across several states during periods of peak demand and emergencies.

- These programs are being built in partnership with companies such as Ford, Tesla and utilities including PG&E.

For investors watching Sunrun (NasdaqGS:RUN), the rapid expansion of these programs arrives after a mixed share price record. The stock last closed at $19.09, with a 1 year return of 116.4%, a 3 year return showing a 24.3% decline and a 5 year return showing a 69.9% decline. That spread highlights how sentiment on the company has shifted several times in recent years.

What is changing now is the scale and visibility of Sunrun’s role in U.S. power infrastructure through these distributed power plant programs. As the company leans further into grid services alongside rooftop solar, many investors will likely focus on how consistently it can translate this larger operational footprint into more stable business performance.

Stay updated on the most important news stories for Sunrun by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Sunrun.

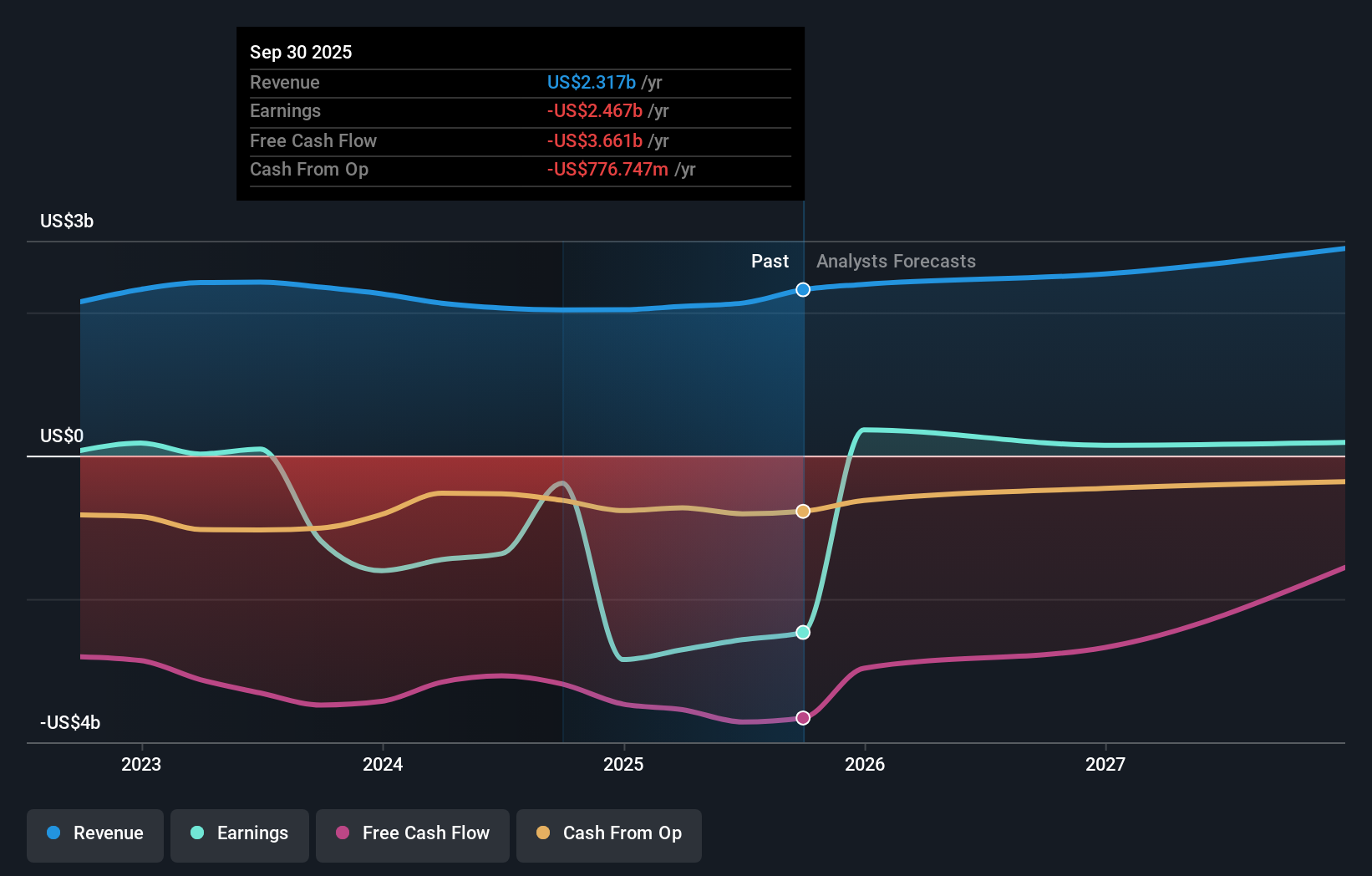

For Sunrun, achieving national scale in distributed power plants shifts more of the business toward recurring, grid-service style revenue rather than relying only on new rooftop solar sales. Dispatching nearly 18 gigawatt-hours from a fleet of 217,000 home batteries and enrolling more than 106,000 customers into 17 programs shows that utilities see real value in Sunrun’s aggregated capacity. That matters when sales have stagnated and free cash flow has been negative, because grid programs can give Sunrun more predictable cash flows from utility contracts and partnerships with players like Ford, Tesla, TXU Energy and PG&E. The flip side is execution risk. Running 1,300 dispatch events in a year and promising grid reliability means Sunrun now has operational responsibilities closer to a power plant operator. With less than one year of cash runway flagged as a key risk, investors may focus on whether these projects can support financing needs without overly relying on fresh equity or higher cost debt.

How This Fits Into The Sunrun Narrative

- The rapid expansion of grid services and dispatchable capacity directly supports the narrative that storage and grid services can become a larger contributor to recurring revenue and margin potential.

- The capital required to build out and maintain this fleet may challenge the narrative that financing access alone can offset policy risk and incentive roll offs, especially with negative free cash flow.

- The growth in distributed power plant programs, including vehicle to grid projects, may not be fully reflected in earlier views that focused more heavily on rooftop solar and tax-credit driven customer growth.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Sunrun to help decide what it is worth to you.

The Risks and Rewards Investors Should Consider

- Analysts have flagged that Sunrun has less than one year of cash runway, so scaling distributed power plants could strain liquidity if utility payments and financing do not line up with spending.

- Negative free cash flow and reliance on external capital create the risk of shareholder dilution or higher interest costs if conditions tighten while Sunrun is still investing in these programs.

- Sunrun is operating one of the largest fleets of residential batteries in the US, which positions it as a provider of flexible, dispatchable energy that utilities and grid operators are actively seeking.

- The company is flagged as trading at good value compared to peers and industry, and earnings are forecast to grow strongly, which some investors may see as supportive if the grid-services strategy executes well.

What To Watch Going Forward

From here, you may want to watch how quickly Sunrun converts distributed power plant capacity into visible, contracted cash flows and how that shows up in cash generation rather than just dispatch statistics. The pace of new partnerships with utilities and energy retailers, and any disclosures on program-level economics, will be important for judging whether this model scales sustainably. It is also worth tracking any updates on financing arrangements, cash runway, and potential equity issuance, given the capital intensity of storage and vehicle to grid projects.

To stay up to date on how the latest news impacts the investment narrative for Sunrun, head to the community page for Sunrun to follow the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.