Please use a PC Browser to access Register-Tadawul

Sweetgreen, Inc. (NYSE:SG) Not Doing Enough For Some Investors As Its Shares Slump 28%

Sweetgreen, Inc. Class A SG | 5.89 | -2.48% |

Sweetgreen, Inc. (NYSE:SG) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 78% loss during that time.

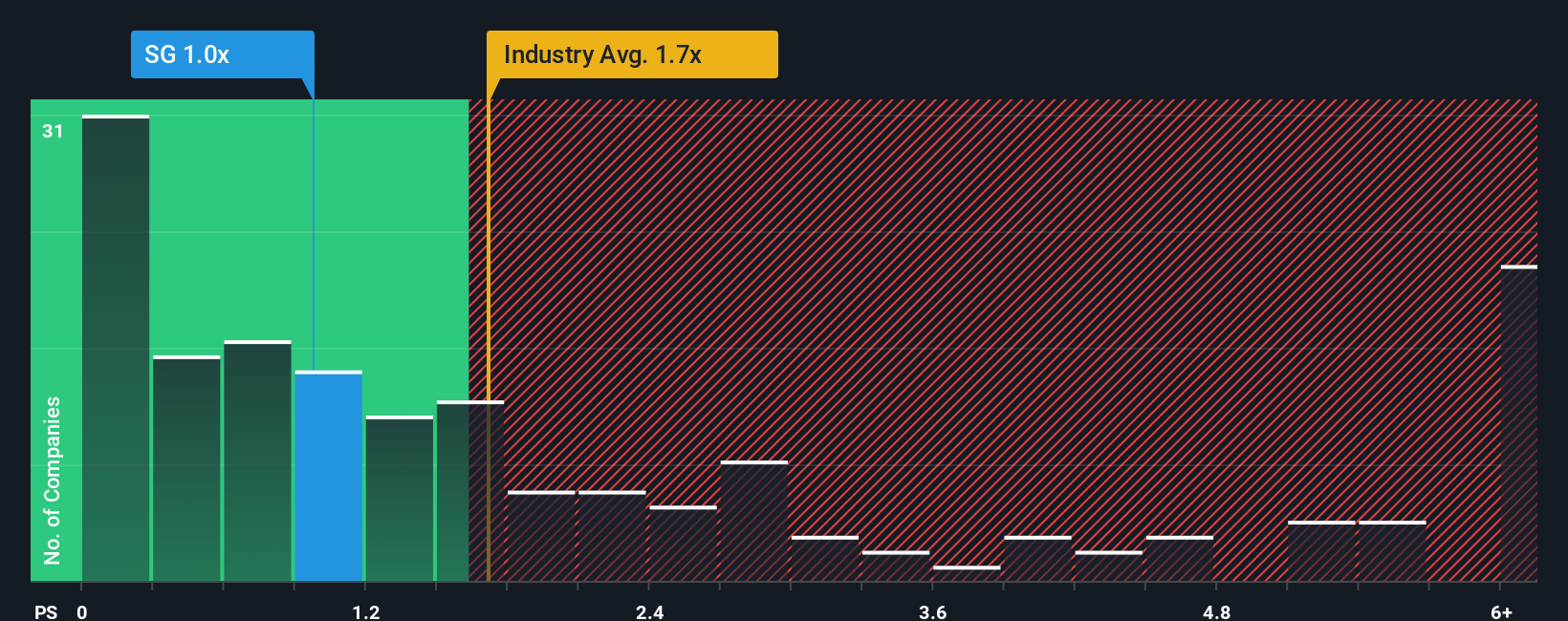

After such a large drop in price, Sweetgreen may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1x, since almost half of all companies in the Hospitality industry in the United States have P/S ratios greater than 1.7x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Sweetgreen Has Been Performing

With revenue growth that's inferior to most other companies of late, Sweetgreen has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sweetgreen.How Is Sweetgreen's Revenue Growth Trending?

In order to justify its P/S ratio, Sweetgreen would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 53% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Turning to the outlook, the next three years should generate growth of 8.1% per year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 14% each year, which is noticeably more attractive.

With this information, we can see why Sweetgreen is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Sweetgreen's P/S?

Sweetgreen's recently weak share price has pulled its P/S back below other Hospitality companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Sweetgreen maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.