Please use a PC Browser to access Register-Tadawul

Symbotic (SYM) Is Up 20.6% After Acquiring Walmart Robotics and Expanding Major Retail Partnerships

Symbotic, Inc. Class A SYM | 54.37 | -3.26% |

- Recently, Symbotic strengthened its market position by acquiring Walmart’s robotics division and securing a US$22.4 billion order backlog, while expanding long-term automation contracts and partnerships with major retailers like Target and Albertsons, along with a joint venture with SoftBank.

- The combination of new contracts and reduced dependence on Walmart highlights Symbotic’s potential to reach a wider customer base and broaden its influence in warehouse automation.

- We’ll explore how Symbotic’s large order backlog strengthens its investment narrative and what this means for future growth expectations.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Symbotic Investment Narrative Recap

To invest in Symbotic today, you have to believe in the long-term shift toward warehouse automation, powered by AI and robotics, which is expected to transform logistics worldwide. The recent acquisition of Walmart’s robotics division and a US$22.4 billion order backlog solidify Symbotic’s position but don’t remove the key short-term risk: execution delays and customer project timing still threaten revenue visibility into 2026, given ongoing transition to next-gen storage systems.

Among several recent announcements, the rollout of new storage technology in August 2025 stands out for its direct relevance to the company’s execution and growth plans. With enhanced storage density, quicker deployment, and modularity, this system aims to accelerate installations and improve project economics, important benefits as Symbotic works through its large backlog and addresses the timing risks posed by complex client migrations.

However, even as Symbotic reduces its reliance on Walmart, investors should not overlook the continued risks associated with large customer concentration...

Symbotic's outlook anticipates $4.1 billion in revenue and $348.5 million in earnings by 2028. This is based on a projected annual revenue growth rate of 23.0% and a $359 million increase in earnings from the current level of -$10.5 million.

Uncover how Symbotic's forecasts yield a $50.82 fair value, a 35% downside to its current price.

Exploring Other Perspectives

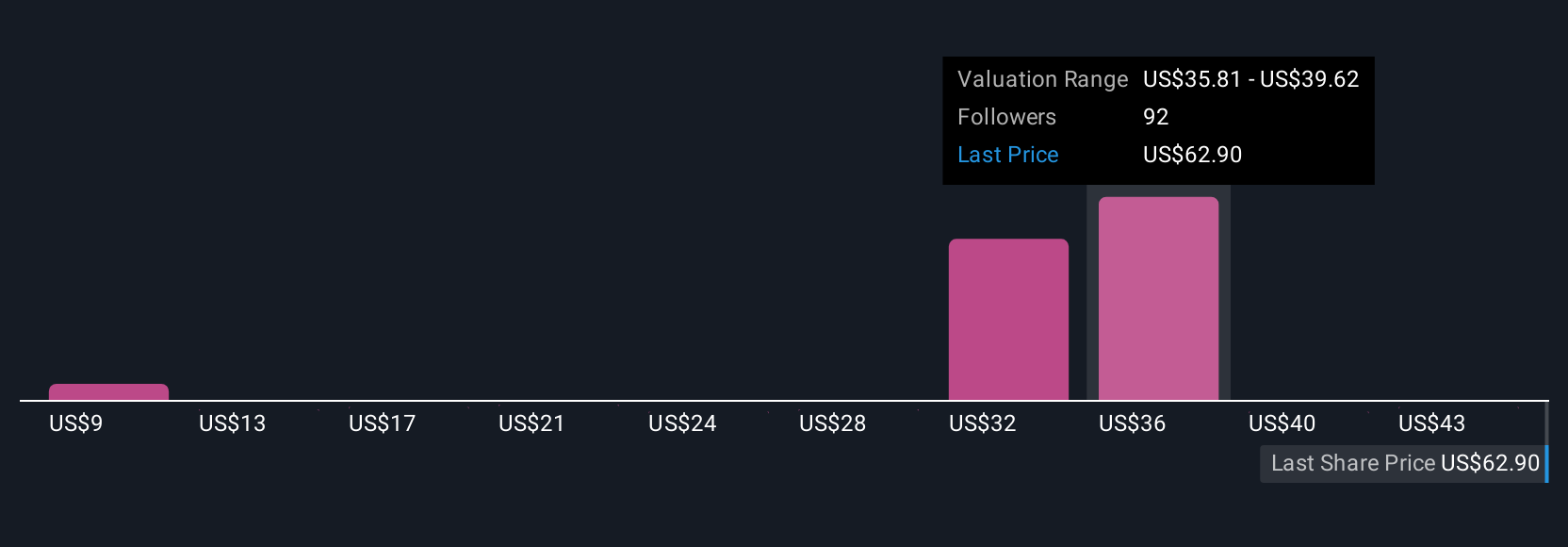

Private fair value estimates from the Simply Wall St Community range widely, from US$9.12 to US$71.74 across 28 viewpoints. With new storage innovations driving project timing risk, you may want to consider how varied these perspectives are before forming your own outlook.

Explore 28 other fair value estimates on Symbotic - why the stock might be worth less than half the current price!

Build Your Own Symbotic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Symbotic research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Symbotic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Symbotic's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- We've found 23 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.